Are we in the midst of a new bear market? Everything I read says we are. Many of my colleagues are only looking for reasons to sell or enter short trades. I was telling someone yesterday that half of my top 10 trades for subscribers this week were on the short side. Yet I think it might be a little early to call this a bear market.

I am willing to let the price action play out and tell all of us for sure what is going on. But the backdrop is strong and accelerating earnings growth. Inflation appears to be in check. Employment is very strong. these have nothing to do with short term fluctuations in prices of stocks. That is all about supply and demand. And in the short run can be ruled by sentiment. It seems to me that is what is happening.

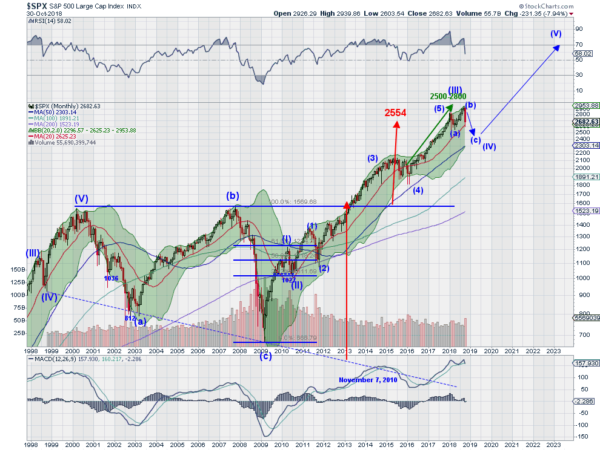

The chart above shows the monthly price action in the S&P 500. There is a lot of technical work that I could discuss about it, but there are 3 key points to make. First, prices are still broadly moving from the lower left to the upper right. They have just touched a 20 month moving average on this recent pullback. Second, momentum had become overheated and is now stalling and reversing. That is a good thing. It is still in very bullish ranges.

The last point has to do with sentiment. It is very tilted to the bearish view. This last piece puzzles me. Extreme moves in sentiment can be a contrarian indicator, if everyone becomes bearish and sells then there is no one left to sell, only buyers. Of course everyone could also be right.

For now I will not be sounding the bear market alarm. That appears to be premature and sensationalist with a reach for clicks and page views. A healthy correction from extreme bullish sentiment? Seems more likely. Either way time will tell.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.