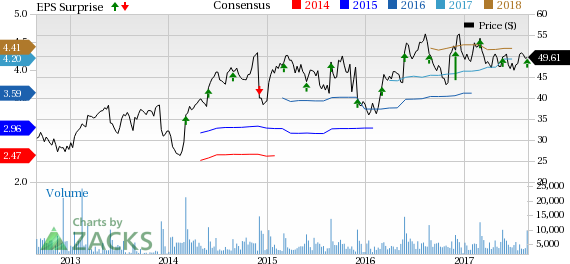

Big Lots Inc.’s (NYSE:BIG) second-quarter fiscal 2017 marked the seventh straight quarter of positive earnings surprise. Moreover, the company’s top-line also surpassed the Zacks Consensus Estimate after missing the same in the trailing four quarters.

Following the results, management raised fiscal 2017 earnings guidance but remained somewhat cautious about its sales and comparable store sales (comps) performance due to competitive retail landscape. Management conservative sales guidance might hurt investor sentiment. However, its shares have declined 4.6% in the past six months, narrower than the industry’s decrease of 7.8%.

Not to forget, cost containment efforts and share buyback activity will continue to provide cushion to the bottom line.

Let’s Delve Deep

The company delivered adjusted earnings of 67 cents per share that beat the Zacks Consensus Estimate of 62 cents and increased 29% year over year. Further, earnings surpassed the company’s guided range of 58-63 cents per share. The results were driven by robust performance of ownable and winnable merchandise strategy.

Moreover, revenues of $1,221.3 million topped the Zacks Consensus Estimate of $1,215 million and jumped 1.5% from the year-ago figure. Increase in sales came on the back of comps growth but was marginally overshadowed by lower store openings compared with the prior-year period.

Big Lots reported comps growth of 1.8%. Notably, comps have increased in 13 out of the trailing 14 quarters.

The company’s gross profit grew 1.2% year over year to $492.5 million, while gross margin contracted 10 basis points to 40.3%. Operating profits totaled $48 million, up 23.2% from the prior-year quarter.

Other Financial Details

Big Lots ended the quarter with cash and cash equivalents of $56 million, down 4% year over year. Inventories were up 0.2% to $810.5 million. Total shareholder equity at the end of the quarter was $584.9 million.

Long-term obligations under the bank credit facility totaled $226.6 million at the end of the quarter under review.

In the quarter under review, the company shut down 11 stores and opened six new stores. As of Jul 29, 2017, Big Lots operated 1,429 stores. During the quarter, the company bought back 2 million of shares for $95 million. Currently, the company has nearly $22 million available under current share repurchase program.

Guidance

The company provided guidance for the third quarter as well as updated fiscal 2017. For fiscal 2017, adjusted earnings per share are projected in the band of $4.15-$4.25, up from the earlier guidance of $4.05-$4.20. This represents growth of 14-17% over $3.64 per share recorded in fiscal 2016. The Zacks Consensus Estimate for fiscal 2017 is pegged at $4.20.

However, the company reiterated cash flow guidance but has lowered sales and comps guidance. Comps are anticipated to increase in the range of 1-1.5%, down from the previous estimate of 1-2%. Moreover, the company expects cash flow generation of nearly $180-$190 million. Sales growth for the full year is predicted to be in the range of 2-2.5%, compared with earlier guided range of 2-3%.

For the third quarter, earnings per share are forecasted in the range of 1-5 cents compared with 4 cents earned in the prior-year quarter. Comps are expected to be up in the low-single digit. The Zacks Consensus Estimate for the third quarter is pegged at 4 cents.

Meanwhile, the company also provided initial guidance for final quarter, wherein earnings are expected to be in the range of $2.30-$2.38, compared with year-ago figure of $2.26 per share. Comps are projected to be in the range of flat to up 2%.

Zacks Rank

Big Lots currently carries a Zacks Rank #2 (Buy). Other stocks which warrant a look in the retail sector includes The Children's Place, Inc. (NASDAQ:PLCE) , Burlington Stores, Inc. (NYSE:BURL) and Dollar General Corporation (NYSE:DG) . All these stocks carry the same Zacks Rank as Big Lots. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Children's Place delivered an average positive earnings surprise of 16.3% in the trailing four quarters and has a long-term earnings growth rate of 9%.

Burlington Stores delivered an average positive earnings surprise of 22.6% in the trailing four quarters and has a long-term earnings growth rate of 15.9%.

Dollar General Corporation (DG) delivered an average positive earnings surprise of 1.4% in the trailing four quarters and has a long-term earnings growth rate of 11.7%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research