The thought of a bear market sends shivers down the spines of most investors.

After all, who wants to see stock prices decline?

I, for one, wouldn’t mind it one bit. Bear Markets provide investors with opportunities to buy stocks at bargain prices.

That’s a positive event, not a negative event. Dividend investors in particular have a big advantage in bear markets.

You may also be interested in stocks that do well during bear markets to insulate your portfolio from the worst ‘bite’ of bear markets. This article covers four bear market stocks as well.

The Likelihood of Another Bear Market

The S&P 500 is very obviously overvalued. The historical average price-to-earnings ratio of the S&P 500 is 15.6. It is currently trading for a price-to-earnings ratio of 19.8.

Based on the numbers above, the S&P 500 needs to decline about 20% to reach fair value.

In addition to the market trading above its historical average price-to-earnings ratio, there are a number of potential crises that are threatening stock markets.

The global economy is looking increasingly fragile. Japan, Europe, and the U.S. carry high levels of debt. Greece and Puerto Rico are on the verge of defaulting. China is propping up its struggling stock market with central bank funded purchases.

There’s no question there will be another bear market. The only question is when. It could be a week from now, a month, or three years.

The Dividend Investor’s Advantage

Dividend investors have a big advantage in bear markets because we care about valuation. We’d rather buy Coca-Cola (NYSE:KO) stock when it yields 5% than when it yields 2.5%. This is just common sense, but it is not so common among many individual investors.

Bear markets allow dividend investors to reinvest their dividends into stocks that offer yields higher than what one could expect in a bull market.

Dividend investors who are still saving have the opportunity to invest additional funds in dividend stocks trading at bargain prices. As an example, Aflac (NYSE:AFL) stock briefly traded for dividend yields over 7% (!) during 2009. The stock currently has a 2.7% dividend yield.

Psychology of Bear Markets

It takes a self-assured investor to not panic during bear markets. The average individual investor sells during bear markets and buys during bull markets. This is completely backward – and it’s the primary reason why individual investors tend to do so poorly.

I hope by reading this you will take action.

When the next bear market hits – and hits your portfolio (and everyone else’s) hard, do not sell.

DO NOT SELL.

Instead, either hold your stocks (which is okay), or buy while bargains are available (which is great).

If you can adjust your psychology to be excited for the bargains that bear markets provide – or at least be ambivalent about bear markets – you will greatly outperform your investing peers.

For me, the key to being excited about bear markets is to invest in high quality dividend growth stocks with a long history of increasing dividends. These are stocks that have proven themselves in both bull and bear markets.

That doesn’t mean high quality dividend growth stocks don’t see price declines in bear markets… These stocks fall as well, but not as much, on average. Case-in-point, the Dividend Aristocrats Index fell 22% in 2008, while the S&P 500 fell 38%.

This article will look at four bear market stocks that have historically performed well during recessions — and are likely to again during the next recession.

Bear Market Stock 1: Church & Dwight

Church & Dwight (NYSE:CHD) has increased its earnings-per-share every year from 1999 through 2014. The company has a low-risk and easy-to-understand growth plan:

Heavily advertise its brands and price them cheaper than other branded competitors. It’s simple, but it has worked very well for Church & Dwight. The company has 9 ‘power brands’ that drive results:

- Trojan

- OxiClean

- Spinbrush

- Arm & Hammer

- Nair (hair remover)

- Xtra (laundry detergent)

- First Response (pregnancy tests)

- Lil Critters/Vita Fusion (vitamins)

- Orajel (tooth/mouth ache medicine)

It is important to note that Church & Dwight only developed one of these brands organically – Arm & Hammer. The other eight were acquired within the last 15 years.

Going forward, Church & Dwight plans to focus 75% of its advertising budget on just four brands – Arm & Hammer, OxiClean, Trojan, and Lil Critters/Vita Fusion. The company behaves much like a highly focused value investor — allocating capital primarily to its best ideas.

Church & Dwight performed exceptionally well during the Great Recession of 2007 to 2009. Earnings-per-share grew each year through the Great Recession, as shown below:

- 2007 Earnings-per-share of $1.23

- 2008 Earnings-per-share of $1.43

- 2009 Earnings-per-share of $1.74

The company is successful during recessions because it sells ‘value-priced’ (relative to other branded competitors), every-day household goods. These are items consumers don’t cut back on during recessions.

Church & Dwight has performed well through both recessions and prosperous times. The company has managed to compound its earnings-per-share at 14.1% a year over the last decade.

Unfortunately, other investors have taken notice of Church & Dwight’s excellent performance, pushing up the company’s price-to-earnings ratio. Church & Dwight's stock now trades at a forward price-to-earnings multiple of 23.9. This is well above the company’s historical average. Church & Dwight appears to be overvalued at this time, and has been for quite some time.

Bear Market Stock 2: Flowers Foods

Flowers Foods (NYSE:FLO) is as boring as bread… Because that’s what they sell. With that said, this ‘plain bread’ business managed to grow earnings-per-share each year from 2000 through 2010.

The company owns the following well known bread brands (among others):

- Nature’s Own

- Wonder Bread

- Cobblestone

- Tastykake (not bread)

Flowers Foods has compounded its earnings-per-share at 13.4% a year over the last decade. The company may operate in a boring industry — but double-digit growth is far from boring.

The company has managed to grow rapidly by consolidating the bakery/bread industry in the United States. Flowers Foods’ market share has grown from 7.7% in 2009 to 13.9% in its fiscal 2014.

Consumers tend to buy bread regardless of the overall economic condition – after all, it’s a cheap staple used in many United States households daily for toast and sandwiches. As a result, Flowers Foods managed to grow its earnings-per-share each year through the Great Recession of 2007 to 2009. The company’s earnings-per-share are shown over this time period:

- 2007 Earnings-per-share of $0.45

- 2008 Earnings-per-share of $0.57

- 2009 Earnings-per-share of $0.63

Flowers Foods is currently trading for a forward price-to-earnings ratio of 22.3. While not wildly overvalued, Flowers Foods is trading for a 35% premium to the S&P 500’s forward price-to-earnings ratio.

The company should trade at a premium to the S&P 500 due its better growth prospects and recession resistance, but Flowers Foods is likely somewhat overvalued at current prices. Flowers Foods currently offers investors a 2.4% dividend yield. If the company’s price-to-earnings ratio ever falls in line with the S&P 500’s (or below it), it will make for a compelling purchase.

Bear Market Stock 3: Wal-Mart

From the beginning of 2007 to the end of 2009, the S&P 500 declined 15.9%. Wal-Mart (NYSE:WMT), on the other hand, gained 19.1%.

Wal-Mart is an ideal bear market stock. The company is known to offer ‘everyday low prices.’ When times get tough, consumers look for ways to get discounts on everyday household items. As a result, Wal-Mart tends to do well during recessions.

Just how well? The company’s earnings-per-share each year through the Great Recession of 2007 to 2009 are shown below:

- 2007 earnings-per-share of $3.16

- 2008 earnings-per-share of $3.42

- 2009 earnings-per-share of $3.66

Earnings-per-share increased 8.2% from 2007 to 2008, and 7.0% from 2008 to 2009. While these are not amazing numbers during a solid economy, they are amazing when one considers the overall economic climate. 2007 through 2009 was a time when many businesses were absolutely struggling — just look at General Motors (NYSE:GM), Lehman Brothers, and AIG (NYSE:AIG).

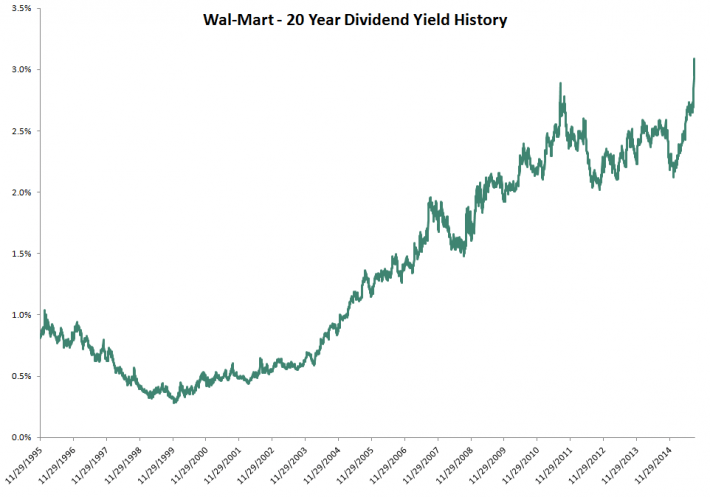

The stocks I’ve examined up to this point appear to be overvalued or somewhat overvalued. This is not the case with Wal-Mart. The company is trading near its highest dividend yield ever. The image below gives a 20-year history of Wal-Mart’s dividend yield to illustrate this point:

Over the last decade, Wal-Mart has grown earnings-per-share at 7.6% a year and dividends at 13.8% a year. The company currently has a payout ratio of around 30%. Despite its low payout ratio, Wal-Mart will likely grow its dividend in line with earnings-per-share growth (instead of growing dividends faster) as the company is plowing money into future growth initiatives.

Wal-Mart is investing heavily in digital sales and better employee compensation. As a result, revenue and comparable store sales are up, but profits were down in the company’s latest quarter due to higher-than-expected employee costs, greater shrink (basically inventory theft), and lower pharmaceutical reimbursements.

Despite recent mediocre results, Wal-Mart’s long-term growth prospects remain bright. Smaller layout Neighborhood Market stores are growing rapidly, as is e-commerce revenue.

Additionally, comparable store sales are up in the United States. If we do enter into another recession, Wal-Mart will likely benefit from increased store traffic and greater sales — and earnings. Regardless of whether we hit another bear market soon — now is the best time ever to buy Wal-Mart stock for dividend investors. The company’s combination of value, potential growth, and safety make it a favorite of The 8 Rules of Dividend Investing.

Bear Market Stock 4: McDonald’s

I listed Wal-Mart’s total return through the Great Recession… and it is impressive, but not compared to McDonald’s (NYSE:MCD). McDonald’s stock gave investors total returns of 55.6% between the start of 2007 and the end of 2009, compared to a 15.9% loss for the S&P 500. That’s an outperformance of over 70 percentage points in three years — not bad for a ‘burgers and fries’ business.

McDonald’s is known for serving cheap food quickly. When bear markets and recession occur, people look for lower priced substitutes for the things they enjoyed during more prosperous times. McDonald’s is a substitute for more expensive restaurants. As a result, the company tends to do very well during recessions.

The Great Recession was likely a net benefit for McDonald’s. The company’s earnings-per-share over 2007 to 2009 are shown below to illustrate this point:

- 2007 earnings-per-share of $2.91

- 2008 earnings-per-share of $3.67

- 2009 earnings-per-share of $3.98

McDonald’s grew its earnings-per-share 36.8% through the Great Recession. It’s no wonder the company’s stock price increased so much while most other stocks were in free fall.

Despite success over the Great Recession, McDonald’s has struggled in recent years amidst negative publicity and an inability to control its ballooning menu and public image. This has resulted in a CEO change. New CEO Easterbrook is expected to simplify the company’s bloated menu and focus on financial and operating efficiency.

The company is well positioned to take advantage of changing consumer preferences during recessions. McDonald’s has over 30,000 locations around the world making it the largest restaurant chain in the world by a wide margin. The company’s tremendous scale means that when comparable store sales rise, McDonald’s will see a large influx of profits.

McDonald’s is shareholder friendly business as evidenced by its 39 consecutive years of dividend increases. The company currently has a payout ratio of about 70% (using adjusted earnings) and a dividend yield of 3.5%. McDonald’s also regularly engages in share repurchases, resulting in further cash returns to shareholders.

McDonald’s currently has an adjusted price-to-earnings ratio of 19.9. The company appears to be trading around fair value given its shareholder friendly management and resistance to recessions.