Most technicians widely use momentum indicators. There’s a wide variety of applications of momentum. Some look at high-low ranges, closing values only, various lookback periods, and smoothed values with the inclusion of moving averages. How they are used also varies. Some traders look for extremes in momentum as signs of potential mean-reversion. Others seek divergences, such as with momentum making a lower-high as price makes a high-high. However, one topic regarding momentum indicators that don’t get as much attention ranges. The range that a momentum indicator – and for this post’s purposes, we’ll be using the 14-period Relative Strength Index (RSI) – can tell us much about what’s going on in the market’s price action.

Ranges can be viewed in various timeframes; my focus today is looking at the weekly chart of the S&P 500 and the 14-week RSI. The focus isn’t on the “overbought” or “oversold” levels of 70 and 30. Instead, we’re more interested in when RSI rises above 60 or below 40. Strong momentum often begets continued strength, so when momentum stays elevated (outside of extreme levels like getting north of 80 back in January 2018), that’s historically been bullish for price continuing to rise. The opposite has also been confirmed, when RSI is weak, hitting levels under 40, the price is deemed in a bearish range, and price activity often finds itself in a downtrend.

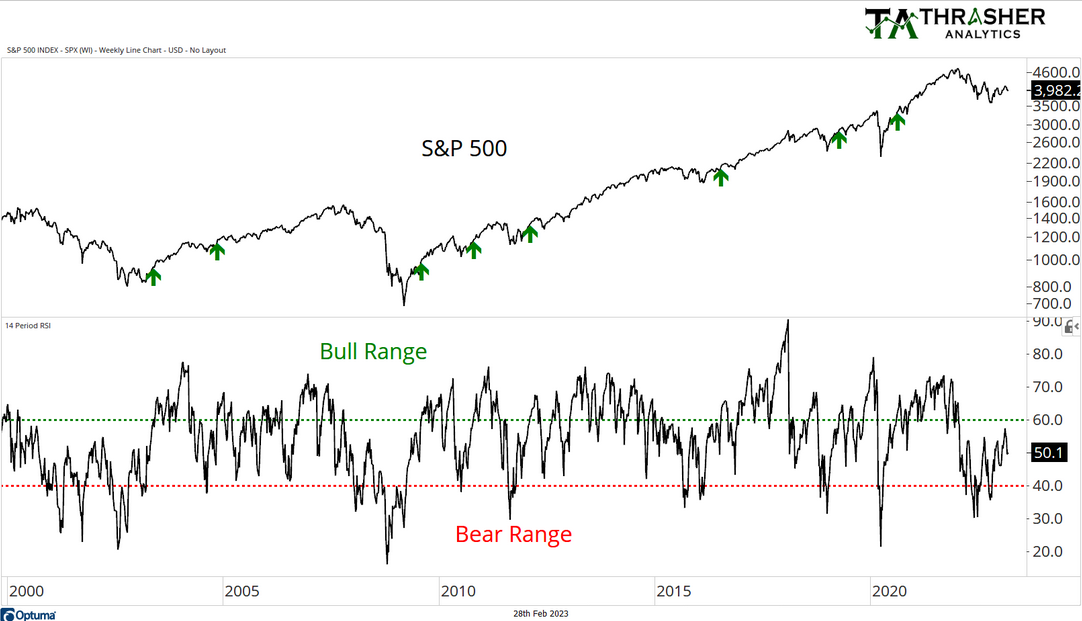

Below is an example using the weekly chart of the S&P 500 since 2000. Let’s unpack what can be learned from this chart:

- First, look at the major bear markets that began in 2000 and 2007. As those down trends developed, the weekly RSI could not produce a reading above 60. It wasn’t until the down trends had ended and the price began to show the strength that we got the first break above 60.

- This doesn’t just apply to major bear markets. Historically, price action has appreciated further when RSI goes from under 40 to above 60. I plotted green arrows when this occurred. For each move above 60 after being under 40, the shift from a possible bearish range to a potential new bullish range has been a positive sign for the Index.

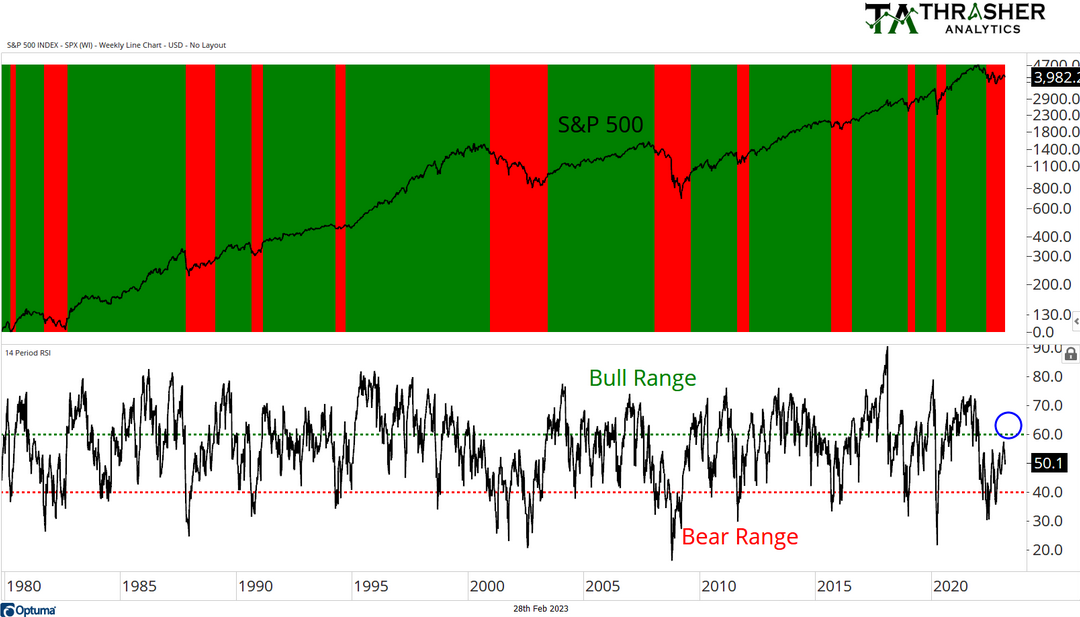

We can take this concept of ranges a step further and look at a more systematic approach to identifying when the S&P 500 is in a bullish or bearish range based on its 14-week RSI. The chart below goes back to 1980 and turns green when the RSI has spent 3 of the last four weeks above 60 and turns red when the opposite occurs, spending 3 of the last four weeks under 40. To identify the ranges, we’re looking for when it’s been above or below the noted levels for at least a few weeks rather than just a week that pierces the threshold and immediately moves away (as we saw in August 2004 and June 2010).

Looking at the far right of the chart, we can see this metric is one that bulls still have left unchecked about the rebound in equities that began in October 2022. The 14-week RSI still hasn’t been able to breach 60 which leaves us in a bearish range.

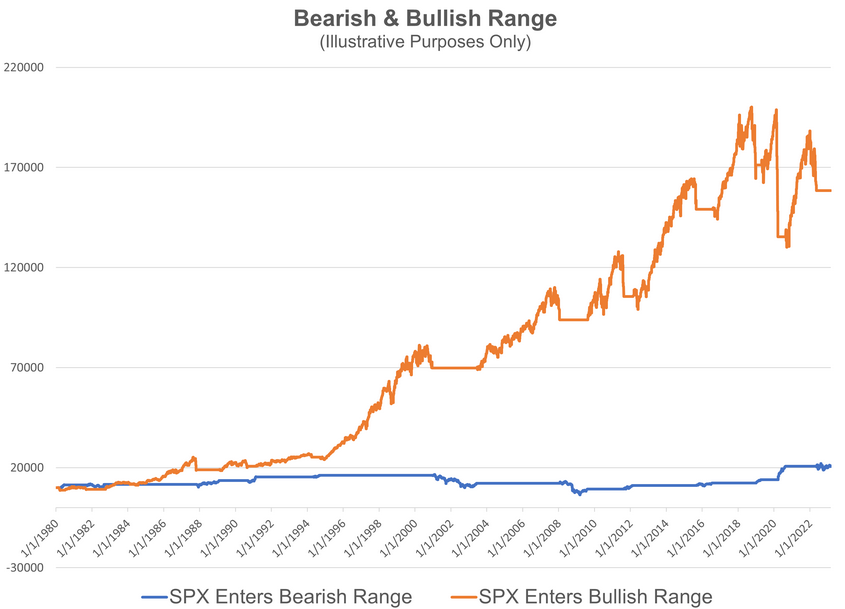

By taking a systematic approach to identifying the momentum ranges, we can run a simple backtest to see how the market has performed in these ranges. The chart below shows the difference in the performance when the market is in a bullish range (orange line) vs. in a bearish range (blue line). This isn’t intended to be a trading signal but to provide insight into the condition of the market based on whether the range momentum finds itself in. And, of course… It’s important to note that this is not a recommendation to buy or sell, and past performance does not indicate future returns.

By taking a step back and looking at longer-term charts such as the weekly chart examples used above, we can evaluate the momentum ranges and work towards identifying what kind of market environment we may find ourselves in. The analyst can also play around with different thresholds. 60/40 are the ones I used today but are by no means the only options available, and other technicians may find other thresholds for range helpful identification.

Disclaimer: Do not construe anything written in this post or this blog as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for the full disclaimer.