Snack foods manufacturer, B&G Foods, Inc. (NYSE:BGS) , has agreed to buy Back to Nature Foods Company, LLC, thereby diversifying its product offering amid shifting consumer preferences.

About the Deal

B&G Foods intends to buy Back to Nature Foods for approximately $162.5 million in cash and will fund the acquisition and related fees and expenses with additional revolving loans under its existing credit facility. The company expects the deal, which awaits regulatory approval, to be over in the third quarter of 2017. The deal is expected to immediately add to cash earnings per share (EPS) and free cash flow generation.

How B&G Foods Will Benefit From the Latest Buyout

Trends that have gathered steam in the U.S. in recent years include a shift toward healthier options in the food sector (predominantly fresh foods) and a high level of price consciousness. Additionally, factors such as growing awareness of "clean label" and genetically modified organism or GMOs, increasing concerns related to sugar consumption and growing demand for free-from products are also sketching the food landscape afresh.

Back to Nature Foods company, which offers the SnackWell’s brand of low fat and no-fat snacks, is the creator in the better-for-you snack foods category. The company’s namesake brand is a leading cookie and cracker brand comprising Non-GMO Project Verified organic and gluten-free products.

We should remind investors that in 2012, Brynwood Partners VI L.P. or Brynwood VI and Mondelez International, Inc. (NASDAQ:MDLZ) formed the Back to Nature joint venture, under which Brynwood VI acquired operating rights, while Mondelez retained a minority position. In 2013, Mondelez contributed the SnackWell's brand to the joint venture.

From the financial perspective, the latest addition will generate net sales of approximately $80 million and adjusted EBITDA of approximately $17 million annually after it completes its six-month integration period.

Product Diversification to Boost Sales

Food majors are aggressively trying to improve their products through innovations as well as strategic acquisitions and divestitures. Additionally, they are channeling funds toward product and packaging innovation as well as reformulating a number of existing products to meet the rapidly changing consumer view on health and wellness.

Given this backdrop, B&G Foods has been on an acquisition spree in recent times to bolster its healthy offerings. In December 2016, the company acquired Victoria Fine Foods Holding Company and Victoria Fine Foods, LLC from Huron Capital Partners and other sellers for roughly $70 million in cash.

Integrating Victoria Fine Foods and the Victoria premium pasta sauce brand to the B&G Foods family, complements the company’s existing portfolio of brands, comprising Don Pepino pizza sauces, Sclafani crushed tomatoes and Emeril’spasta sauces.

Again, in Nov 2016, the company acquired the spices and seasonings business of ACH Food Companies, Inc. With the acquisition of ACH Food, B&G Foods bolstered its presence in the shelf-stable product market.

Price Performance and Zacks Rank

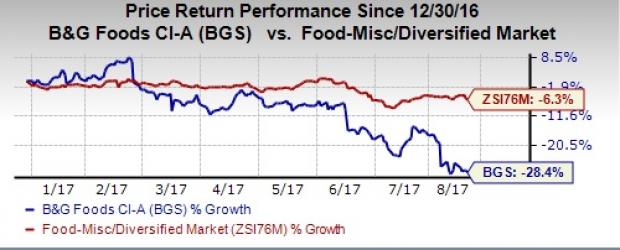

B&G Foods’ shares have lost 28.4% so far this year compared with a decline of 6.3% of the industry it belongs to.

The company missed the Zacks Consensus Estimate in second-quarter 2017 by 16.33%. In the last one month, none of the analysts have increased their earnings estimates for the current quarter, while two analysts have revised their estimate downward. The Zacks Consensus Estimate for the current year has declined from $2.22 per share to $2.11. It’s no surprise that the stock has a Zacks Rank #4 (Sell).

That said, these latest additions should help drive growth.

Key Picks from the Industry

A few better-ranked stocks in the same space are Post Holdings, Inc. (NYSE:POST) , Ingredion Incorporated (NYSE:INGR) and McCormick & Company, Incorporated (NYSE:MKC) .

Post Holdings’ current quarter earnings are expected to increase 48.6%. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Full-year earnings of Ingredion, a Zacks Rank #2 (Buy) stock, are likely to increase 7.6%.

McCormick’s, also a Zacks Rank #2 company, full-year earnings are expected to increase more than 8%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

(We are reissuing this article to correct a mistake. The original article, issued earlier today, should no longer be relied upon.)

B&G Foods, Inc. (BGS): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

Post Holdings, Inc. (POST): Free Stock Analysis Report

Mondelez International, Inc. (MDLZ): Free Stock Analysis Report

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

B&G Foods (BGS) To Acquire Back To Nature Foods For $162.5M (Revised)

Published 08/21/2017, 07:04 AM

Updated 07/09/2023, 06:31 AM

B&G Foods (BGS) To Acquire Back To Nature Foods For $162.5M (Revised)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.