- No market goes straight up or straight down

- Nothing on the horizon indicates a bear market is imminent

- But a correction? Overdue.

- And September 2017 is twice cursed…

As made clear in previous articles, I see nothing to indicate a bear market is imminent. But the number of trailing stops I have now placed in my family and client portfolios and in my Growth & Value Portfolio clearly shows my concern for the likelihood of a correction (not a new bear) in the ongoing bull.

Bull markets don’t die of old age. Never have. Which is why the calls for an end to the bull in 2015, 2016 and 2017 were and likely still are off base. But like any living, breathing thing – like, say, a real-life bull – as it gets older it gets winded more easily and must take more breathers before gaining the strength to charge ahead.

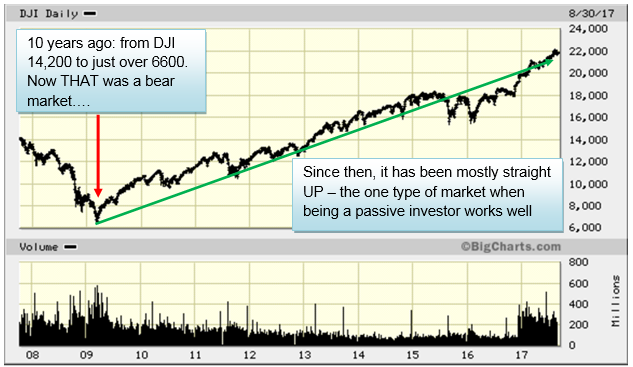

Please note the massive selling and buying on the Dow by institutions and individuals in the 2008 and 2009 period. Some people sold, others bought expecting the bottom was in. Maybe those buyers then panicked and sold as new buyers thought the bottom was in. I’ll take some small credit for keeping a cool head in those emotional days and keeping my powder dry until March 3, 2009. That’s when I wrote an article title”Can You Hear the Bell Signaling a Bottom?” still available here.

Don’t give me too much credit for picking the exact bottom within a couple of days. Preferred shares at 50 cents on the dollar were a pretty good indicator that people were panicking en masse! Besides, I was then early in predicting the 2015 correction you see below. I went to high yield, municipals, energy and long/shorts, making only about 4% while equities meandered slowly higher for another 12 months at a rate of 6%.)

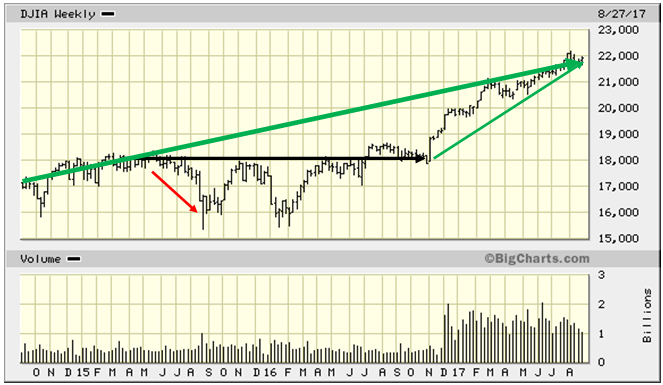

Bringing that 2015-2016 “under-performance” into better focus, we can see that “in retrospect” (!) it was simply a correction along the way to greater gains. Closing above 18,000 for a few days in February and March 2015 the DJI then fell three times below 16,000. It finally re-conquered 18,000 in July 2016, moved sideways until the day after the election, since which time it has roared ahead 4,000 points.

Seeing this chart should disabuse anyone of the notion that the stock markets move in straight lines. Sit by the seashore and watch as the tide comes in. Does it come in one smooth wave that covers the entire distance from low tide to high tide? Of course not! It comes in waves that increase the distance covered when incoming as well as when outgoing. It is the same in the stock markets. They move in waves.

Now look again at the chart above. If you were a passive investor in a DJI index ETF you would be at the exact same point in early November 2016 as you were in early March 2015. For 1 year and 8 months of being true to your school (or in this case ETF) you would be right where you started. On the other hand, if you decided the market was going nowhere and the election would bring even further meandering or worse, you would have missed an amazing rally, accompanied by the best volume in many years.

Where do we go from here?

Who knows? We have a word for anyone who believes they can predict what the market will do tomorrow: charlatans. We have a word for anyone who believes anyone who says they can predict what the market will do tomorrow: stupid. (There are, of course, enough in each camp to keep the 3-Card Monte Society in clover for some time...)

All the intelligent investor can do is weigh the odds and make intelligent incremental moves that in the aggregate enhance their chances of protecting and growing their portfolio.

With that in mind, I believe a parabolic rise needs time to digest the gains. The way I do this is to place ever-tighter trailing stops on positions as the market continues to move higher. Right now the average trailing stop in our portfolios is between 3 and 4%. Yes, that tight.

With that in mind, I am willing to indulge in a bit of historic hocus-pocus. I have no idea why this historical anomaly takes place but I am willing to pay attention to it. Something that happens 7 times out of 10 is worth paying attention to even if it doesn’t happen this time and there is a historic tendency for years ending in “7” – 2007, 2017, etc. – to have a correction, most often in the late summer or early fall. Specifically, the August-November timeframe of years ending in “7” seem particularly volatile, most often on the downside.

The rest of the historic hocus-pocus is that, within that August to November period, September seems to be the weakest month of all. It doesn’t happen every September of course and there is no saying it will again be the weakest month. But history is at least a little more empirical a guide than throwing bones into a circle so I’m more cautious than I have been prior to now.

What gives me the greatest concern is even more empirical and historically proven, however: you can barely find a technician who is not screamingly bullish thanks to the absence of market divergences. Economists are as bullish as ever because the leading indicators all look just spiffy. And those who have been sooooo very wrong—touting gold or oil futures or iron ore while steadfastly maintaining that US markets like the DJI are ready to tumble from 22,000 to 6,000 tomorrow if not sooner—need a couple months of vindication to keep their livelihood. Every dog shall have its day and a correction is just what these folks need to keep the Fear Factor alive and get subscription renewals.

For the record: I believe it is at least as likely as not that we will have a correction before the bull resumes its climb. I think the late summer / early fall is an even more likely place than other times during the year to see it happen. I am positioning my family and client portfolios by establishing trailing stops and a cash cushion to pick up bargains if it does. I believe a correction is due. I do not believe it will be the end of this bull for the all the reasons cited in my article of a week ago, “Believe the Market, Not the Headlines.”

Disclaimer:

(1) Do your due diligence! What's right for me may not be right for you; what's right for you may not be right for me.

(2) Past performance is no guarantee of future results. Rather an obvious statement, but too many people look solely at past performance instead of seeking the alpha that comes from solid research and due diligence.