As the first quarter grinds to an end, we don’t have much to show for it. Year to date, the market is flat.

But, that doesn’t mean it’s been boring. It’s been a choppy, volatile year as investors have tried to digest plunging crude oil prices, mixed economic data, and the never-ending speculation over when — or if — the Fed will ever raise rates.

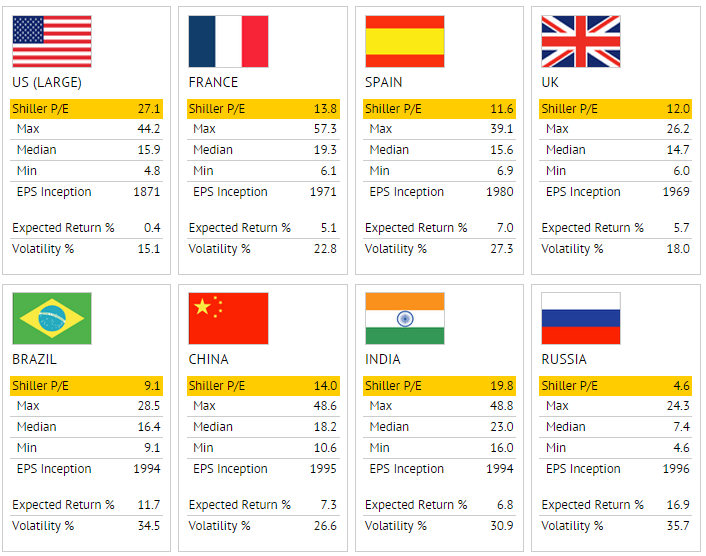

Adding to all of this, the U.S. market is very expensive, by historical norms. The S&P 500 is trading at a cyclically-adjusted P/E ratio (“CAPE”) of 27.1 — roughly the valuation at the market tops in 1929 and 2007. The only time in history the market has been more expensive was during the 1990s dot-com bubble. Looking forward, this implies annual returns over the next decade of less than 0.5%, or roughly what you might earn on a CD.

Yet, overseas — and particularly in Europe — the picture is a lot brighter. CAPE ratios are lower, implying better expected returns, but this only tells half the story. Earnings have been depressed for years by the economic malaise and policy uncertainty following the 2010-2012 eurozone crisis. European stocks are even cheaper than they look, thanks to the double whammy of investors awarding a lower price multiple to already-depressed earnings.

Europe is cheap. But, within a cheap continent, Spain, as represented by the iShares MSCI Spain ETF (ARCA:EWP), is a particularly cheap country. And, while Spain is certainly not without its problems (Catalonia is still threatening to secede…), its economy is finally on the mend. Spain’s economy is expected to grow at a 2.5% clip this quarter, and the unemployment rate has been steadily ticking down for the past 12 months. The country is still a mess, but it’s quietly getting its house in order.

Take a look at the country chart, produced by Research Affiliates, which lists the CAPE (also called the “Shiller P/E”) and the expected returns over the next decade. Research Affiliates expects the Spanish market to return 7% per year. I would be thrilled with a decade of 7% annual returns in Spanish equities, but I think these figures could actually prove to be a little too conservative. Let’s dig into the specifics.

Research Affiliates builds its return estimates from four pieces: dividend yield, real economic growth, valuation and currency movement. The Spanish stock market currently yields 5%, and Research Affiliates estimates a rather conservative 1.3% real-growth rate. Despite the low CAPE valuation at just 11.6, earnings multiple expansion only accounts for 0.1%. The remaining 0.7% comes from expected appreciation in the euro.

The high dividend yield speaks for itself, though I expect Spanish companies to boost their dividends at a healthy clip going forward. Some of Spain’s biggest companies by market cap — including Telefonica (MADRID:TEF, NYSE:TEF) and Banco Santander (MADRID:SAN, NYSE:SAN) — have had to slash their dividends over the past few years. But, the pain has now already been taken, and as the Spanish economy improves, I expect to see decent dividend growth.

The estimate of 1.3% annual growth seems a little on the low side, but I’ll be generous and give Research Affiliates a pass on this one. And, after the massive run the dollar has had, 0.7% attributed to euro appreciation doesn’t seem completely unreasonable.

It’s the valuation that I think is grossly undervalued here. With eurozone bond yields at record lows, European stocks should be trading at premiums to their long-term averages. But, in Spain’s case, the CAPE of 11.6 is significantly below its long-term average of 15.6. Rather than add 0.1% to annual returns, I believe 0.5%-1.0% seems more reasonable. That would put us closer to 8% annual returns.

Does any of this guarantee that Spain will outperform over the next quarter? No, of course not. But, I would use any sell-offs in the Spanish market as buying opportunities. At current prices, Spain is a developed market offering the potential for emerging-market returns.