While many sentiment polls last week showed evaporating optimism among stock traders, the latest American Association of Individual Investors (AAII) poll suggests many bulls are rushing back from the sidelines. In fact, AAII respondents that identified as bullish jumped by the biggest one-week margin since September, according to Schaeffer's Quantitative Analyst Chris Prybal. Here's what that could mean for the S&P 500 Index (S&P 500).

The AAII survey polls individual investors on whether they are bullish, bearish, or neutral over the next six months. In the latest survey, the number of self-proclaimed bulls jumped 11.7 percentage points, to 37.8% of respondents. Meanwhile, the number of AAII bears depleted by 13.5 percentage points -- the biggest decline since mid-February -- to 29.2% of respondents. The number of neutral respondents edged higher by 1.8 percentage points, to 33%.

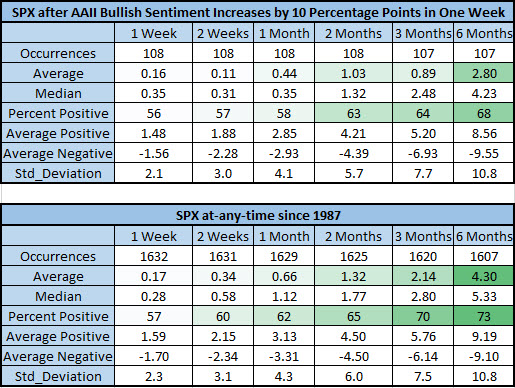

Since 1987, there have been 108 weekly surges of at least 10 percentage points in AAII bullish sentiment -- what we'll call a "signal." However, afterwards, the S&P has tended to underperform slightly. Two weeks after a signal, the S&P 500 was up just 0.11%, on average, compared to an average anytime gain of 0.34%, looking at anytime data since 1987. In fact, the index has generated weaker-than-usual returns across the board after AAII bull spikes, looking six months out.

Nevertheless, we still have a ways to go before optimism hits levels we saw in early 2018, just before the stock market correction. Unless we hit the "euphoria" phase of the sentiment cycle that tends to corroborate market tops, Wall Street shouldn't be too concerned about the whipsaw sentiment reflecting market volatility.

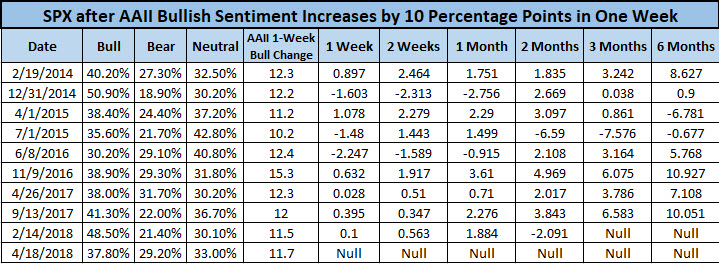

Plus, more recent signals have preceded healthy stock gains. There were two similar surges in AAII bulls in 2017 -- in April and September, specifically. In fact, there have been two signals every year since 2014, and this is the third April signal in that time frame. Six months after the signals in 2016 and 2017, the S&P 500 was comfortably higher across the board, and gained 10.05% in the two quarters following the September 2017 signal.