Investing.com’s stocks of the week

- The average holding period for stocks has dwindled to a mere six months.

- Considering recent years, it is almost impossible to rack up gains with such a short holding period.

- As investors, we are addicted to instant gratification, and that can be destructive for our portfolio and life savings.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

In today's world, speed is everything. From shaking your screen for 5-second videos to 1-minute ballets and websites loading in 3 seconds, the pace of life has accelerated.

Instant messaging has become the norm, making everything faster and more convenient.

While technological advancements have undoubtedly made everyday life easier, they present a challenge for us as investors. Recognizing this impact early on can help us avoid the pitfalls of impatience while investing.

Regrettably, the financial markets are the least forgiving when it comes to impatience, instant gratification, or demanding swift performance, be it from an index or an individual stock.

In the world of investing, patience remains a virtue, and haste can be a costly companion.

Source: Tarhan

It is hardly surprising that the average holding period for a stock (or ETF or Fund) in a portfolio has fallen dramatically over the years, to a record 6 months.

Imagine such a short holding period in the last few years (2022, 2023) where the market went through a bit of a roller coaster. It was nearly impossible to lock in returns with a 6-month holding time.

Assuming one did manage to lock in profits with such a short holding period, what are they likely to do with the profits?

Probably reinvest, incurring additional costs such as commissions, fees, and potential market-timing pitfalls.

This approach risks compromising the fundamental benefits of investing in the stock market: the invaluable factors of time and compound interest.

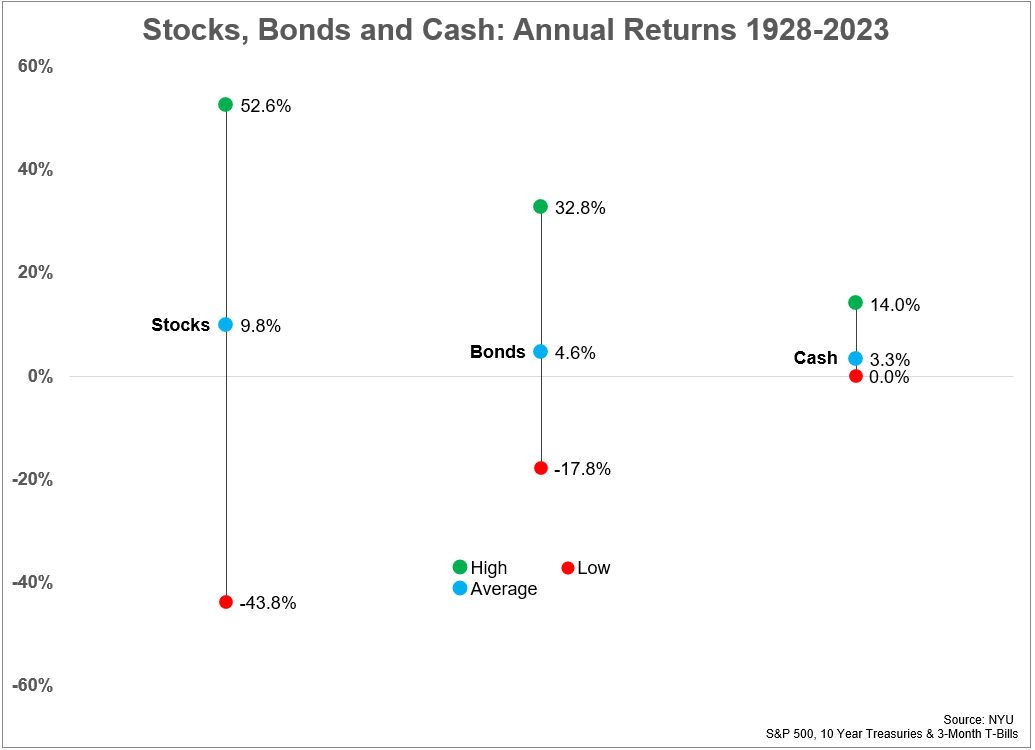

Source: NYU

Above I have indicated the characteristics of the 3 main asset classes - stocks with S&P 500, cash, and bonds. When it comes to managing the most challenging asset for human beings—stocks—there are key questions that warrant consideration:

- Risk: Am I willing to buy something that may perhaps drop as much as 40 percent at some point?

- And am I willing to hold it even after that while sticking to my long-term strategy?

- Do I know the characteristics of what I am buying?

Investors today buy a stock, and complain if the next day (or even immediately after the purchase) it does not perform as they expected.

But this is not investing, this is gambling. And that can be destructive.

Therefore, stick to what truly matters in the long term, and if this message doesn't align with the narrative you're accustomed to, shrug it off for the next news story.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.