Our Zacks Bear of the Day, Motorcar Parts of America (MPAA) has recently experienced a decline in demand as retailers have reduced their restocking orders as of late. The company has experienced weakness in both the wheel hubs and break master cylinder segments.

This Zacks Rank #5 (Strong Sell) company is a leading manufacturer of replacement alternators and starters for imported and domestic cars and light trucks in the United States and Canada. The company's full line of alternators and starters are remanufactured for vehicles imported from Japan, Germany, Sweden, France and Korea. The imported vehicles for which the company remanufactures alternators and starters also include vehicles produced by GM, Chrysler and Ford. The company also assembles and distributes ignition wire sets for imported and domestic cars and light trucks.

Recent Earnings Results

The company posted Q4 17 results in mid-June where they missed both the Zacks consensus earnings and revenue estimates. Management blamed mild winter weather and delayed tax returns as the main reasons for the top and bottom line misses. Further, the poor weather conditions caused their retail point of sale (POS) customers to see increased inventories, and in some cases these retailers returned the excess inventory to MPAA. While weather and delayed tax returns may have had some impact on the buildup of inventories, most analysts would counter with the fact if there was true demand for their products weather and tax returns would not have detoured the sales of their products. These two excuses are typically looked upon as vague scapegoats for lack of true demand for products.

Management’s Take

According to Selwyn Joffe, President and CEO, “Our results for fiscal 2017 reflect strong growth and continued momentum into the new fiscal year despite the impact of a mild winter on our sales.”

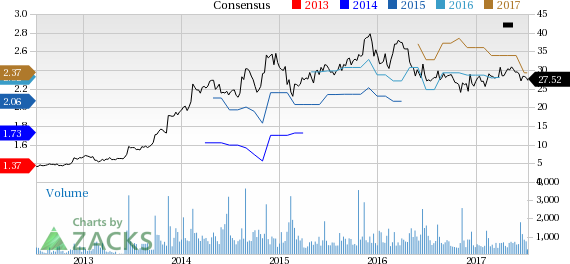

Price and Earnings Consensus Graph

Due to the recent customer softness, the stock price and future earnings estimates have decline as of late.

Motorcar Parts of America, Inc. (MPAA): Free Stock Analysis Report

Original post