The Dollar still looks bearish. Even after bouncing from a 15-month low the U.S. Dollar is still seemingly stuck in a bearish trend. Investors begin positioning for this Friday’s U.S. employment data that has created a pause in selling of the battered currency. The Dollar was weighted down by political turmoil this Monday and uninspiring U.S. economic data that raised doubts about the path for higher interest rates.

The Kiwi slips into a 1-week low. The New Zealand dollar was down 0.5 percent at a one-week low of $0.7427 on the data, and it shows that the number of jobs created fell unexpectedly and the wage inflation remains tepid in the second quarter.

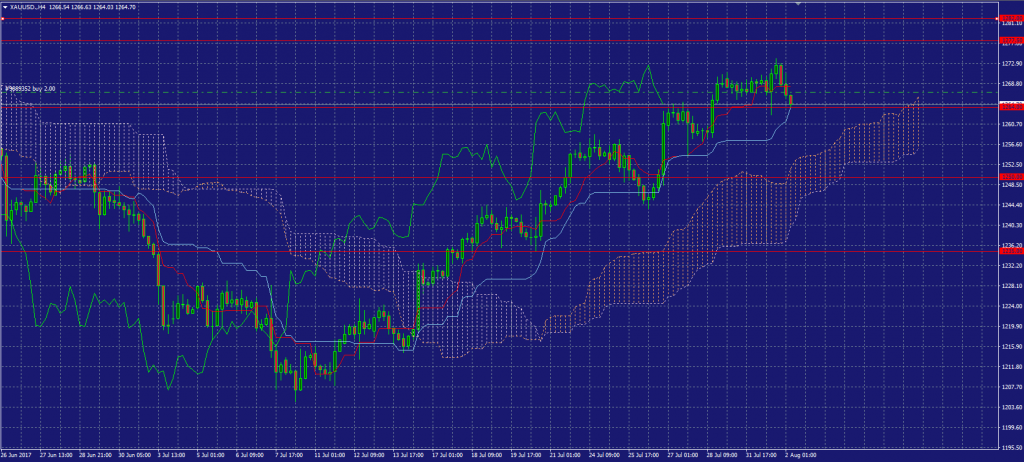

Gold moving up. Weak dollar makes gold prices trading nominally higher. The turmoil within White House staff can be interpreted as mildly supportive for safe-haven gold. Oil bulls still have upside technical momentum, and that’s also friendly for the metals. Investors may be reluctant to take large positions ahead of closely watched U.S. employment data, that may tend toward gold prices consolidation for the next few days.

Price may approach the 1277.50 level if the bulls can hold prices above the hourly cloud. Closing beyond 1277.50 may be a sign that market is getting ready to test 1282. If XAU/USD falls through 1264-1262.70 (the bottom of the hourly cloud), the market will be aiming for 1257.50-1255. The bears will have to overcome this support so that they can set sail for the 1250 level.

Aussie is ranging due to the RBA’s Rate Statement. Due to a strong currency and weak inflation; Australia’s central bank on Tuesday marked a full year without changing interest rates. Economists say that rates could stay at record lows of 1.5 percent for another year. The Aussie jumped about 8% since June to a two-year peak, driven by a weakened U.S. Dollar. It is now seemingly going nowhere, ranging in a wide zone between 0.7878 and 0.8069.