Nothing has changed for nearly two years now, and I say that with a sense of sadness to everyone who plays this incredibly difficult game. Long-term lateral consolidations of this length can be looked at two ways. First is when a stock or index moves laterally for a long time it usually continues the trend in place. However, there is another side to see. If the consolidation is too long, nearly two years, you have to start wondering if the market is slowly turning over.

The bulls have been unable to move this market higher. The reasons are quite clear for everyone by now. Horrible negative divergences have NOT gone away on those key monthly charts, and while fed Yellen may be able to rise above them you better not get too complacent, thinking that's a slam dunk to occur. The negative divergences are quite steep in nature and need to be fully respected, even if we would like to think Yellen will make them meaningless.

I wouldn't count on that as a definite. Possible for sure as her actions have defied all logic and reality. Still, we haven't yet broken through 2134, and until we do, you must or least should respect all possibilities that exist when something so dangerous against the bulls is in place. So maybe we're just meandering before breaking out, but take in the chance that those negative divergences actually mean the oscillators are weakening as time moves along. If that's the case, then you'll be glad you didn't get overly involved.

If you want to throw caution to the wind, then by all means do so, but I believe this game needs to be respected for all possibilities, and, thus, some form of appropriateness for the risk at hand should be exercised by all bulls. It's your call. Maybe being without caution will pay off handsomely. The gambler in you must decide. I don't believe in taking risks until things are at least a bit clearer. Tough market and tough times for all traders.

So on Wednesday we get the word from fed Yellen regarding interest rates. We all know she'll do nothing because of the horrible news last week from the Jobs Report. The huge miss now has her talking data-dependent nonsense once again. It would be a huge shock to the market system if she was to raise rates now. She'll talk about how things are improving, yet act as if they're not, which clearly they are not. So many economic reports are coming in poorly, and with the last Jobs Report missing so badly, the odds of her raising rates on Wednesday are as close to zero as possible. The last thing she wants to do now is to hit the S&P 500 lower with unexpected news.

She can do that once the elections are over, but she won't want to hurt the party that put her in office, so expect her to keep talking lower rates overall, even if one more has to occur this year. If the data stays weak, there won't be any more this year. If it improves, she can justify one more, but that would very likely be it. It's hard to think that anything she'll do Wednesday will be a big-market mover, so we may be stuck in this malaise for some time to come folks. Maybe Brexit will be the big-market mover. We can hope something will be, but who knows for sure. For now, there isn't too much hope for a big move coming on the fed decision. It is what it is. The range remains what it is. Boring and going nowhere.

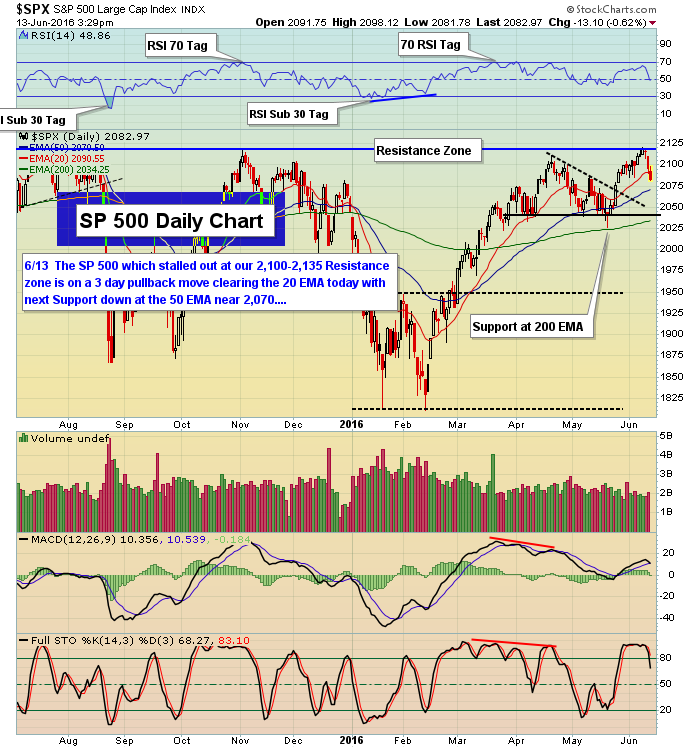

The gap down on the SPDR S&P 500 ETF (NYSE:SPY) is big from 210.86 to 212.08. That area will act as strong resistance on any attempts high in the coming days or weeks. The market can take it out, but it is a large gap and gaps of that size are normally very tough to get through, especially if you have no real catalyst. This market has acted as if all is well yet hasn't broken out, and now that we have added more resistance at that 12-point gap, the job won't be any easier for the bulls.

However, until the bears can remove 2033, or the once, already-tested 200-day exponential moving average, they have nothing to feel good about. Same holds true for the bulls. Now they must remove 2120 on the S&P 500, or they too have nothing to hang their hats on. The market to nowhere is still with us in a big way.