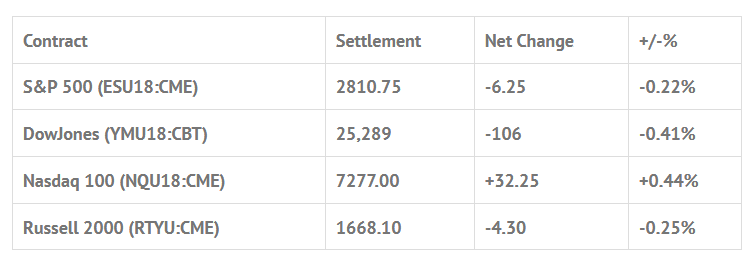

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed lower: Shanghai Comp -2.03%, Hang Seng -2.21%, Nikkei -1.03%

- In Europe 13 out of 13 markets are trading lower: CAC -0.65%, DAX -1.54%, FTSE -1.21%

- Fair Value: S&P -0.10, NASDAQ +8.05, Dow -31.85

- Total Volume: 1.09mil ESU & 762 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Weekly Bill Settlement, Challenger Job-Cut Report 7:30 AM ET, Jobless Claims 8:30 AM ET, Factory Orders 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: Dow & S&P Fall Over Tariff Concerns, 10 Treasury Yield Tops 3% Again

The good news is that second quarter earnings continue to beat expectations. The bad news is the Trump administration has been ramping up its China tariff threats. The net of the two has weighed on the stock market. Yes, the S&P traded back up to the 2830 area Tuesday after Apple (NASDAQ:AAPL) reported, but the markets sank as the tariff news hit the tape after the markets closed.

Tuesday night, the S&P 500 futures sold off to 2810.75 on Globex, and opened Wednesday morning at 2819.50. The ES rallied up to 2822.50, pulled back dow 2818.25, then rallied up to 2825.75 at 9:52 am CT. After the high the ES sold off down to 2808.00, had a few small rallies, then traded down to 2805.50 just after 1:10. Then, within minutes, traded back up to 2815.00.

After reaching an afternoon high of 2817.00 in the closing minutes, the ES printed 2813.50 on the cash close, before settling the day at 2810.75, down -6.25 handles, or -0.22%, after trading as low as 2808.25 in the minutes before the settlement.

In the end, yesterday’s trade was another case of failed rallies. In terms of the ES’s overall tone, I think it traded on the weak side. In terms of the days overall volume, 1.09 million ES contracts traded, which again is not bad for being this time of year.

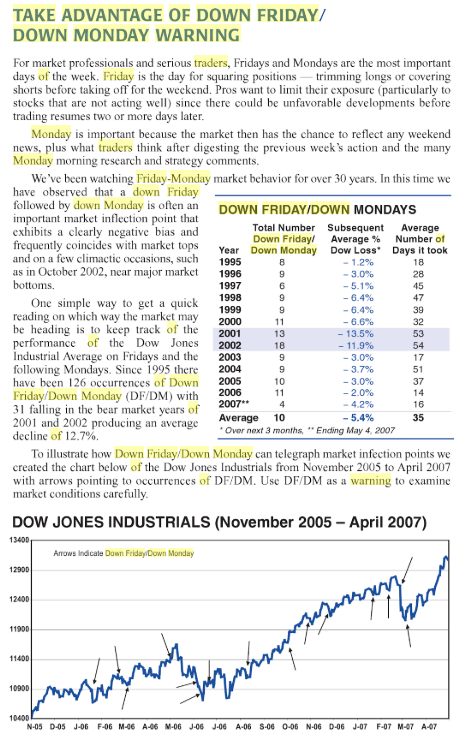

From Stock Traders Almanac:

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.