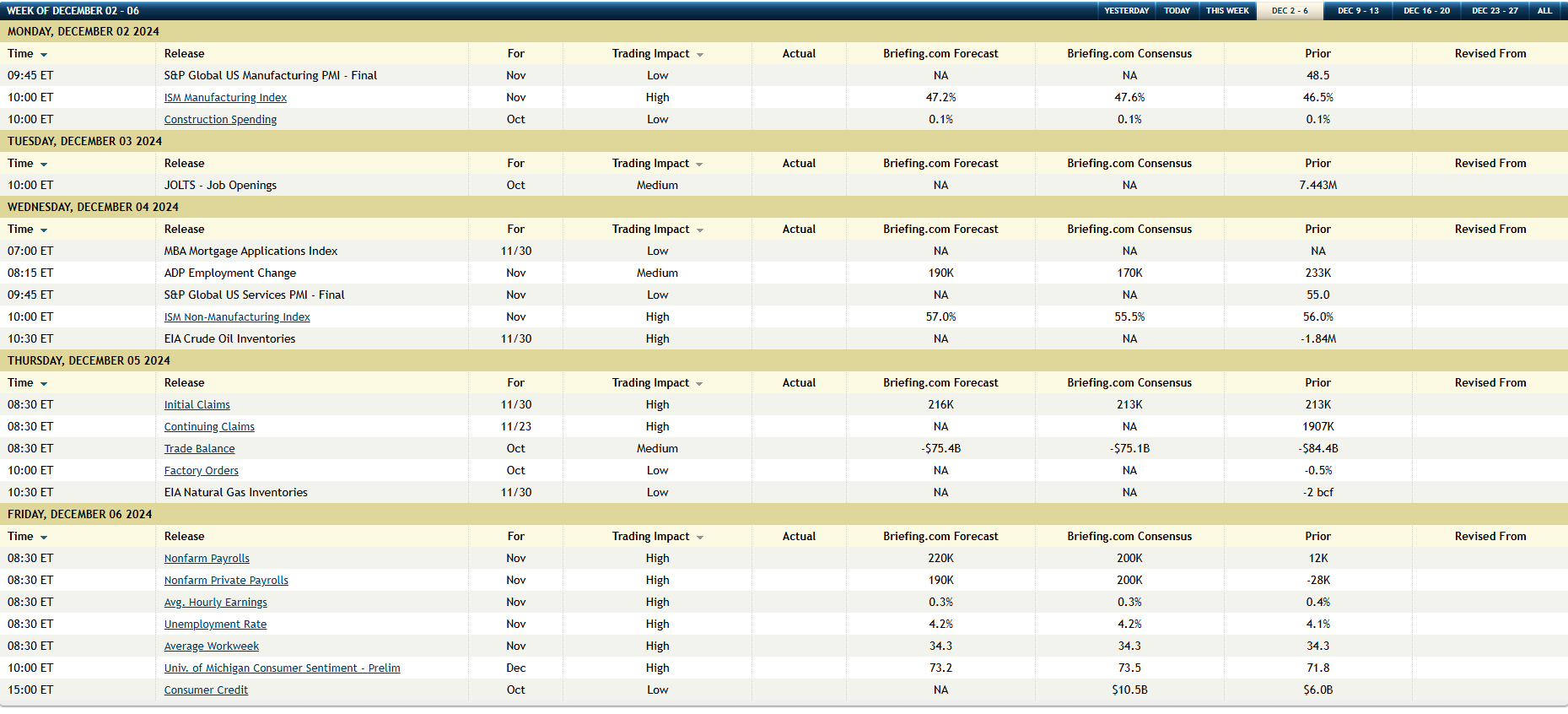

The following table from Briefing.com lists the scheduled economic data releases for December 2nd through December 6th, and like the first week of every month, the first week of December ’24 is heavy with labor market data releases, culminating with the Friday, December 6th 7:30 am release of the November ’24 nonfarm payroll report.

Source: Briefing.com

Rather than get lost in the prediction game, as so many in the financial media do, I don’t have any edge on predicting what with the November ’24 nonfarm payroll report will be next Friday morning, December 6th, but I will say that the Treasury rally this past week, was somewhat surprising, and maybe (just maybe) it’s an early warnings indicator of what November job creation and the unemployment rate will look like.

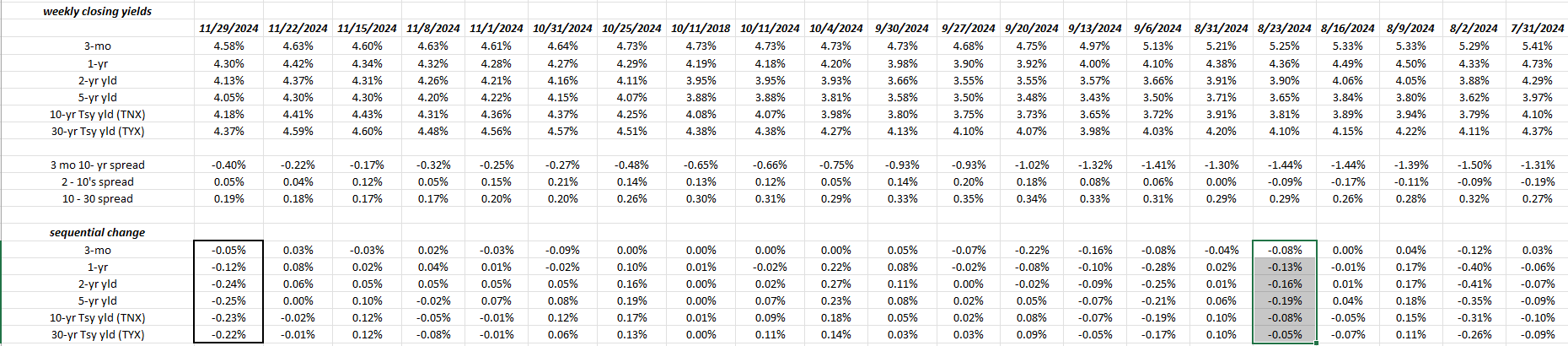

Here’s how the Treasury yield curve changed this past Thanksgiving holiday week:

Source: Internal spreadsheet

The two bordered boxes show that this past weeks decline in Treasury yields was the sharpest rally since August 23rd, but this week’s Treasury rally was greater for the 2-year, 5-year, 10-year and 30-year maturities for the Treasury yield curve, than the late August rally.

Is the Treasury rally forecasting weaker labor market data ? The “net new job creation” estimate for November ’24 is now +200,000 jobs, which is higher than the last few months, which likely eliminated the drag of the hurricane impact and the port and Boeing (NYSE:BA) strike on the numbers, so November’s new, net jobs number may be a “purer” number than what investors have seen since the summer of ’24.

The Treasury curve did rally along with US dollar weakness this past week, which is tracked via the UUP, so don’t forget about the buck.

The next FOMC decision is Wednesday, December 18th, ’24. I do think investors and the markets will see another 25 bp’s lower on the fed funds rate, with the mid-point of the new fed funds range at 4.375%.

S&P 500 Data:

- The forward 4-quarter estimate rose this past week to $263.58 from last week’s $253.38. It was the 3rd straight week of a sequential increase in the forward 4-quarter estimate.

- The PE ratio on the forward estimate is 22.9x versus last week’s 22.7 and the start of the quarter’s 21.5x;

- The S&P 500 earnings yield fell again this week to 4.37% from last week’s 4.41% and early October’s 4.64%.

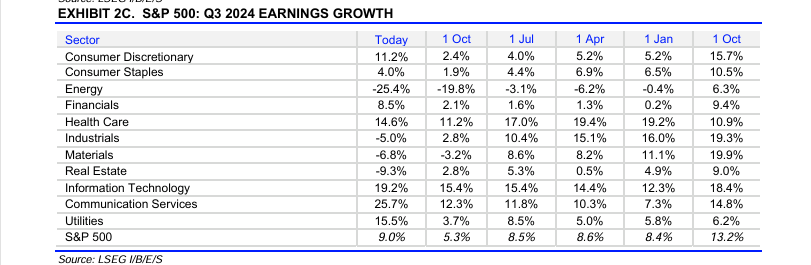

Biggest changes in sector growth since October 1 for Q3 ’24 S&P 500 sector EPS growth:

No surprise from consumer discretionary, technology, communication services, and financials.

Look at the downward revisions in growth rates for commodities, including energy and basic materials and even real estate.

Conclusion:

The S&P 500 is back into “PE expansion” mode, since early October ’24 with much of it happening in November post the election results.

President Trump’s tariff policies will have a big impact on some sectors in ’25, thus it’s hard to make confident predictions. Supposedly the semi’s rallied Thanksgiving Day in Europe as Bloomberg (i thought) published a headline reportedly from a President Trump comment that China tariffs might not be as onerous as originally suspected.

Until the President actually takes office, this back-and-forth could continue.

December will see a number of large-cap companies reporting including Oracle (NYSE:ORCL), Nike (NYSE:NKE), Accenture (NYSE:ACN), FedEx (NYSE:FDX), and many more. The last month of the quarter typically sees a good cross section of the market reporting, so don’t put the year to bed yet.

Disclaimer: None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can and does involve the loss of principal, even for short periods of time. All EPS and revenue data for the S&P 500 is sourced from LSEG. All of the opinions above may or may not be updated, and if updated, may not be done in a timely fashion.

Thanks for reading.