The year 2015 has already seen many market mood swings. Heightened volatility and flight to safety suggest that investors are nervous about the prospects for global economic growth this year. A weak start to the fourth quarter earnings season and the uncertain political situation in Greece have further added to investor fears. Despite somewhat shaky start, there are many reasons to believe that the bull market for stocks remains intact this year.

Strong U.S. Economic Growth despite Global Weakness

The U.S. economy is growing at the fastest clip in a decade while growth in many other parts of the world remains sluggish. Most economic data points have confirmed this trend. While there was some nervousness in the market after the Retail Sales data for December, I believe investors should not read too much into a single month’s number when the year-over-year trends are very impressive. (Read: Best ETF Strategies for 2015)

Abundance of Cheap Money in the World

The ECB announced another aggressive stimulus package last week. Adding that to the money being printed by the Bank of Japan--about $1.5 trillion of ultra-cheap money is being pumped into the system every year. Cheap money is always good for stocks and with a strong dollar and improving American economy, a lot of this money will flow into U.S. assets.

Low Oil Prices a Powerful Tailwind for the Economy

Some investors are worried about the impact of oil price plunge on the sector’s earnings and lay- offs, banks exposed to the sector and junk bonds. Yes, there will be some negative implications but overall, lower oil prices are very supportive of the U.S. economy and consumers.

Stocks Still the Best Place to Be In

After a bull run of almost six years, stocks are not cheap but they are not in a bubble either. Looking at bond yields and dismal outlook for commodities, stocks are still the best place to be in. At the same time, it is important to stay diversified. (Read: 5 Dividend ETFs to buy for Income in 2015)

Focus on High Quality U.S. Stocks

While I remain positive on stocks, I do believe that easy money in stocks has already been made. As the Fed moves towards policy normalization, markets will see great volatility and investors will become increasingly discerning with their stock investments. It would thus be better to focus on fundamentals and invest in “high-quality” stocks. (Read: Oil yet to find bottom, go short with these ETFs)

Academic research shows that high quality companies—as determined by factors such as high earnings quality and low leverage-- consistently deliver better risk adjusted returns than the broader market over long term. An easy way of investing in such stocks is via ETFs that focus on such “high-quality” stocks. Such stocks usually have an excellent earnings record and strong balance sheets. These stocks also hold up rather well during market swings.

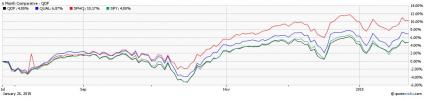

iShares MSCI USA Quality Factor ETF (NYSE:QUAL - ETF report)

QUAL tracks the MSCI USA Quality Factor Index, which identifies stocks with high quality scores based on three main fundamental variables: high return on equity (ROE), stable year-over-year earnings growth and low financial leverage. It charges a low expense ratio of 15 basis points.

The product holds 124 securities in its portfolio with Apple (NASDAQ:AAPL) (4.9%), Exxon (NYSE:XOM) (4.7%) and Microsoft (NASDAQ:MSFT) (4.7%) being the top three holdings. In terms of sectors, Technology takes about 34% of the asset base, while Consumer Discretionary, Healthcare and Industrials also get double digit allocations.

The fund sports a yield of 1.4%. Launched in July 2013, the fund has attracted $830 million in assets so far.

PowerShares S&P High Quality Portfolio (NYSE:SPHQ- ETF report)

SPHQ tracks the S&P 500 High Quality Rankings Index which is comprised of S&P 500 stocks with highest “Quality Rankings”. Quality rankings are based on long-term growth and stability of a company’s earnings and dividends, using records of the most recent 10 years.

This product is slightly more expensive than the iShares product with an expense ratio of 29 basis points. It currently sports a dividend yield of 1.7%.

The product holds 130 securities in its basket but is very well diversified with the top holding accounting for just 1.33% of the asset base (index is score weighted). Industrials have the highest weight at 27%, with Consumer Discretionary (19%) and Consumer Staples (19%) rounding out the top three.

FlexShares Quality Dividend Index Fund (NYSE:QDF - ETF report)

The ETF uses a proprietary model that includes factors like profitability, management efficiency and cash flow. Firms are selected for inclusion in the index based on expected dividend payments and long-term capital growth potential.

Financials currently take the top spot with about 18% of assets, followed by Information Technology (17%), and Consumer Discretionary (12%). Top holding Apple accounts for just 4.4% of the asset base.

QDF has a nice dividend yield of 2.5% while the expense ratio is modest at 38 basis points.