Home goods retailer Bed Bath & Beyond Inc (NASDAQ:BBBY) late Wednesday posted much worse than expected third quarter earnings and noted its full-year results could miss estimates as well.

The Union, NJ-based company reported Q3 EPS of $0.85, which was $0.13 worse than the $0.98 that Wall Street had expected. Revenues rose just 0.1% from last year to $2.96 billion, also missing analysts’ view of $3.01 billion.

Comparable sales in Q3 fell by -1.4%, falling well short of the +0.5% estimate that Bed Bath & Beyond had made earlier this. That sales momentum was also down from last year’s +0.4% gain in Q3. Comparable store sales, also known simply as “comps,” are considering a key indicator of a retailer’s health.

The company noted that digital channel sales saw strong growth of 20%, while comparable sales from physical retail stores declined in the low single-digit percentage range.

Looking ahead, BBBY forecast full-year EPS to come in at the low end of its previously announce outlook of $4.50 to $5.00, which could miss Wall Street’s $4.71 estimate.

The company provided an update to its buyback program via press release:

During the third quarter of fiscal 2016, the Company repurchased approximately $76 million of its common stock, representing approximately 1.8 million shares, under its existing $2.5 billion share repurchase program. As of November 26, 2016, the program had a remaining balance of approximately $1.9 billion, and is expected to be completed sometime in fiscal 2020.

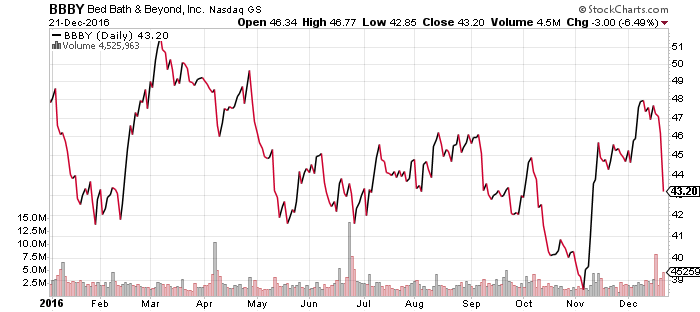

Bed Bath & Beyond shares fell $2.01 (-4.41%) to $43.55 in after-hours trading Wednesday. Prior to today’s report, BBBY had fallen -5.58% year-to-date, versus a +10.74% gain in the benchmark S&P 500 index during the same period.