If you’ve read my articles in the last few weeks, you may have noticed I’ve been writing about inflation more lately. I’m doing so because your income portfolios—especially your bonds!—are at risk as a result of recent money printing.

My recent monetary focus has taken many readers by surprise. After all, we haven’t seen sustained inflation in 40 years. Nothing like a four-decade lull to lure an investor into a false sense of “60/40 retirement portfolio” security!

But even though we’re staring at day-to-day deflation right now, with lockdowns hitting demand for most products beyond the essentials, make no mistake: the ingredients for inflation are there. Most obvious: the massive increase in the money supply, which has soared by $3 trillion since March, thanks to Federal Reserve Chairman Jay Powell’s printing press corporate-bond-buying program.

More Money, More Problems?

I’m not saying we should panic about inflation today. But we do need to keep it on our radar. Here are two ways you can prepare.

Buy This Inflation “Go-To” (but not for income!)

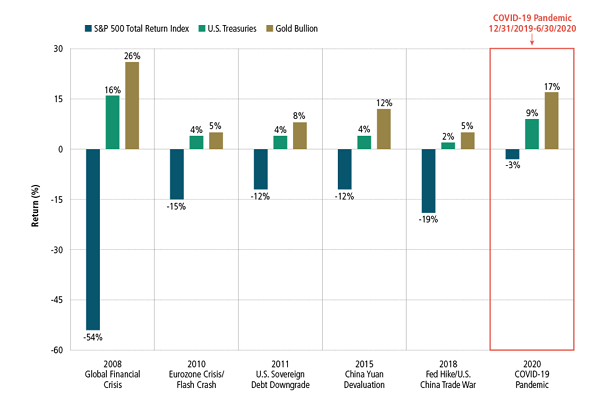

Gold has long been a mainstay in times of inflation—or any crisis, really. And for good reason: it does tend to beat stocks and bonds in a collapse, as the folks at Sprott Asset Management remind us:

Gold Outperforms in a Crisis

And the massive run gold has turned in year to date has the yellow metal within a whisper of its 2011 high:

A Sugar High—but Not Yet a Bubble

Could we see a gold bubble for the first time in four decades? It’s gaining in popularity, but I wouldn’t call it “hot” yet, as I’ve gotten few gold questions from readers. That’s interesting for an asset that’s about to make an all-time high.

If you want to buy gold, there are a few ways to do it, besides buying physical bullion. You can go the ETF route, with the SPDR Gold Shares (NYSE:GLD), or there’s the Sprott Physical Gold Trust (NYSE:PHYS), a closed-end trust you can buy just as you would a closed-end fund (CEF). Both GLD and PHYS track the price of gold without saddling you with gold bars you’d need to pay someone to store.

But if you’re looking for income, you’re out of luck: GLD, like bullion itself, pays 0%. PHYS? The same.

What about shares of gold-mining companies? Sure, there are some that pay dividends. As I write this, Newmont Goldcorp (NYSE:NEM), the biggest gold miner by market cap, yields 1.6%.

Two problems here (besides the meager yield):

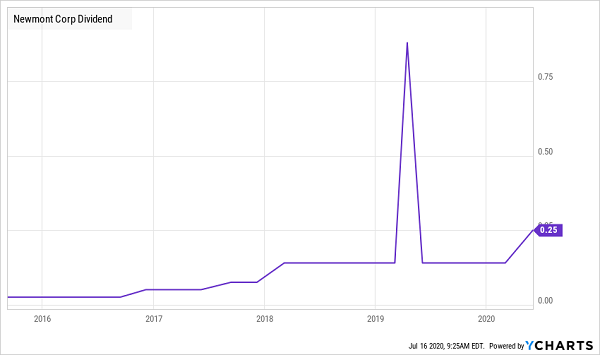

- Newmont’s dividend depends heavily on gold prices. That’s meant an overall rise in payouts in the last five years, but also long periods when the payout went nowhere—not what we want in a dividend payer:

Newmont’s Unpredictable Payout

- Newmont is a crowded trade: While gold may not be in bubble territory, Newmont shares have soared, more than doubling the rise in gold prices this year!

A Big Risk for a 1.6% Payout

That brings me to my favorite way to hedge your portfolio against rising inflation. You’ll collect a growing income stream, too.

The Income-Seekers’ Inflation Hedge (2 Simple Steps)

Here’s what we’ll look for:

- Dividends that outrun inflation: If we want to maintain our lead over rising prices, we need stocks with growing—and ideally accelerating—payout growth.That not only builds our income stream but, as I showed you last week, enhances your upside (and hedges your downside) because a rising payout acts like a magnet on a company’s share price, yanking it higher despite inflation, debt crises, pandemics—just about any disaster you can name.

- A low beta rating: Beta is a volatility measure. A rating below 1 means the stock is less volatile than the S&P 500; above 1 is more volatile. That makes it easy: we want a rating of 1 or below so we can enjoy our dividends without taking extra risk.

This Soaring Dividend Crushes Inflation

Let’s put these two steps together with Roper Technologies (NYSE:ROP), a stock I’ve recommended in my Hidden Yields dividend-growth service.

The firm specializes in enterprise software but is too smart to actually build the products itself. (Developing an “enterprise app” costs tens of millions of dollars and, once you’ve built it, who knows if you can sell it?)

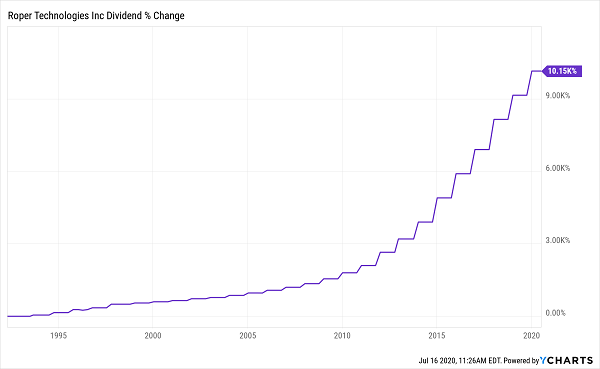

Instead, Roper buys proven products and cross-sells them to its growing base of business customers. The firm is a cash cow that’s rewarded shareholders with a fast-rising payout since it started paying dividends in 1992:

Roper’s Inflation-Busting 10,000%+ Payout Growth

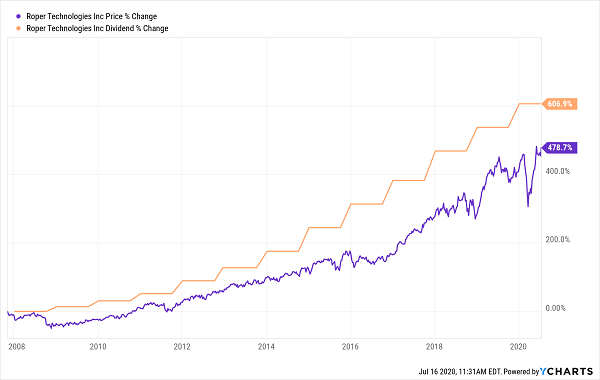

Now let’s look at more recent history. Below is a chart of Roper’s dividend and share-price growth from October 9, 2007, the day the market peaked before the 2008/09 financial crisis, to today.

It’s a useful period to look at because it includes the two biggest crashes since the Depression, plus the period from December 2015 to December 2019, when the Fed aggressively hiked rates, something we’d surely see if inflation spikes.

As you can see, Roper’s shares have tracked its dividend higher, hike after hike.

“Dividend Compass” Steers Roper Through Storm After Storm

Investors who bought then have seen a jump in their yield on cost, too. Even though Roper yields just 0.5% now, you’d be bringing home seven times that in dividends today on a buy made then, thanks to its 478% payout growth in that span.

Finally, let’s take a look at the beta rating, which you can find on just about any stock screener out there. According to Ycharts, it stands at precisely 1. That’s exactly the same as your typical S&P 500 stock and much less volatile than many bigger tech firms, like Apple (NASDAQ:AAPL) and Amazon.com (NASDAQ:AMZN).

7 Inflation-Busting Buys for 15% Yearly Returns (Forever!)

No matter what happens with inflation, my advice remains the same: buy dividend growers—but not just any dividend growers: we want the elite group of stocks that can hand you a steady 15% every year—forever.

And I’ve zeroed in on 7 specific tickers that can do just that.

These 7 stout income plays are so far off the radar, I’ve dubbed them “hidden yield” stocks. They all have one critical thing in common: they’re quietly handing smart investors growing income streams plus annual returns of 15%, 17.3%, 20.8% or more.

These 7 stocks are perfectly positioned to beat back the pandemic and soar on the other side. They ALL boast rising free cash flow, deep order backlogs and healthy balance sheets—a trifecta of inflation-beating strengths few companies can match.

Your next move is simple: buy now and set yourself up for 15%+ annualized returns. That’s easily enough to outrun any inflationary wave we’ll see, because a return like that would double your nest egg every 5 years!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."