The commodity experts at Palisade Research point out the recent bounce in the uranium ETF and speculate that another massive rally could be shaping up.

Uranium ETF Global X Uranium (NYSE:URA) just crossed an important technical indicator.

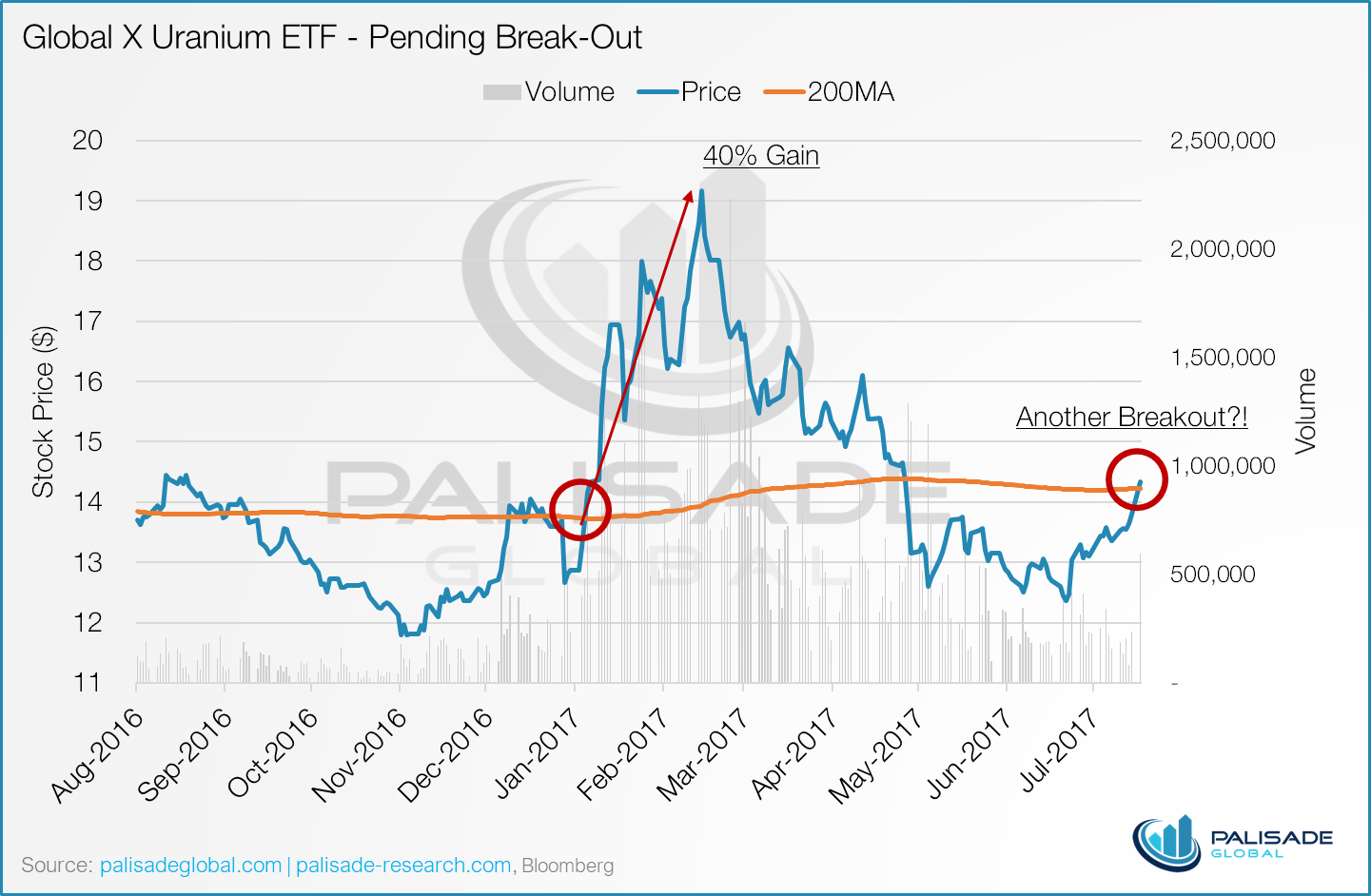

After falling from its high in February, URA has once again crossed its 200-day moving average.

The last time this occurred was in the beginning of January, when the ETF gained 40%.

It appears volume is once again on the rise as the Global X Uranium ETF breaks through this important resistance, as even the juniors are rallying.

While URA came close to retesting its lows in November of 2016, we still maintain that it was likely a multi-year bottom. Only time will tell.

Collin Kettell and Cejay Kim from the Palisade Global Investments team will be in Vancouver for the Sprott Natural Resource Symposium on July 25-28. Also in attendance will be one of our top uranium picks, GoviEx Uranium.

The Global X Uranium ETF was unchanged in premarket trading Wednesday. Year-to-date, URA has gained 10.96%, versus a 10.92% rise in the benchmark S&P 500 index during the same period.

URA currently has an ETF Daily News SMART Grade of C (Neutral), and is ranked #60 of 130 ETFs in the Commodity ETFs category.