The S&P 500 stumbled as value plunged—corona fears are back as Austria's lockdown might very well be followed soon by Germany.

The mood on the continent is souring, and coupled with accelerating German inflation data, helping to underpin the dollar. Overall, the reaction reminds me of the corona market playbook of Feb-Mar 2020 when I aggressively took short positions, riding them all the way down to the Mar. 23 bottom. So, why am I not beating the bearish drum today as well?

We have a lot of incoming stimulus (both monetary and fiscal), the economy is slow but the yield curve hasn‘t inverted the way it did in 2019—make no mistake, we‘re in a rate raising cycle (even if the Fed didn‘t move, the markets would force it down the road). I know, pretty ridiculous notion with the 10-year yield at 1.54% and October YoY CPI at 6.2%. But with the rates being even more negative elsewhere, that helps to explain the dollar 2021 resilience. That‘s the bullish side to last week‘s bearish argument.

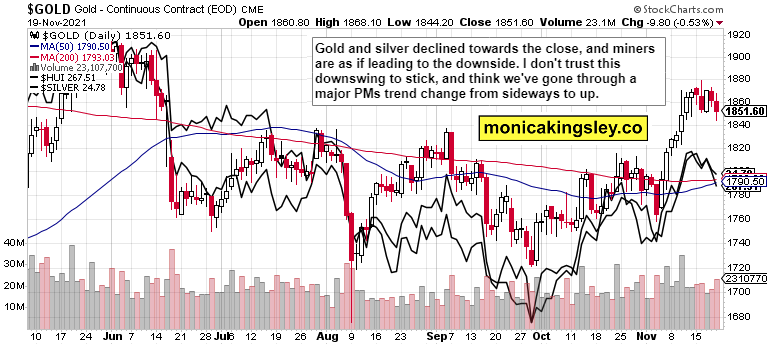

What gold and silver are realizing is that the Fed would have to reverse course once the tapering effects start to bite—not now, while more than $100bn of monthly fluidity is being added to the markets.

Cyclicals and commodities that had massively appreciated vs. the year ago period (oil doubled), are feeling the pinch of fresh economic activity curbing speculation in spite of the polar shift of U.S. strength in energy in 2019 and before. Begging OPEC+ to increase production might not do the trick, and with so much inflation already (and still to come), the key investment theme is of real assets strength.

Precious metals have broken out and are no longer an underdog, while inflation's deceleration won't occur for quite a few months still. And even then, it would come at a palpable cost to the real economy. Resolute fresh stimulus action wouldn‘t be far off then. As I wrote in April 2020, it‘s continuous stimulus that‘s the go-to response anytime the horizon darkens, for whatever reason. Wash, rinse, repeat.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

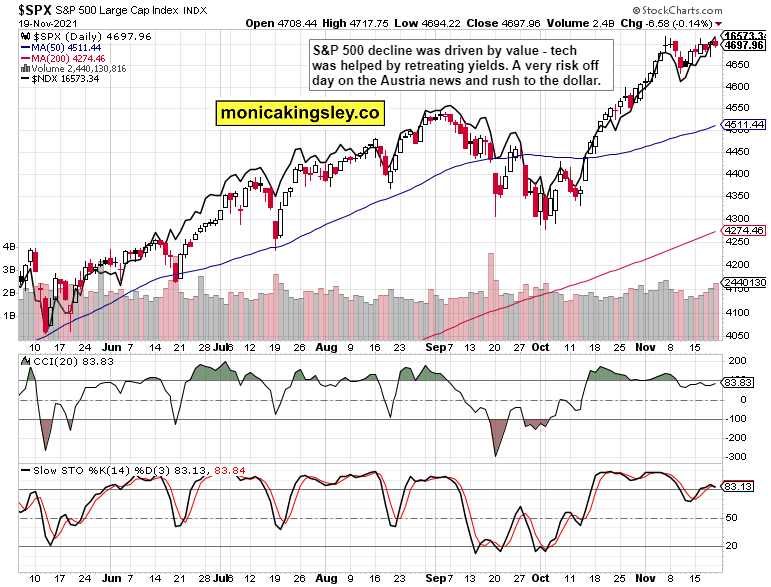

S&P 500 And NASDAQ Outlook

S&P 500 bulls still have the upper hand, and value recovery accompanied by good tech defense via high ground gained, is the awaited mix. The market breadth is narrowing, and needs to be reversed to give the bulls more breathing room.

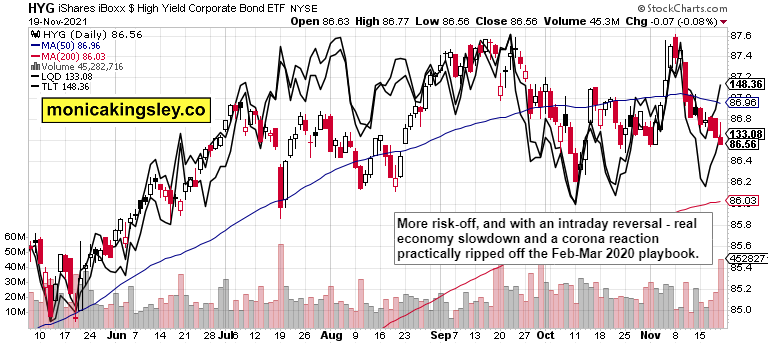

Credit Markets

Once corona returns to the spotlight, bets on "reversion to the mean" in credit markets, e.g., iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG), are off. Weakening data gathers more focus, and the flight to safety commences, puncturing the rising yields trend that would inevitably lead to yield curve control.

Gold, Silver, And Miners

It‘s as if gold and silver bulls don‘t trust the latest rally. I think that‘s a mistake because we've turned the corner, and precious metals are about to shine—of course, invalidating the latest miners' weakness in the process.

Crude Oil

Crude oil bulls didn‘t recover from Friday‘s spanner in the works, and while the dust hasn‘t settled, black gold is prone to an upside reversal at little notice. I‘m not overrating the oil index weakness.

Copper

Copper smartly recovered, moving at odds with the CRB Index, which I treat (especially given the repercussions post Friday‘s news out of Austria) as a vote of confidence that the economy isn‘t rolling over into a deflationary hell (pun intended).

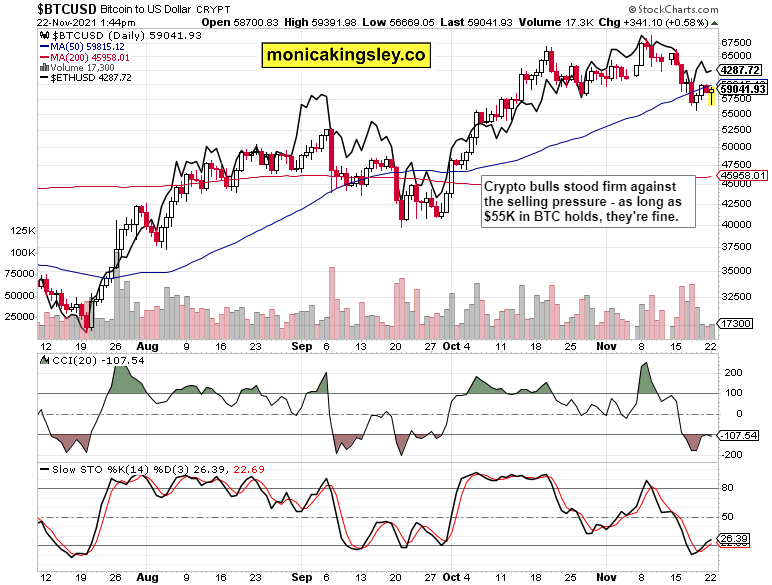

Bitcoin And Ethereum

Bitcoin and Ethereum are still going sideways in this correction, but Monday's lower knot is encouraging. The consolidation though still appears to have a bit further to go this time.

Summary

S&P 500 bulls keep hanging in there, waiting for bonds to come to their senses, which might take a while longer. Tech keeps cushioning the downside, and we haven‘t peaked in spite of the many warnings. Value and Russell 2000 upswings would be good confirmations of the bull market getting fresh fuel.

Precious metals would have the easiest runs in the weeks ahead, though commodities in general not so much. Their breather is of a temporary nature as all roads lead to real assets.