A 14% return is nothing to be ashamed of in a year where the S&P 500 is up only 8%. Yet it looks awfully meager when my competition in the Best Stocks contest is up 144%.

As I write, blue-chip natural gas and natural gas liquids pipeline operator Enterprise Products Partners (NYSE:EPD) is up 13%, including dividends, as of Friday. Yet Tracey Ryniec’s Etsy (NASDAQ:ETSY) is up a whopping 144%. Chipotle Mexican Grill (NYSE:CMG) and Amazon.com (NASDAQ:AMZN) take the second and third slots with returns to date of 71% and 68%, respectively.

So, barring something truly unexpected happening, it’s looking like victory may be out of sight this time around.

Can’t win ‘em all.

EPD Stock Still Looks Good For The Long Haul

While Enterprise Products may finish the contest as a middling contender, I still consider it one of the absolute best stocks to own over the next two to three years. Growth stocks have dominated value stocks since 2009, but that trend will not last forever. Value and income stocks will enjoy a nice run of outperformance — and when they do, Enterprise Products will be a major beneficiary.

Enterprise has spent much of the past three years trading in a range. We can blame this on two primary factors.

The first is the implosion of energy prices starting in 2014, which hit the over-leveraged MLP sector particularly hard.

I should point out that EPD stock itself was not particularly overleveraged by the standards of the industry. At no point in the past 20 years has Enterprise Products’ creditworthiness or ability to fund both its growth projects and its distributions been called into serious question. But many of EPD’s peers were far more reckless and were forced to slash their distributions. This hurt the reputation of the entire industry and sapped investor enthusiasm for even the bluest of blue chips.

The second factor is rising bond yields. MLPs came to be viewed by many investors as bond substitutes, as the payouts on fee-generating midstream pipeline assets tend to steady and “bond like.” (The distribution cuts of three years ago had little to do with the cash flows of the pipeline assets, which remained as consistent as ever, and everything to do with excessive leverage and forays into non-pipeline investments.)

MLPs, along with REITs, BDCs and high-yield dividend stocks, have been facing serious headwinds due to rising bond yields. All else equal, rising bond yields mean rising MLP yields. And you know the rule: Yield up means price down.

At 5.9%, EPD’s yield has come down from its recent highs of close to 7% due to stock price appreciation. But it is still vastly higher than the yields that prevailed prior to the energy correction that started in 2014.

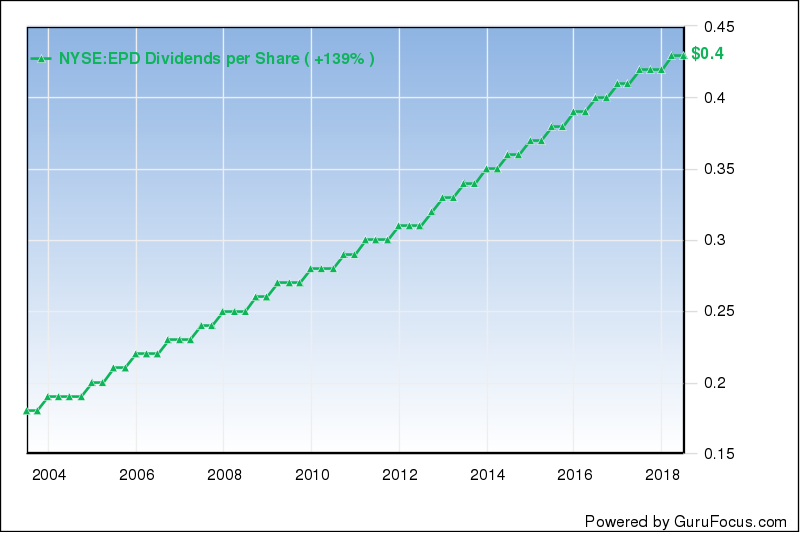

The higher yields can be partially explained by EPD’s sluggish stock price, but that’s certainly not the whole story. Enterprise Products has also been a reliable payout booster over its entire history as a public company. Over the past three-, five- and 10-year periods, EPD has raised its distribution by between 5% and 6% per year, like clockwork.

Longer-term, EPD will face the same structural problems that the rest of the fossil fuel industry faces. Advances in green energy and battery storage will erode the market share of traditional sources like crude oil, coal and natural gas. Yet the International Energy Agency forecasts that demand for natural gas will continue to rise through at least 2040. Renewables will almost certainly account for most new infrastructure spending, but natural gas is likely to do the heavy lifting for a long time to come.

Are natural gas pipelines exciting? Absolutely not. They may, in fact, be the single most boring asset class on the planet. But in a market in which the investment themes of the past decade – such as the FAANGs and tech in general – are starting to look stale, a workhorse income producer like Enterprise Products stands to outperform.

Charles Sizemore is the principal of Sizemore Capital, a wealth management firm in Dallas, Texas. As of this writing, he was long EPD.