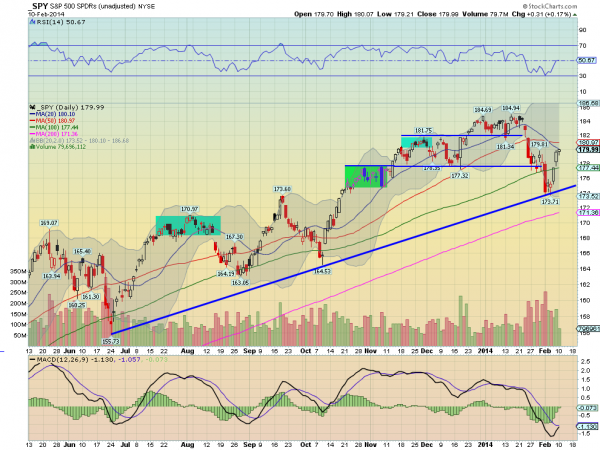

Just last week I wrote about the damage that was done as the equity indexes made new lows in The Needle and The Damage Done. I noted it was not time to panic as the S&P 500 SPDRs, (SPY), was only down 6% and was sitting on a rising trend line that had been in place for 7 months. But damage nonetheless. It turns out that support held and the market bounced. It is recovering. Not in a strong way as yet. And we all know that addicts often suffer a relapse. The price action through Monday in the SPY has left it in an important place. The chart below shows the move off of support saw a strong candle followed by a gap and slightly smaller candle and finally an even smaller body candle Monday. A continuation higher the rest of the week would help show some strength but that series makes me think of potential exhaustion. The close Monday left the SPY at the 20 day Simple Moving Average (SMA) and it needs to push through that

to show strength, not a relapse. The Relative Strength Index (RSI) is at the mid line, also a critical place. A fail here shows weakness, and pushing higher continued recovery. Finally the MACD looks like it was ready to cross up Friday, but no longer so after the Monday session. Will this be like a good first few days in rehab for Lindsay Lohan ending up in tragedy like Phillip Seymour Hoffman? Or will the recovery stay on track? The next few days are critical to answering that question. I still believe a move over 181.80 will sound the all clear bell for the SPY. The Powershares QQQ Trust (QQQ), its sister, is looking stronger. It has recovered above its SMA’s with a RSI in the mid 50′s and rising and a MACD about to cross. This bodes well for the SPY, but the rehab is far from over yet. It is still a recovering addict.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.