T2108 Status: 56.0%

T2107 Status: 59.5%

VIX Status: 14.4

General (Short-term) Trading Call: neutral

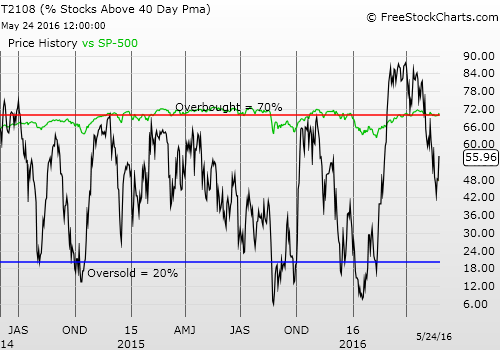

Active T2108 periods: Day #71 over 20%, Day #70 over 30%, Day #67 over 40%, Day #1 over 50% (ending 5 days under 50%) (overperiod), Day #9 under 60% (underperiod), Day #16 under 70%

Commentary

Just like that, sellers melted away from the market and the bulls ran wild. The buyers and bulls have forced bears and sellers to stand down.

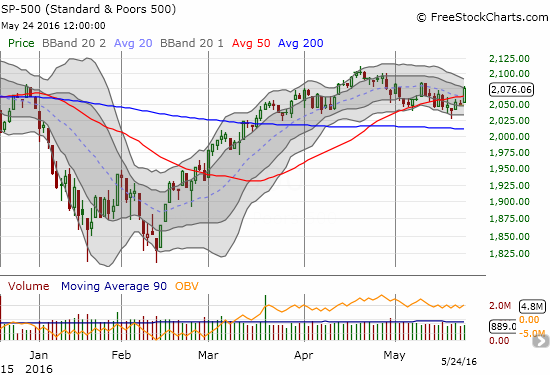

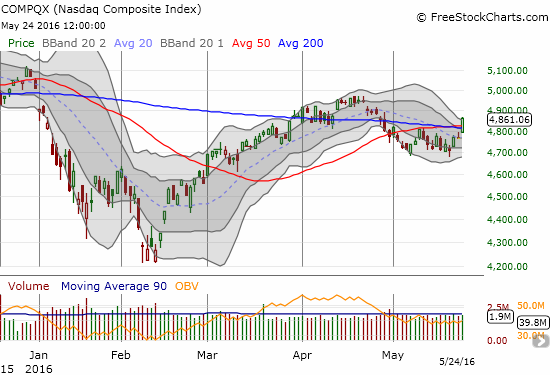

In the last T2108 Update, I stayed cautiously bearish as the major indices remained in a chopfest under key 50-day moving average resistances. Tuesday, May 24, 2016, that resistance melted away simultaneously as the S&P 500 (SPDR S&P 500 (NYSE:SPY)) and the NASDAQ (PowerShares QQQ Trust Series 1 (NASDAQ:QQQ)) punched through resistance and re-entered bullish territory.

The S&P 500 (SPY) is just one follow-through day away from confirming a bullish breakout.

The NASDAQ (QQQ) pulls off a breakout of dual resistance at its 50 and 200DMAs

As my assumption of an extended “chopfest” gets challenged, this quick potential switch from a bearish to a bullish trading bias is consistent with the whiplash that a chopfest can dish out. My trading bias has moved from “cautiously bearish” to neutral to recognize the imminent switch to a bullish bias.

T2108, the percentage of stocks trading above their respective 40DMAs, fully confirmed today’s rally. T2108 soared from 48% to 56%. T2107, the percentage of stocks trading above their respective 200DMAs, could easily hit a new high in short order given the current momentum.

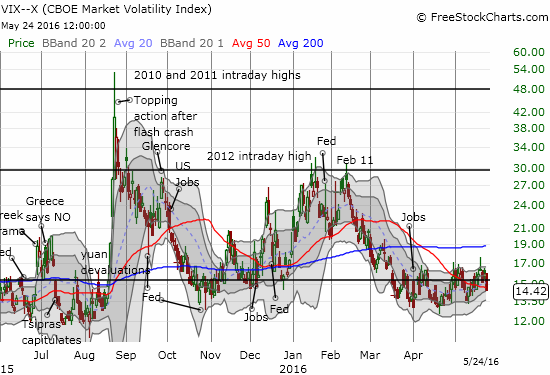

The volatility index, the VIX, receded with the bears and sellers. Once again the VIX treated the 15.35 level as a pivot.

The VIX looks ready to retest lows.

Several stocks demonstrate my changed thinking.

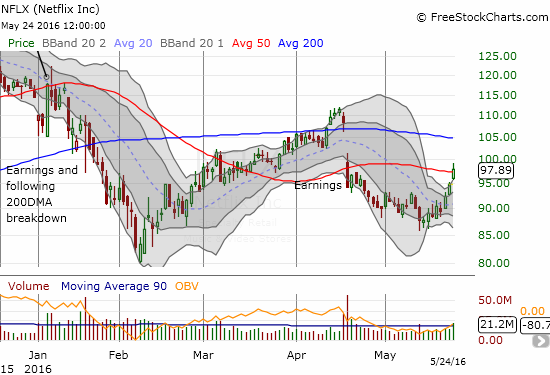

Netflix (NASDAQ:NFLX) is a stock that was poised for a big breakdown or breakout from a Bollinger Band (BB) squeeze. With my bearish bias, I assumed the top of the recent range would hold, and NFLX would hurtle quickly downward from there. I was clearly thinking too many steps ahead. NFLX has gained about 10% in just three days. It is over-stretched above its upper-Bollinger Band (BB) and faded from its high to close on its 50DMA.

Normally, I would expect a pullback from here to at least the upper-BB, but this is a stock on fire with INCREASING buying volume. The over-stretched trend could continue a lot further with this kind of momentum.

Netflix suddenly accelerates from 0 to 60 and stretches toward a 50DMA test of resistance.

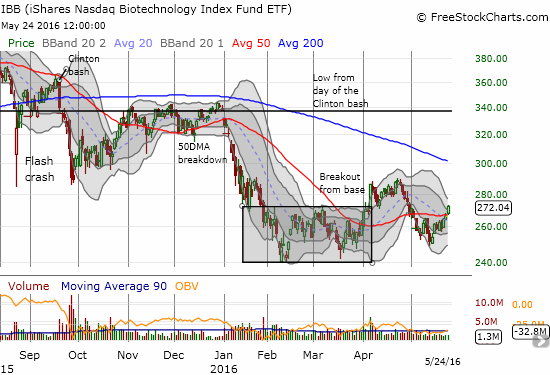

The iShares Nasdaq Biotechnology (NASDAQ:IBB) broke out above its 50DMA resistance and goes from bearish to bullish all over again. I started this month lamenting how IBB completely disappointed me by failing to deliver much follow-through to April’s (initially) impressive breakout.

The iShares Nasdaq Biotechnology ETF (IBB) avoided a retest of recent lows so the latest 50DMA breakout looks like a bottoming underway.

Qualcomm (NASDAQ:QCOM) broke out last week above its 200DMA. The buying has accelerated and put QCOM at a new high for 2016. The stock is definitely in a bullish position.

Qualcomm (QCOM) is surging higher in convincing follow-through to last week’s 200DMA breakout.

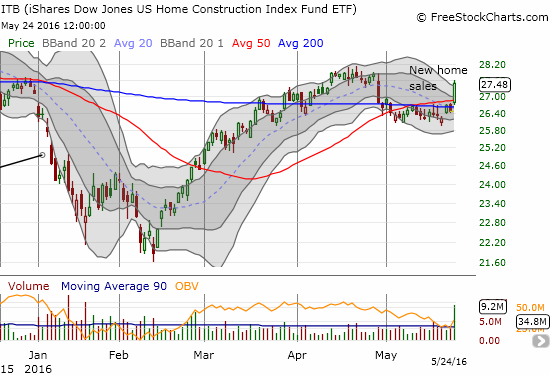

Even home builders joined the breakout party. I wrote about the bullish implications in housing in my latest Housing Review for May, 2016.

iShares US Home Construction (ITB) breaks out from 50 and 200-day moving average resistance on buying volume that has not been this large since the recovery from August’s flash crash.

This is an interesting time for the market to get a fresh boost. The rally comes right on the heels of selling that was presumed to come from rate hike fears. The odds of a rate hike in July are as strong as ever but so is the market. Even if I switch back to a bullish bias, I will remain bearish on dollar-sensitive plays (excluding gold and silver) as long as Fed Fund futures project an imminent rate hike.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

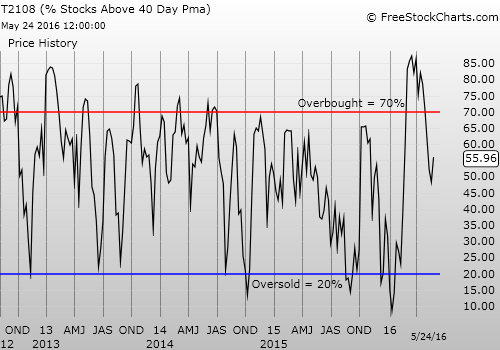

Weekly T2108

Be careful out there!

Full disclosure: long UVXY call options, long SSO put options