Let’s start today’s analysis with a question I just received. It was about whether I felt that GLD and GDX were forming a W-shaped bottom, and whether I would consider going long if the price kept moving up, at least for a short term.

Starting with the last part, it’s a definite “yes.” I would definitely “consider” going long. In fact, I consider going long each day (and I featured long positions in the precious metals sector earlier this year). My aim is to look at the charts as if I didn’t have any investment or trading position open, and to determine IF and what kind of position I would like to open on a given day based on what I see in the charts.

This approach helps to avoid the so-called “conservatism bias,” which emerges when one sticks to a belief, outlook, opinion, (or trading position in this case), just because they had them previously. People with strong conservatism bias might even not want to read/listen to anything that might challenge their original views.

Anyway, as soon as the bearish indications are either nullified or overwhelmed by bullish factors, I’ll be happy to go long the precious metals and/or mining stocks. However, most likely, the situation will have turned neutral before that happens, or not bearish enough to justify keeping the short position intact.

At this time, I continue to think that the outlook remains bearish and the short position in the mining stocks remains justified. It’s not a feeling, it’s an analysis-based opinion.

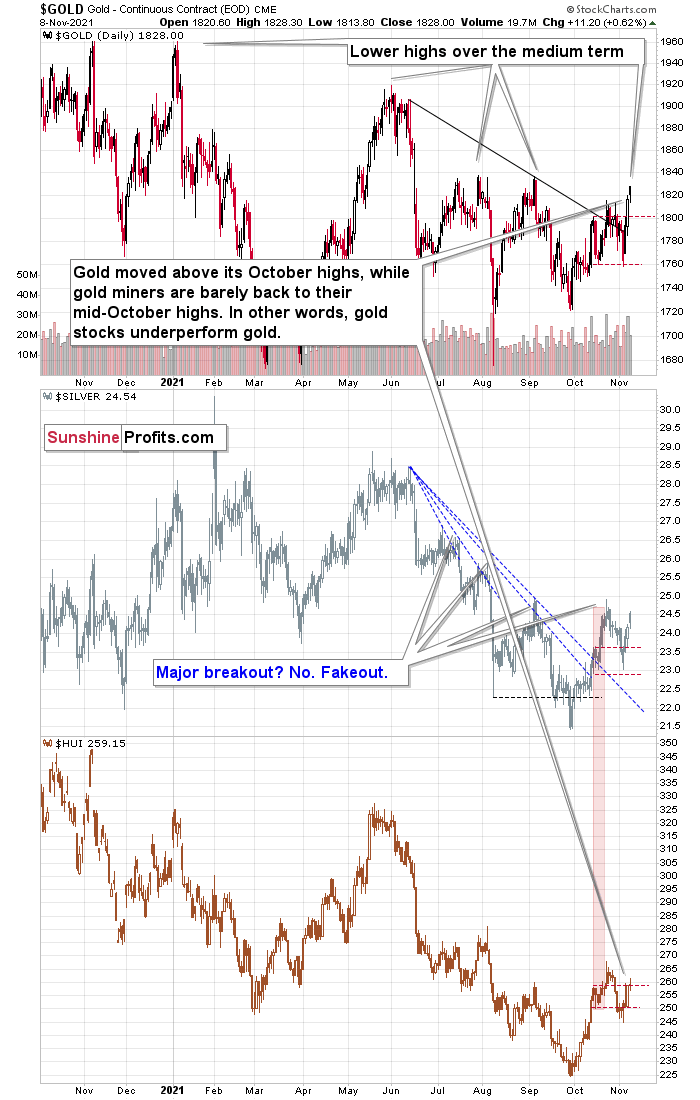

Is gold or GDX forming a W-shaped bottom? I don’t think so.

Ultimately, whether something was a W-shaped bottom or a horizontal consolidation becomes clear only after a breakdown below the previous lows, or after a sizable rally that is accompanied by other bullish confirmations.

We haven’t seen a breakdown to new lows recently, but we haven’t seen meaningful bullish confirmations either.

The key bullish ingredient that is missing, and something that provides us with clear bearish indications instead, is mining stocks’ relative strength.

The above charts clearly show how weak mining stocks are compared to gold, and it is particularly bearish given the support that miners have been receiving recently from the general stock market. The latter moved to new highs, helping the miners move up. And what did they do? They did move up indeed, but in a very weak manner.

From the short-term point of view, gold stocks are weak because they barely got back to their mid-October highs, let alone the October highs. Gold moved visibly above its recent highs, but the HUI Index—the flagship proxy for gold stocks—was barely affected. This is very bearish, and there’s no other way to call it.

Miners’ weakness doesn’t end there. Looking from a broader point of view, we see that miners are currently trading close to their March lows. Gold is now about $150 above its March low, so miners more or less ignored that move over the medium term. That’s not a small move, and the importance of this indication is not to be ignored.

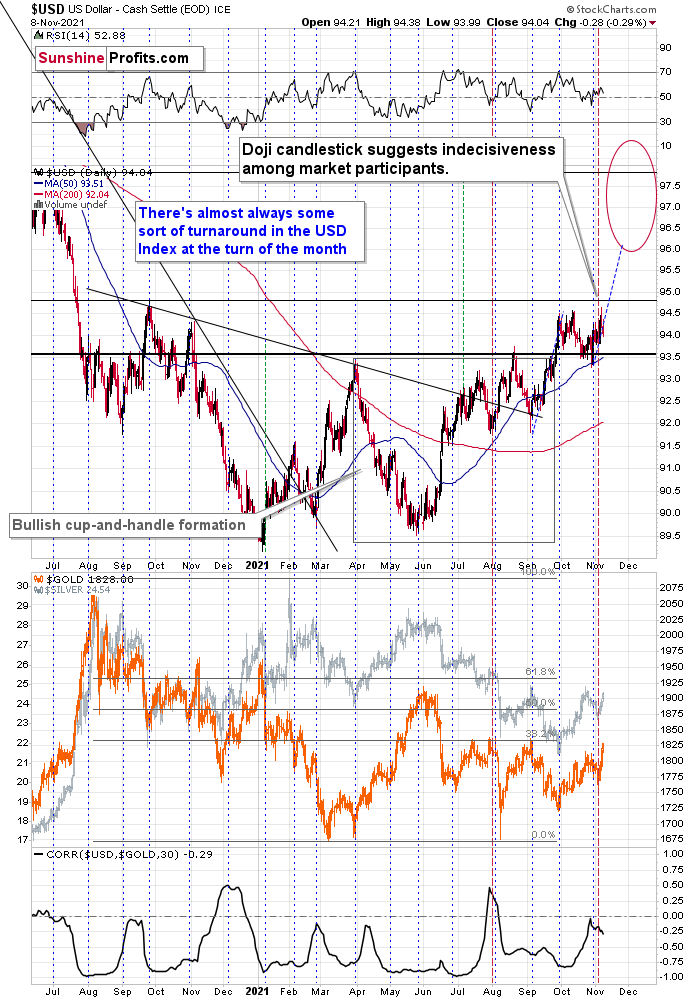

Besides, let’s keep in mind that the USD Index remains above its previous 2021 highs, and the breakout above them was more than confirmed. This means that it’s likely to move to much higher values, even though it may seem that it will continue to hesitate and trade sideways “forever.”

There’s a technical rule of thumb that says that the longer the base is, the bigger the following move is going to be. The post-breakout consolidation has been taking place for over a month, so it’s likely preparing the USD Index to move much higher. The implications for the precious metals sector are bearish.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI