Investing.com’s stocks of the week

Unless you've been hiding under a rock, you're probably aware that the stock market has been pretty volatile lately, especially compared to the slow burn higher of 2017. Day traders especially might have noticed the massive intraday swings we've experienced lately; for instance, the Dow erased a 500-point deficit to end higher Monday, and traded in a range of 500 points on both sides of breakeven yesterday. So, just how sensitive is Wall Street's proverbial hair trigger right now, and what could that mean for stocks heading into 2019?

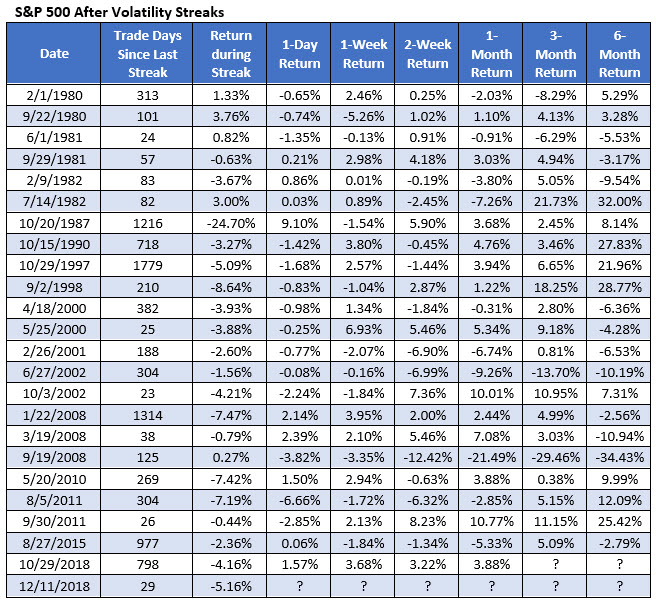

The S&P 500 Index (SPX) on Tuesday endured its fifth straight session where it moved at least 2% from its intraday low to its intraday high. The last time this happened -- considering just one signal every 21 days -- was in late October, when stocks were wrapping up a brutal month. Prior to that, you'd have to go back to the "flash crash" of August 2015 for a volatility signal, which was the first of its kind since September 2011, per data from Schaeffer's Senior Quantitative Analyst Rocky White. Below are all of the SPX volatility signals since 1980, of which there are 23.

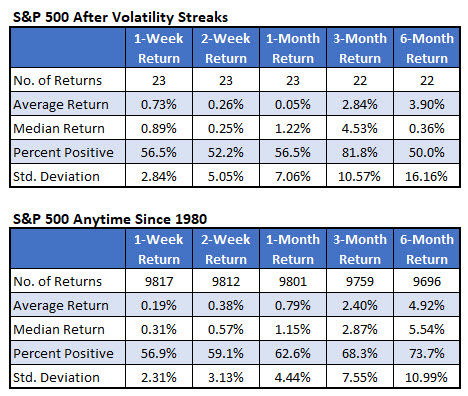

It seems stretches of extra volatility tend to beget more volatility, in the short-to-intermediate term, at least. The standard deviation of S&P returns after these stretches is higher than normal, as you can see on the chart below.

As far as performance after signals, it's difficult to get a good read. The SPX was higher than normal in the short term, averaging a one-week gain of 0.73% after signals -- that's more than three times its average anytime one-week return of 0.19%. On the other hand, one month after signals, the index was higher by just 0.05%, on average, compared to 0.79% anytime. Looking six months out, that underperformance continued, with the S&P up a weaker-than-usual 3.9%, and higher just 50% of the time.

In conclusion, stocks' longer-term trajectory will likely be determined by macro events, like the U.S.-China trade war, the Fed's pace of rate hikes, and possibly even a hard Brexit from the European Union in March. In the near term, at least, traders should watch the S&P's movement between the 2,600 and 2,800 levels, per Schaeffer's Senior V.P. of Research Todd Salamone, and hope that another rough start to December once again bodes well for bulls in the end.