In a recent email to Bloomberg, the “bond king” Bill Gross made it very clear that he wasn’t a fan of the recent Trump-fueled stock rally, nor is he a believer in the supposed factors driving it.

Gross, who manages over $1.7 billion via the Janus Global Unconstrained Bond Fund, noted that supposed economic growth prospects are overblown, and that the true driver of economic prosperity — productivity — has been depressed for years and will remain so throughout Trump’s presidency:

“A strong dollar and continuing structural headwinds including aging demographics, de-globalization trade policies, and accelerating debt-to-GDP in almost all countries at now higher interest rates, promise to contain productivity at perhaps 1 percent annual growth rates and therefore real GDP growth at 2 percent,” he wrote.

Gross also had some very conservative advice to investors:

“An investor should move to cash and cash alternatives, such as high probability equity arbitrage situations,” Gross, who runs the $1.7 billion Janus Global Unconstrained Bond Fund, said. “Bond durations should be far below benchmarks.”

Any bump from supposed tax cuts, infrastructure spending, and financial deregulation under Trump will only provide temporary benefits, he concluded.

Gross joins fund manager Jeffrey Gundlach in remaining bearish on stocks despite the recent rally.

“The bar was so low on Trump to the point people were expecting markets will go down 80 percent and global depression – and now this guy is the Wizard of Oz and so expectations are high,”

said Gundlach this week.

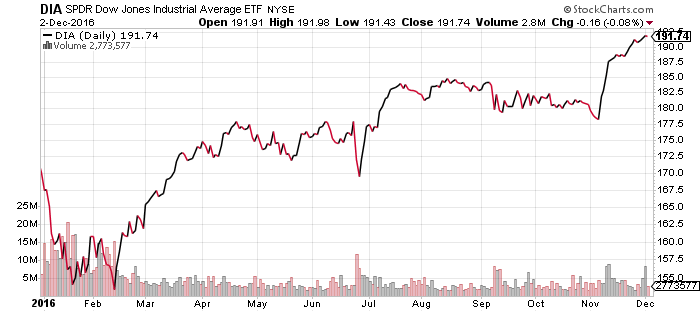

The SPDR Dow Jones Industrial Average (NYSE:DIA) closed out the week’s trading at $191.74 per share, up 0.23% on the week. Year-to-date, the only ETF tied to the DJIA has gained 10.2%.