Not much to say after Friday's action. Instead, I will take a look at some of the longer term charts.

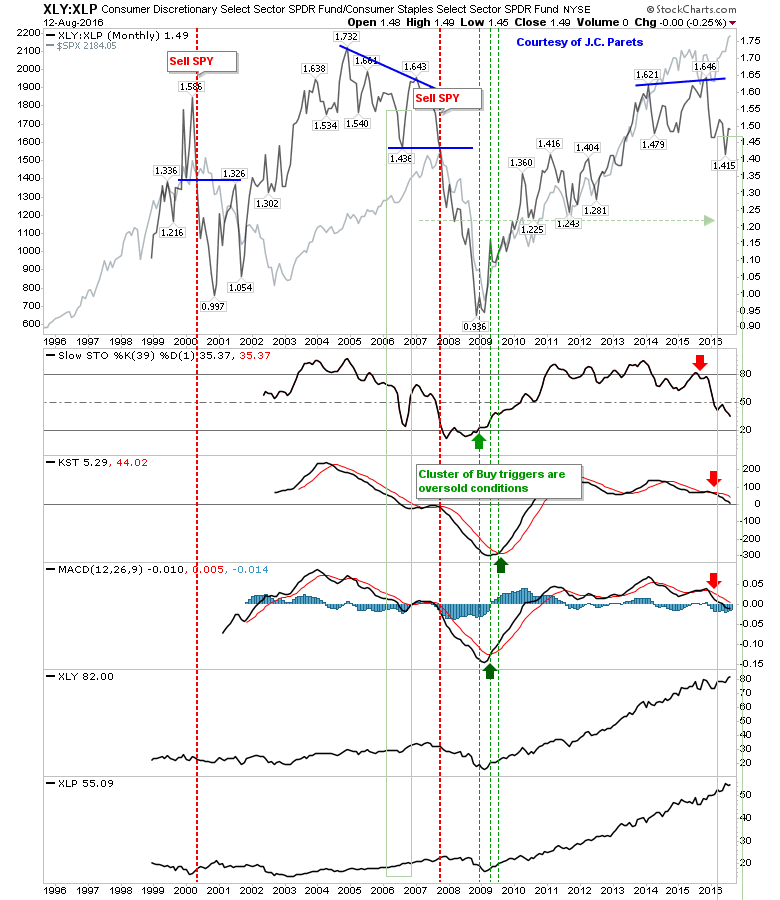

Of these, bears look to have an edge. The relationship between consumer discretionary (Consumer Discretionary Select Sector SPDR (NYSE:XLY)) and staples stocks (Consumer Staples Select Sector SPDR (NYSE:XLP)) has been in a slow decline, which in the past has led to big sell offs, but the market has refused to buckle and is trading in a manner much like it did in 2006. If the latter pattern was to repeat, it could be another year before sellers regain control.

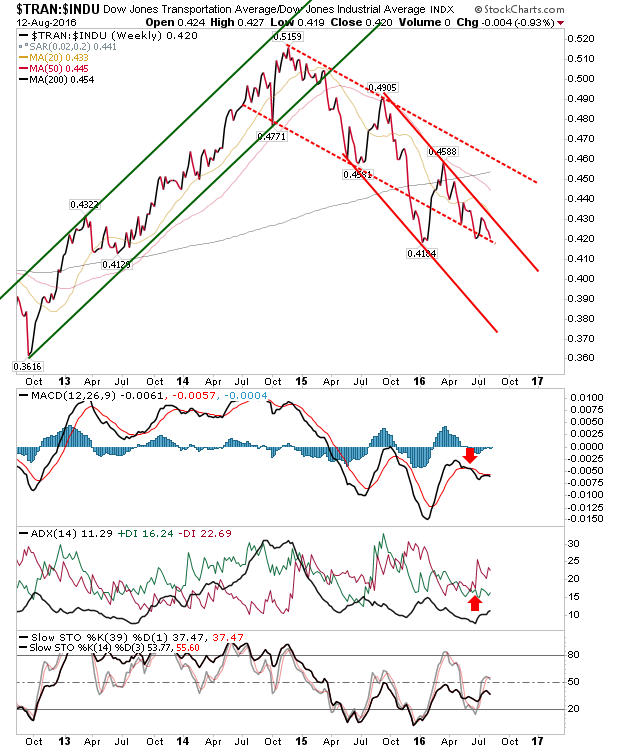

The Dow Theory set up is also in bears' favour. Transports have struggled despite low oil prices. This is a worrying trend as it started in 2014 and doesn't look to be improving any time soon. Technicals have also stayed on the bearish side since early 2015.

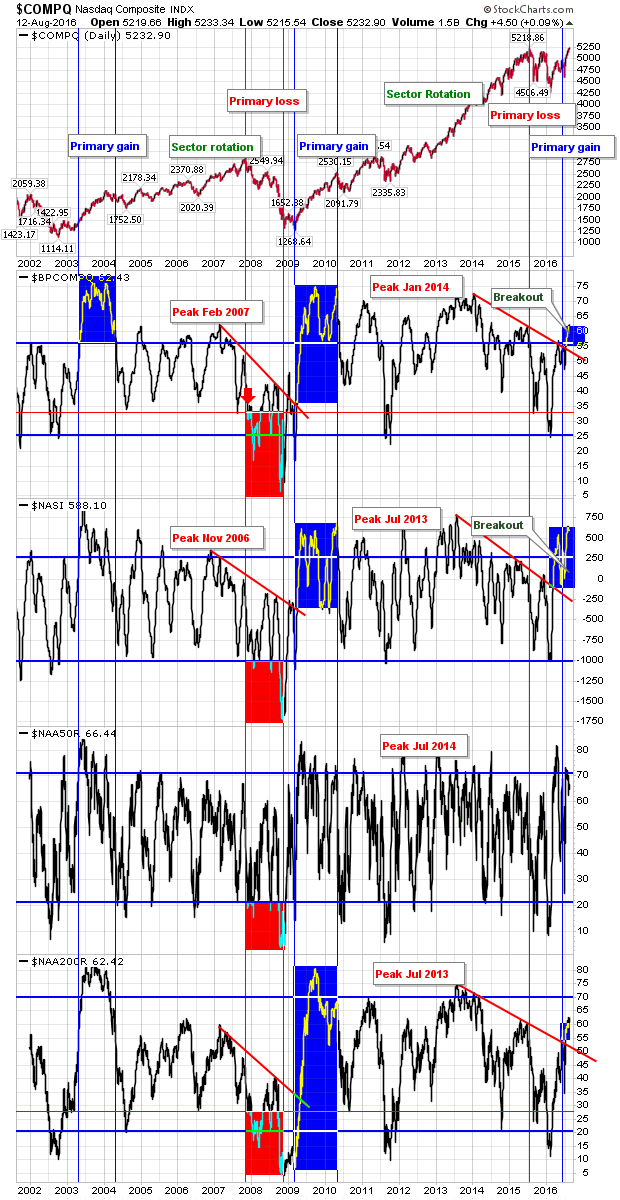

NASDAQ breadth has kicked back in bulls' favour, although the Summation Index is overbought. By this measure, markets are still in their Primary (rising tide raises all ships) Gain Phase, than the Sector Rotation phase. The latter could suggest multi-year gains lay ahead—contrary to what the previous two charts suggest.

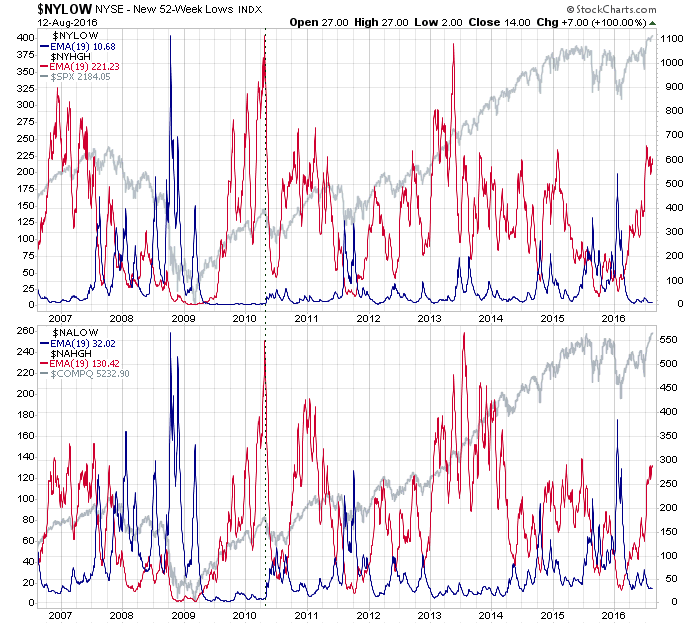

The new highs - new lows relationship also suggests there is more to come from bulls:

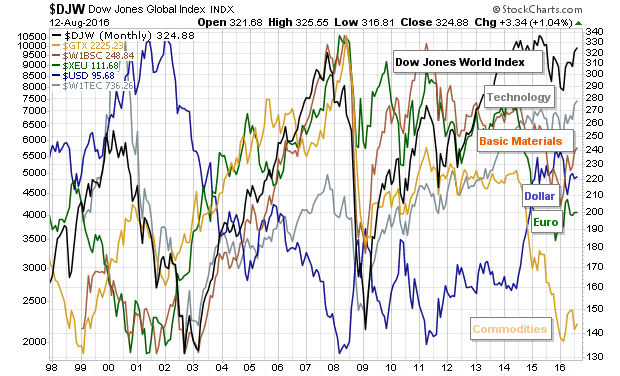

Although value buyers may find more joy with Commodities which are in the discount bin of international assets.

Let's see what the rest of August brings...