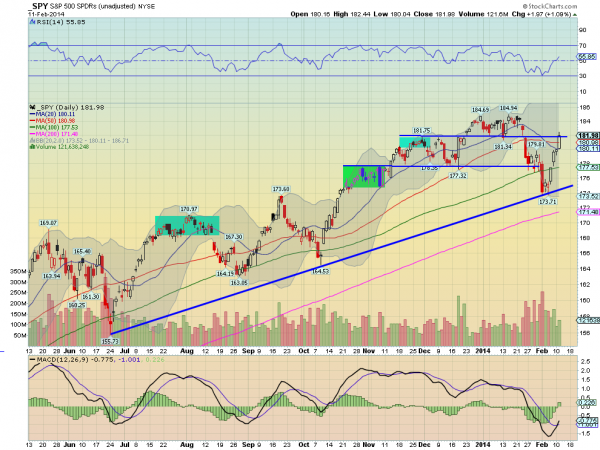

Well I went on record saying that a close over 181.80 in the SSPY and the all-clear signal would sound. So what happens? A 1% up day with a push over 182, followed by a pullback and close over 181.80. In fact in after hours and the pre-market, it continued to retest the 181.80 level and held.

So is it it time to go whole hog into the market? It certainly looks very strong now. The chart below shows that three of the reservations I had on the recovering market went away. The Relative Strength Index (RSI) turned back higher and moved through the mid line. The doji at the 20-day Simple Moving Average (SMA) confirmed higher. And the MACD did cross up. And if Technical Analysis was a pure science with no art involved, it would be time to back up the truck. But it is not, so I reserve the right to look to Wednesday (or after) for a continuation through the resistance line at the 181.80 area. That does not mean stay i'm out of the market or am not buying. The PowerShares QQQ made a new 13-year and 4-month closing high. Some individual charts are very strong and remember that the long-term prevailing trend is higher. What it means is that you still need to be stock selective and, like always, respect your stops. If we do get continuation Wednesday, the close focus on the daily SPY will fall back a bit.