As if the Fed’s unlimited QE wasn’t enough, we’ll get $2-trillion stimulus now. Predictably, the S&P 500 loved that. As it sprang to life, we’ve already cashed in an 82-point profit on that upswing. As we’re currently riding another immediately profitable open position, what kind of gain will it bring this time around?

In other words, will the futures keep on climbing later today as well?

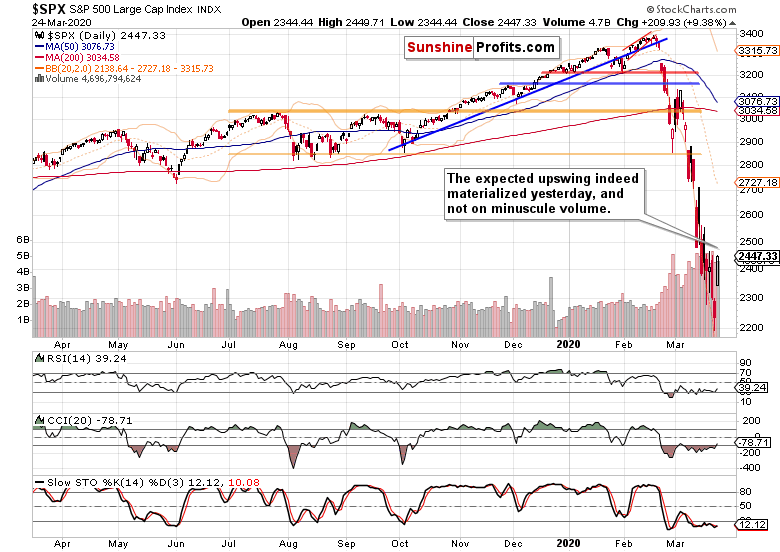

It’s highly likely. Let’s start our analysis with the daily chart examination (chart courtesy of http://stockcharts.com).

Stocks both opened and closed on a strong note yesterday. And the volume wasn’t at all shabby. After the overnight climb higher, they ran into quite some fast and furious selling earlier today, which we partially avoided. Instead of seeing gains shrink, we still cashed in an 82-point profit. As the selling pressure dried up, we entered the market again, and are currently riding the momentum for an open gain of around 30 points as the futures change hands at over 2450 close to 11 o’clock Eastern time.

While the daily indicators are solidly in bearish territory, they’re increasingly curling higher, thus supporting another leg up.

Let’s remember our Monday’s notes regarding the market breadth indicators:

While they all confirm the bears as being in the driving seat, new highs minus new lows reveal that the sellers aren’t as strong as they appear to be when one looks at price action only. The bullish percent index has also curled higher despite new 2020 lows being hit.

As a result, the market breadth indicators indicate a high likelihood of pause in the trend of continuously lower prices. Be it in the form of a sharp rally that runs out of steam relatively fast, or a somewhat more prolonged sideways trading with a bullish bias, it nonetheless justifies our decision earlier today to take the 168-point profit on our short positions off the table.

On top of today’s and yesterday’s gains, these observations keep turning out as expected.

Summing up, while the bears have the upper hand, the potential for a temporary upswing to continue, is still there. And this Fed and stimulus-triggered move might surely stick on. As the markets like this move, it makes sense to give it the benefit of short-term doubt.