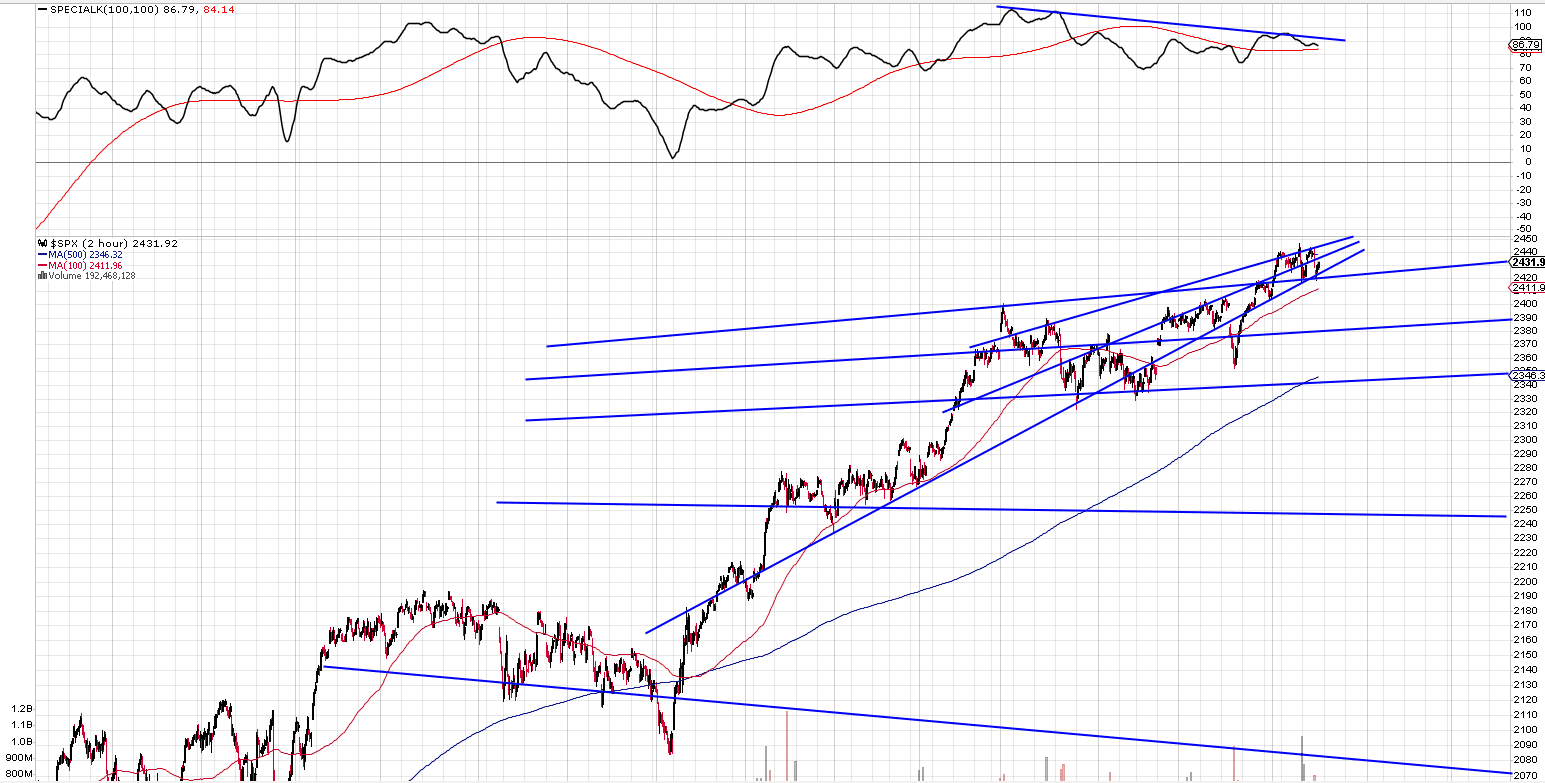

Hey Slopers! Here is my quick view of how I see S&P 500 right now. We have had a almost non-stop rise since November, but I am seeing the possibility of rising volatility for the rest of the summer. We all know what happened to Tech last Friday and I believe that was a warning to the rest of the markets.

I have one of my favorite indicators with a fairly big divergence forming and about to roll over. On top of that this rising wedge has narrowing price action. We have violated the bottom trend line a couple of times already.

My thought is we are about to have a breakdown back into a big broadening triangle. Obviously we can continue going up but here is my road map if we go below 2415 SPX. With little support I do not think a retest of the lows in November are out of the question.

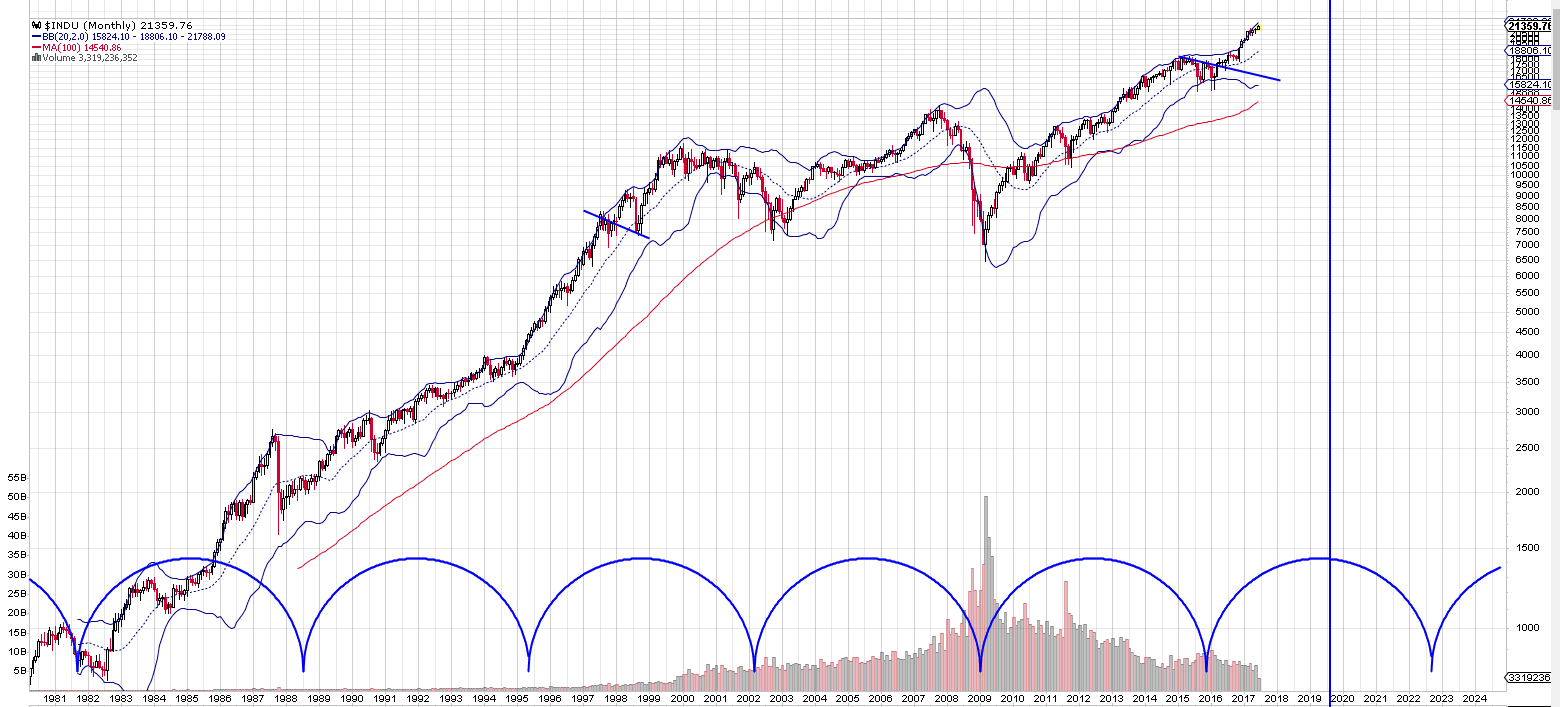

It is there that I believe would be the last great buying opportunity of this bull market that could take it higher than most believe. 2016 marked the bottom of a 7 year ongoing cycle in the markets. If correct we have 2-3 years left of the bull market and could see big gains yet.