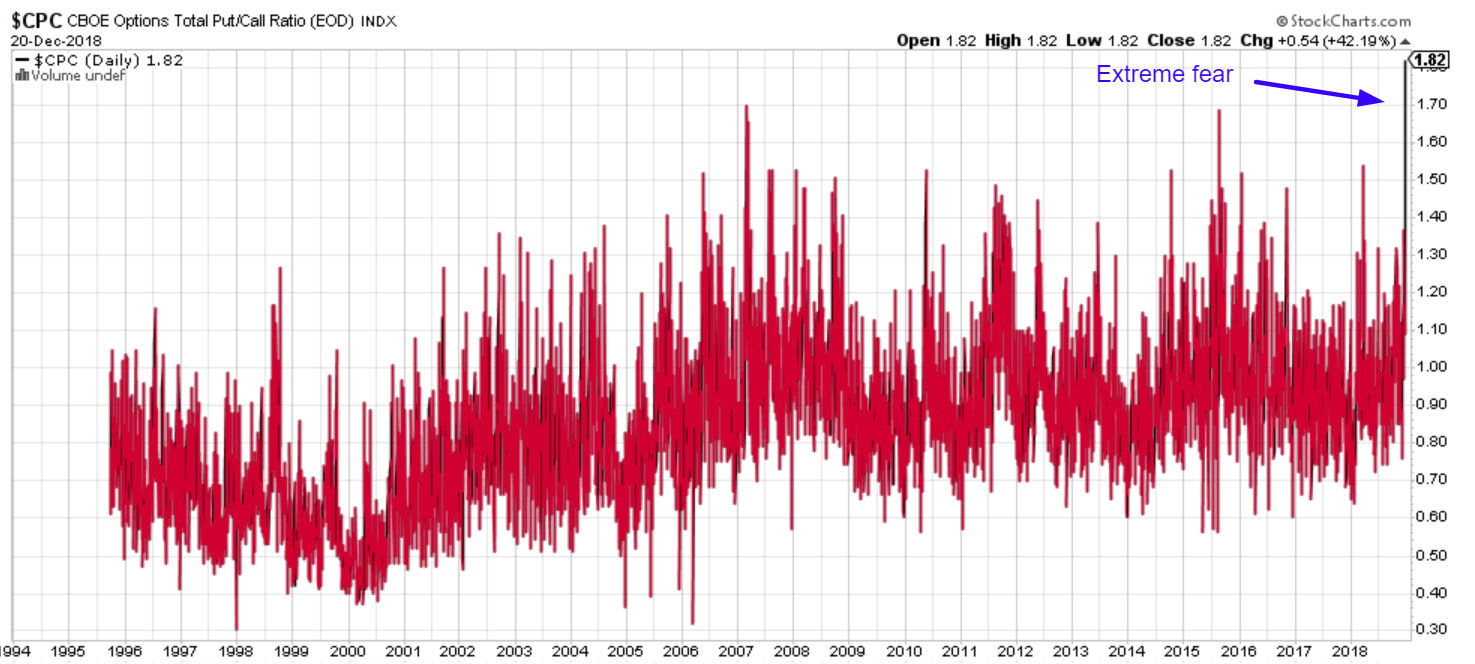

Bearish sentiment in the stock market is at an extreme right now. For example, the Put/Call Ratio is at its highest level ever. During such times, the stock market can go down more in the short term (when panic sets in, it’s hard to know the exact bottom). That’s why it’s always better to focus on risk:reward and remain unemotional.

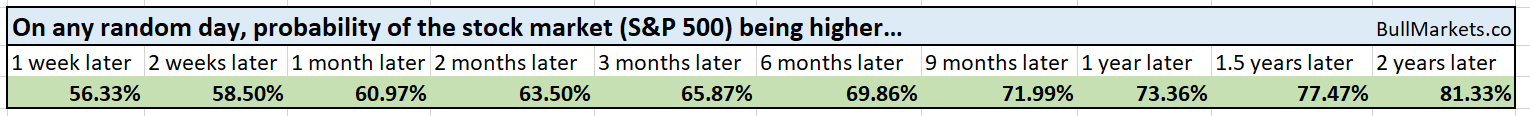

Let’s determine the stock market’s most probable medium term direction by objectively quantifying technical analysis. For reference, here’s the random probability of the U.S. stock market going up on any given day, week, or month.

*Probability ≠ certainty. Past performance ≠ future performance. But if you don’t use the past as a guide, you are walking blindly into the future.

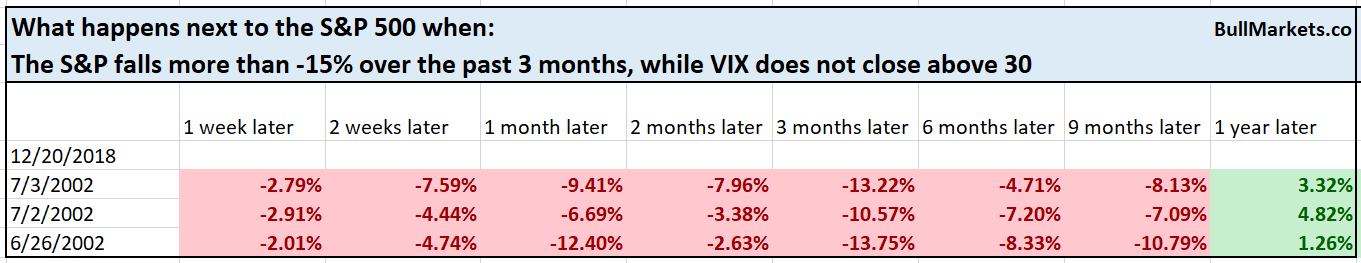

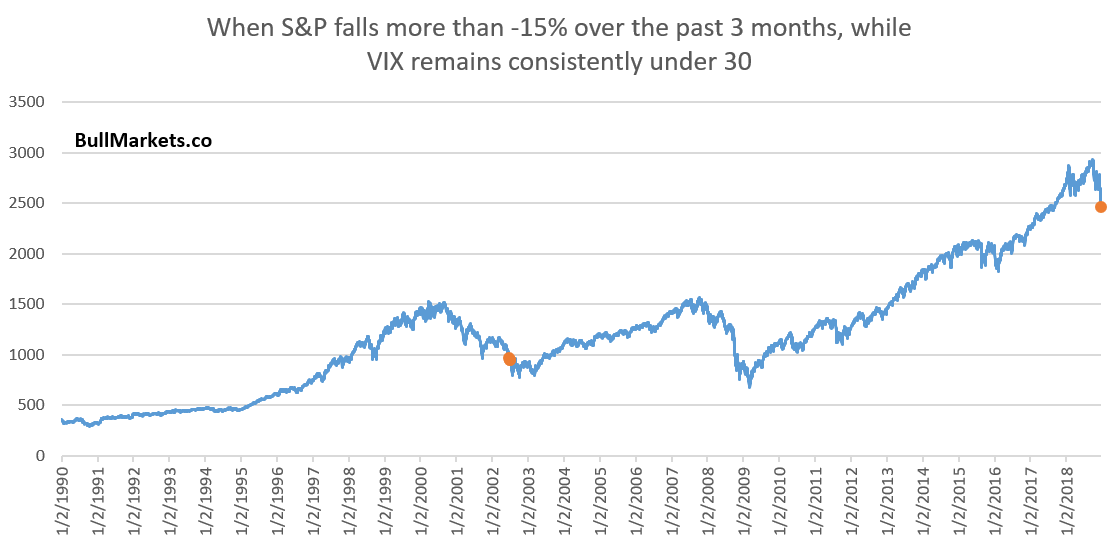

No VIX Spike

What’s particularly interesting about the stock market’s current -16% decline is that CBOE Volatility Index hasn’t gone up significantly. This has some investors worried that the S&P 500 needs to fall much more in order for VIX to spike, and only then will the stock market make a meaningful low.

Here’s what happened next to the S&P 500 when the S&P fell more than -15% over the past 3 months, while VIX never closed above 30.

*Data from 1990 – present

As you can see, this study is particularly interesting. This only happened in June/July 2002, near the bottom of the bear market (after the S&P fell more than -40%). In that historical case, the S&P fell another 10%, but that was the bottom of the massive 50% bear market.

A lot of our recent market studies have pointed to similarities between now and October 2008 (i.e. after the 40% crash). Such quick crashes so close to an all-time high are rare. They tend to happen near the bottom of bear markets. But at the very least, this supports the case for a mean-reversion bounce.

Small Caps

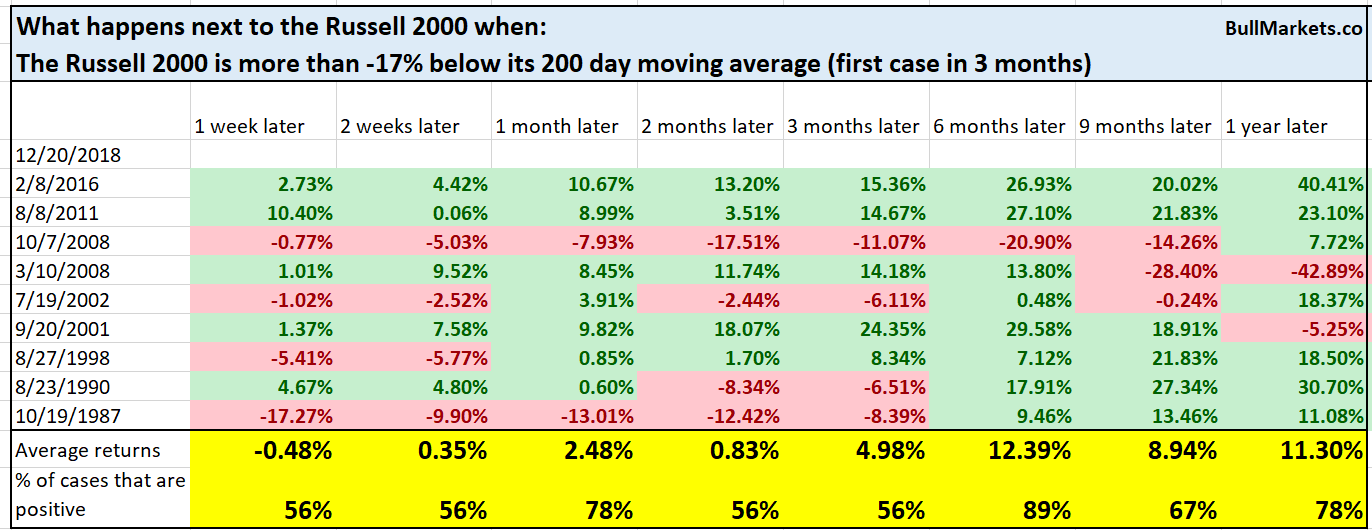

Small cap stocks (Russell 2000 index) have been absolutely crushed recently. It is now more than -17% below its 200 day moving average.

Here’s what happened next to the Russell when it fell more than -17% below its 200 dma.

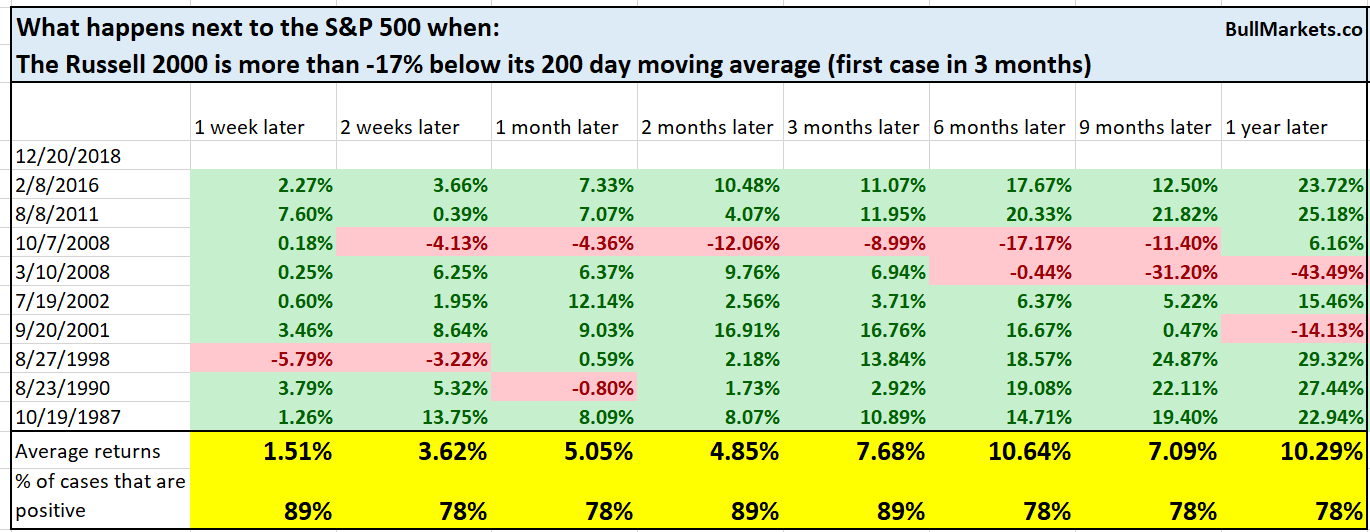

Here’s what happened next to the S&P 500 when the Russell fell more than -17% below its 200 dma.

This is generally a bullish sign for the stock market over the next 2-3 months, which is the standard for at least a bear market rally.

The only real bearish case here is October 7, 2008. I think such a setup is unlikely. The economy was in a massive recession by October 2008 and the financial system was collapsing. Today?

This is an extreme overreaction in the stock market. Main Street is fine. Context matters.

S&P 500’s Overreaction

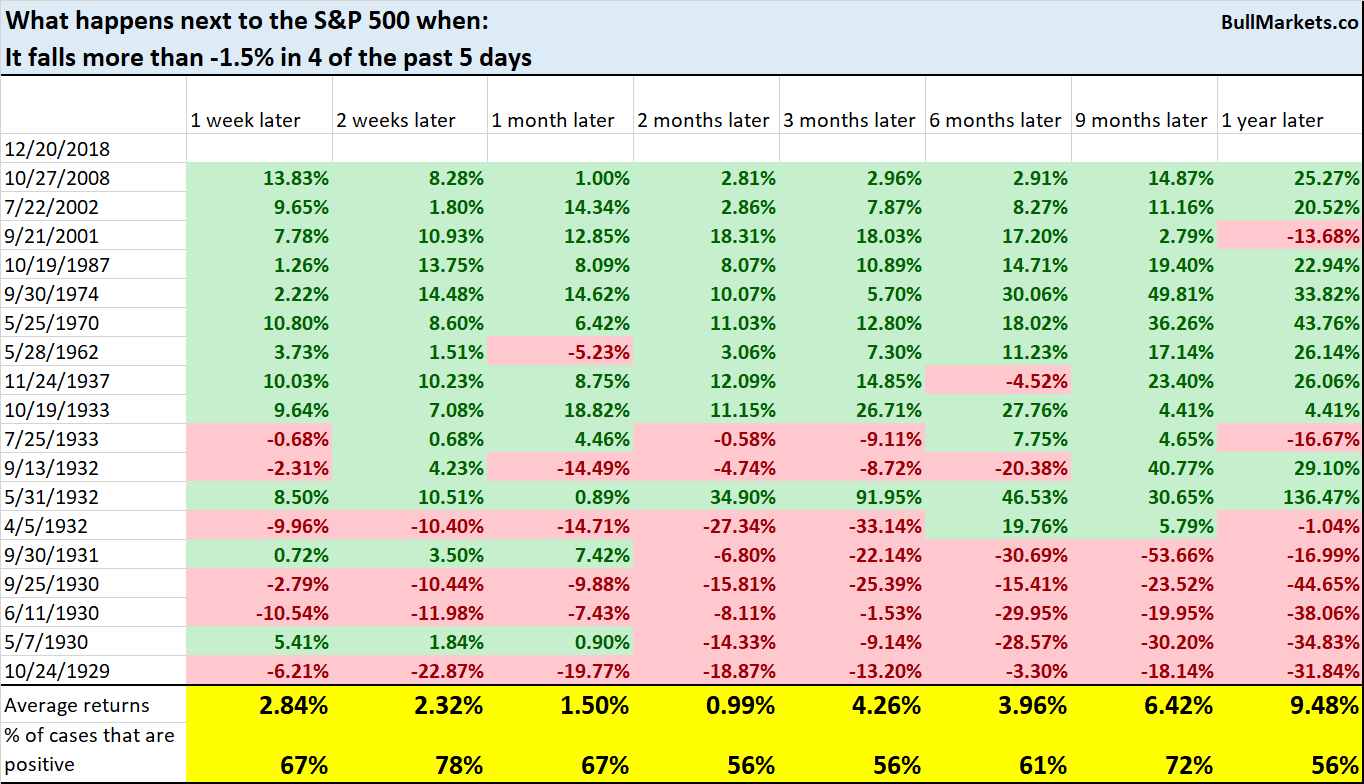

The S&P has fallen more than -1.5% in 4 of the past 5 days. Is this a sign of “capitulation selling”?

Here’s what happened next to the S&P 500 when it fell more than -1.5% in 4 of the past 5 days.

*Data from 1928 – present

As you can see, this was consistently bullish for stocks (a sign of capitulation selling), except when it came to the 1929 – 1932 bear market in which the stock market fell 90%+

I think a repeat of 1929-1932 is unlikely. Unemployment skyrocketed to 25% and the global economy was in a MASSIVE depression. Few of our readers think a repeat of the Great Depression is likely too. Otherwise you wouldn’t be reading this. You’d be reading Zerohedge, which brings you regular programming on how “every day, the stock market will crash like 1987”.

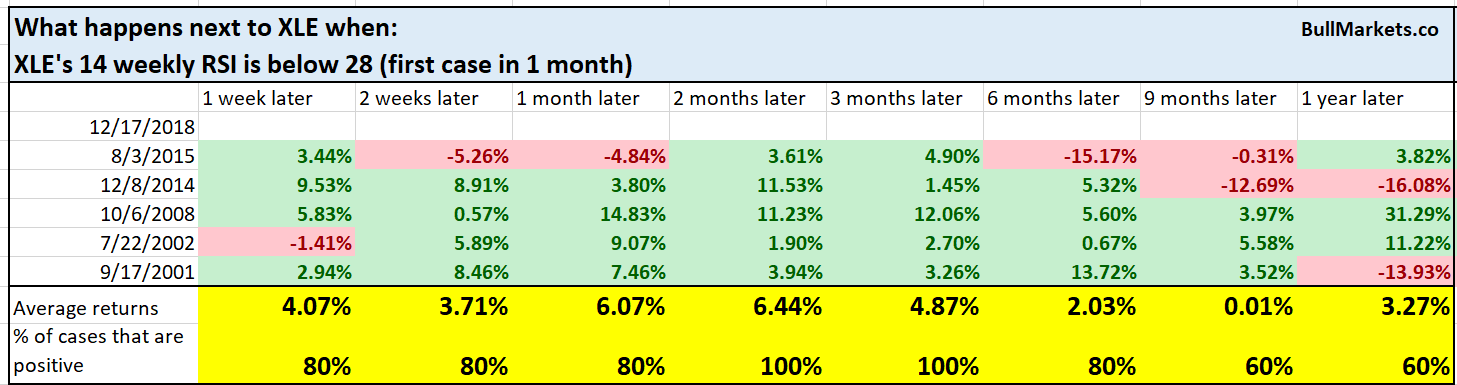

XLE (NYSE:XLE)

Along with the rest of the stock market, the energy sector’s crash and oil’s “crash” is approaching an extreme. Oil’s weekly RSI is now at 27

Here’s what happened next to XLE (energy sector ETF) when its weekly RSI fell below 28

Once again, the setup for a bounce

Gold’s Breakout

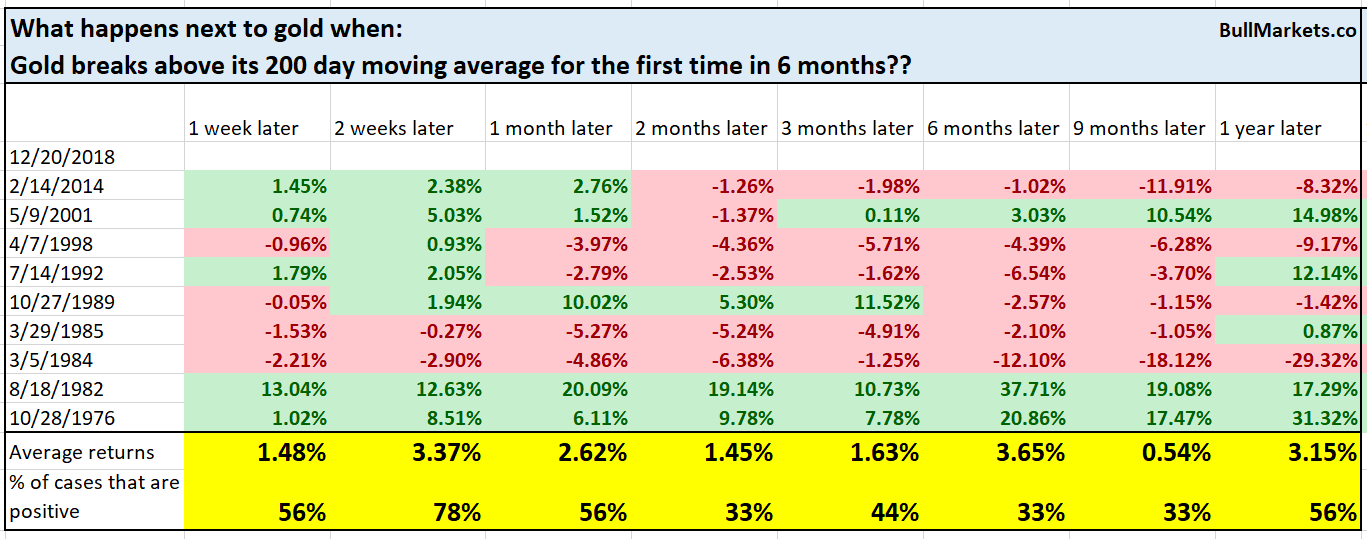

Gold has done well during the stock market’s recent decline. It has finally broken above its 200 day moving average for the first time in more than 6 months.

Here’s what happened next to gold when it broke above its 200 dma for the first time in 6 months (i.e. first breakout after a long downtrend).

Gold might continue its rally in the short term (especially if the stock market falls more in the short term), but its long term prospects aren’t good.

Observations

Here are some interesting observations. This is not quantitative (serious) analysis, so take this with a serious grain of salt.

While the permabears are enjoying their moment in the sun, it’s worth asking “is this the death of the stock market’s bubble?”

Let’s look at the stocks that best symbolized the stock market’s “bubble”: Amazon (NASDAQ:AMZN) and Netflix (NASDAQ:NFLX)

Here’s Amazon:

Here’s Netflix:

As you can see, the 2 biggest “bubble stocks” have not made new lows this month while the rest of the stock market has tanked. This suggests there is a “buy the dip” force waiting under the market, especially under the bubble stocks.

Here’s the emerging markets ETF iShares MSCI Emerging Markets (NYSE:EEM):

Notice that EEM was much worse than the U.S. from January – September 2018, but since then has not gone down by much.

Conclusion

Here is our discretionary market outlook:

- For the first time since 2009, the U.S. stock market’s long term risk:reward is no longer bullish. This doesn’t necessarily mean that the bull market is over. We’re merely talking about long term risk:reward.

- The medium term direction is still bullish (i.e. trend for the next 6 months). However, if this is the start of a bear market, bear market rallies typically last 3 months. They are shorter in duration.

- The short term is a 50/50 bet

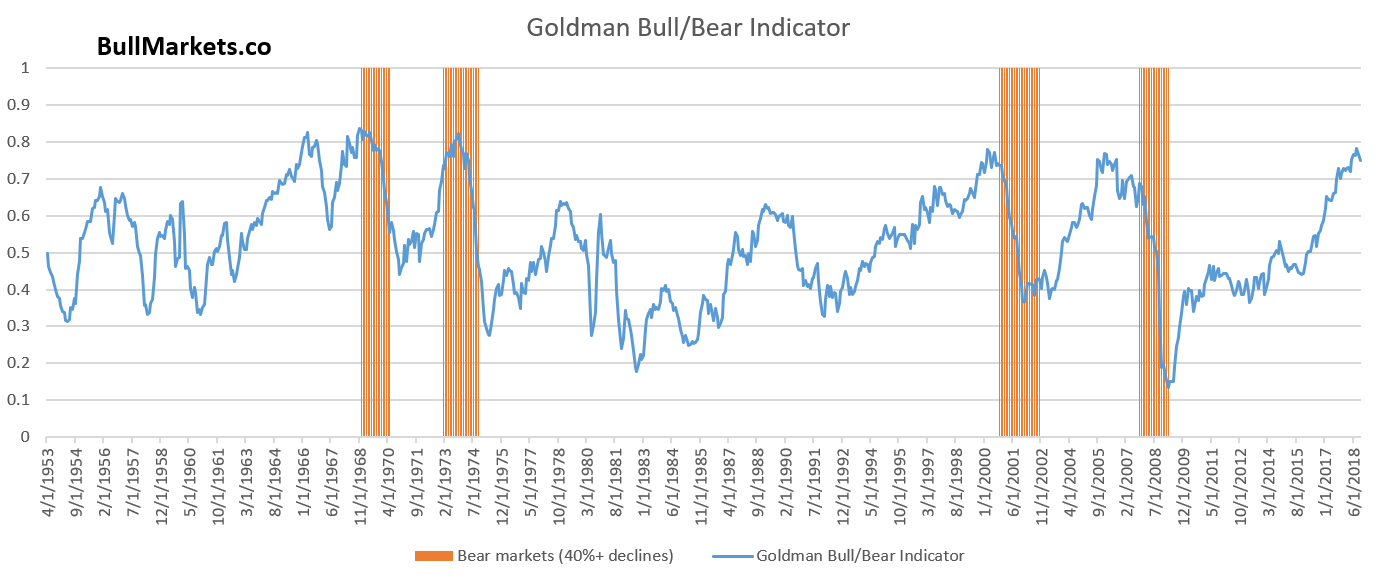

Goldman Sachs’ Bull/Bear Indicator demonstrates that while the bull market’s top isn’t necessarily in, risk:reward does favor long term bears.

Our discretionary outlook is not a reflection of how we’re trading the markets right now. We trade based on our quantitative trading models, such as the Medium-Long Term Model.