Bear Market Rallies (times that the market rises during a bear market) are some of the sharpest types of advances that markets experience. They are buying panics fueled by short covering and fear of missing out on a recovery.

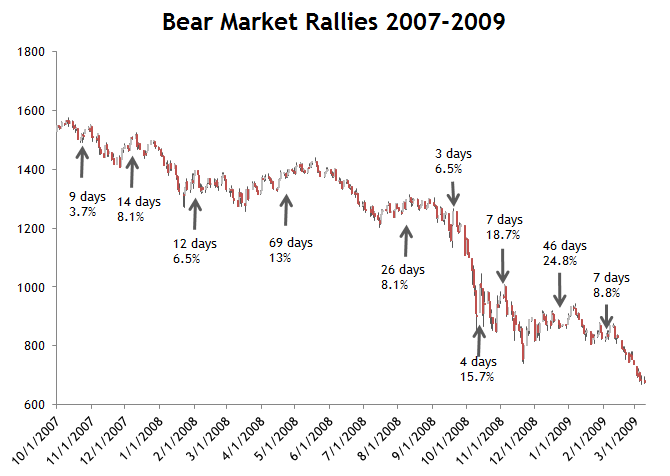

In the last bear market, we experienced 10 periods that I would count as bear market rallies between the peak in 2007 and the bottom in 2009. On average, each rally lasted 19.7 calendar days and the S&P 500 rose by 11.4% during the period.

The sharpest bear market rally came right on the heels of the crash. Between October 10 and October 14, 2008, the S&P 500 rose 15.7% in just three trading sessions. The longest bear market rally lasted 69 days between March and May after Bear Stearns collapsed (many thought that the bear market was over).

Our most recent rally has seen the S&P 500 rise 7% in 7 days. It’s anyone’s guess as to whether or not this is just the first rally of a bear market, but the strength of the advance doesn’t rule that out.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.