Forex News and EventsBCB to release interest rate decision

Later this evening the BCB will release it interest rate decision. According to the latest survey, market participants expect the Selic rate to remain unchanged at 14.25% as inflation expectations start to anchor around 5.50% for 2016. Even though the BCB’s target of 4.5% will be missed in 2016, the market still believes that the Central Bank is committed to bring inflation toward this level.

We think the Central Bank has done its job so far and that any additional increase of the Selic will have a higher marginal cost for the economy in terms of growth and unemployment level. Now it is the turn of the politicians to do their job and to get the country back on track. The congress has to find new sources of revenue and to cut expenses to address the fiscal deficit. This situation is not sustainable over the long term and the longer it lasts, the bigger the damages. USD/BRL rose almost 40% since the beginning of the year as it reached 3.70 yesterday - the highest level since December 2002 - and we see no reason for the real to continue depreciating.

IMF: Lagarde says global growth is at risk

Christine Lagarde, the International Monetary Fund Manager, held a public lecture at the University of Indonesia in Jakarta. She has given her view on the global market outlook and she mentioned the current Chinese weakness can spill over to the rest of the world. Indeed, China is shifting to a more market-oriented economy. The mainland has also started to get rid of its U.S. Treasury Bonds, only a few weeks after the debasement of its own currency. China is now ready for the yuan to float with the market. In addition, we think that the PBoC is trying to force the IMF to accept the yuan as one of the world’s reserve currencies. China’s weakness also weighs on emerging market economies especially in Latin America. Lagarde concluded that the global growth outlook is weaker than IMF July forecast.

Mixed data from UK

We have an extremely bullish call on the GBP/USD year-end price (1.62) so yesterday’s clear break below the 200d MA was concerning. The direct catalyst was disappointment over the manufacturing PMI index that slipped to 51.5 from 51.9 rather than rising to 52.0 (traders were less concerned over US ISM downside surprise). Therefore positive economic data would help ease our downside concern. However, UK construction PMI was mixed coming in at 57.3, below expectations of 57.5 but above prior read of 57.1 in July. The slight increase was the supported by sentiment and output growth which have decelerated but still stands at elevated levels. Not a huge positive adjustment but perhaps enough to keep GBP/USD consolidating above retracement level at 1.5250 (initial reaction was minor selling of GBP/USD).

Our bullish view remains that the market is underestimated the strength of the UK economy and misjudging the BoE inflation fighting intentions. BoE Governor Carney sounded relatively optimistic at Jackson Hole shrugging off downside risk to the global economy. Noting, China’s troubles could “impart further imported disinflationary pressures over the policy horizon,” however, “developments in China are unlikely to change the process of rate increases.” This suggests that the BoE is likely on a path for rate hikes in early 2016 should the economy remain strong. A higher conviction level regarding the BoEs rate path would give the oversold GBP the kick were are looking for.

EUR/GBP - Pushing Higher

The Risk Today

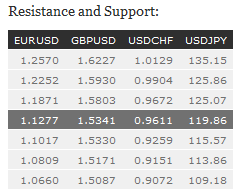

EUR/USD is now moving in either direction. We consider that we are in a short-term upside momentum. Hourly resistance lies at 1.1714 (24/08/2015 high). Hourly support can be found at 1.1236 (27/08/2015 low). In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We have broken the resistance at 1.1534 (03/02/2015 reaction high). We are entering an upside momentum.

GBP/USD has broken hourly support at 1.5330 (08/07/2015 low). Hourly resistance is given at 1.5930 (18/06/2015 high). We now target 505 Fibonacci retracement at 1.5248. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY is still holding below the 200-day moving average. Hourly support is given at 116.18 (24/08/2015 low). Stronger support can be found at 115.57 (10/11/2014 low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF is pushing downward. Hourly resistance is located at 0.9690 (31/08/2015 high). Hourly support is given at 0.9259 (24/08/2015 low). As expected, the pair is consolidating above 0.9600. In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).