According to a Wealth-X census, the world’s billionaires have roughly 22.2% of their total net worth in cash. That’s the highest percentage since tracking began in 2010.

Why are the wealthiest among us choosing an asset that currently yields next-to-nothing? The report cites uneasiness related to the global economy as well as anticipation that asset valuations will drop to more attractive levels.

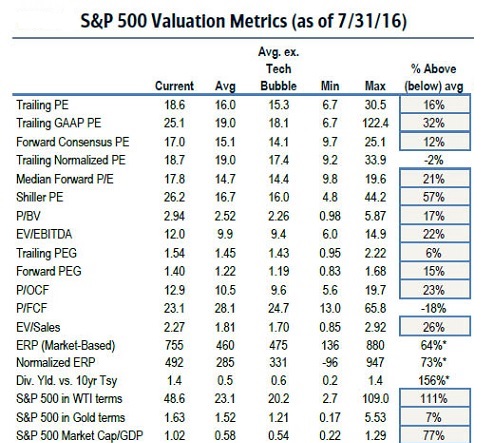

Perhaps ironically, persistent economic weakness has largely inspired central banks to support inflated asset prices through unconventional policies like quantitative easing (QE). Stock valuations, for example, remain elevated across a wide variety of indicators.

Voting members on the Federal Reserve Open Market Committee (FOMC) started the year talking about raising overnight lending rates four times. None have come to pass. Bad economic news has served as the primary excuse for standing down.

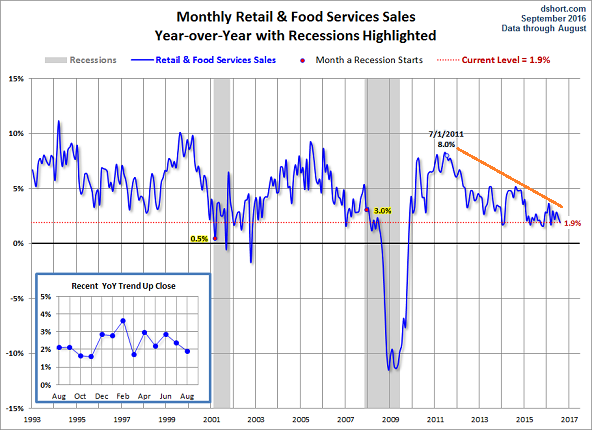

It may be a pretty sharp excuse. Consider the most recent data on U.S. retail sales. Year-over-year retail growth of 1.9% is historically anemic, while the month-over-month headline pullback (-0.3%) is unsettling.

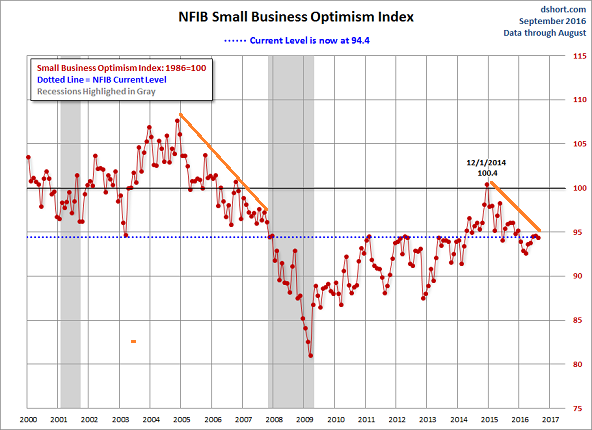

If consumers are less inclined to open their wallets, what about businesses? The National Federation of Independent Business (NFIB) recently confirmed that small business optimism continues to wane. Interestingly, business optimism peaked (12/01/14) at about the same time that S&P 500 corporate earnings peaked (9/30/14).

The less vibrant the economic data, the greater the likelihood that the Fed will favor policies that maintain borrowing costs at negligible levels. Yet central banks like the Fed are doing little to stimulate overall economic well-being; rather, they’re keeping the prices for stocks, bonds and real estate higher than they might otherwise be.

In spite of a feedback loop where a slow-going economy keeps rates “lower for longer” and pushes stocks to new heights, billionaires still favor a higher allocation to cash. Is the defensiveness warranted? Recent volatility alone suggests that it might. Equally worthy of note, fewer and fewer S&P 500 components remain in a technical uptrend. The number of stocks above a 50-day moving average has been deteriorating since mid-August.

Ultra-low-rates (a.k.a. “easy money”) have played a supersized role in pushing risk assets like stocks to incredible heights. Ultra-low rates may even be instrumental in keeping prices near those highs. On the flip side, you do not need to be a billionaire to make a tactical shift toward cash. Indeed, having cash in your portfolio is the best way to scoop up bargains down the road.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients June hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.