- The semiconductor industry could witness a rising Nvidia-AMD rivalry amid surging demand for artificial intelligence chips.

- While Nvidia secured a 240% surge in 2023, AMD is gearing up to challenge the chipmaker for market share in 2024.

- The semiconductor battleground sees Nvidia's financial strength against AMD's growth initiatives, setting the stage for a dynamic clash in the upcoming year.

In 2023, the semiconductor industry witnessed remarkable growth, propelled by the increasing demand for chips, especially with the rapid expansion of the artificial intelligence (AI) sector.

Notably, Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD), renowned for their high-performance chips, have consistently shared the spotlight.

The pervasive integration of artificial intelligence into various aspects of daily life has driven substantial revenue growth for chip manufacturers. Consequently, the stocks of these companies have experienced significant gains over the years, fueled by the escalating demand for their products.

Shares of Nvidia, which dominates the market share in chip production, have increased in value by almost 240% since the beginning of the year. Meanwhile, Advanced Micro Devices shares are up 112% as the end of 2023 approaches.

Nvidia, the market leader, has managed to take a step forward by dominating the artificial intelligence sector much faster with the advantage of its experience in the GPU business.

On the other hand, its smaller rival AMD is preparing to launch a more powerful chipset that has the potential to increase its market share next year, while making a name for itself with the important collaborations it established in 2023.

While it is obvious that the artificial intelligence sector will become more competitive in the coming years, it seems likely that chip manufacturers will enter a similar competition to meet the demand in this field.

This competition will contribute to the growth of the semiconductor industry and it would not be surprising to see long-term investors allocate more of their portfolios to chipmakers.

AMD to Continue Gaining Market Share in 2024?

It is known that Nvidia currently has a huge market share of over 80% in the chip market used by AI.

However, as AI companies continue to grow and the number of companies starting to develop their products continues to increase, it can be seen that Nvidia will struggle to maintain its market share due to the growth in the chip market.

In fact, AMD has signaled that it will make its name mentioned more in 2024 with the successes it has achieved in the last few months.

Finally, tech giants such as Meta and Microsoft announced their intention to use AMD's Instinct MI300X AI chip, a critical move to reduce dependence on Nvidia in this field.

If AMD can capitalize on this advantage and offer a more cost-effective alternative to Nvidia with optimal performance, it could see strong growth in 2024.

Next year, AMD will launch the latest in its MI300X chip series and what it claims to be the most powerful GPU ever.

Another advantage AMD has in growing its market is its product diversity. With a wide range of products, AMD has revenue streams that could be more resilient in the event of an industry disruption than its larger AI-focused rival.

Source: InvestingPro

Still, with a market capitalization of $1.2 trillion, nearly four times that of AMD, and strong financials, Nvidia is well-positioned to withstand market volatility.

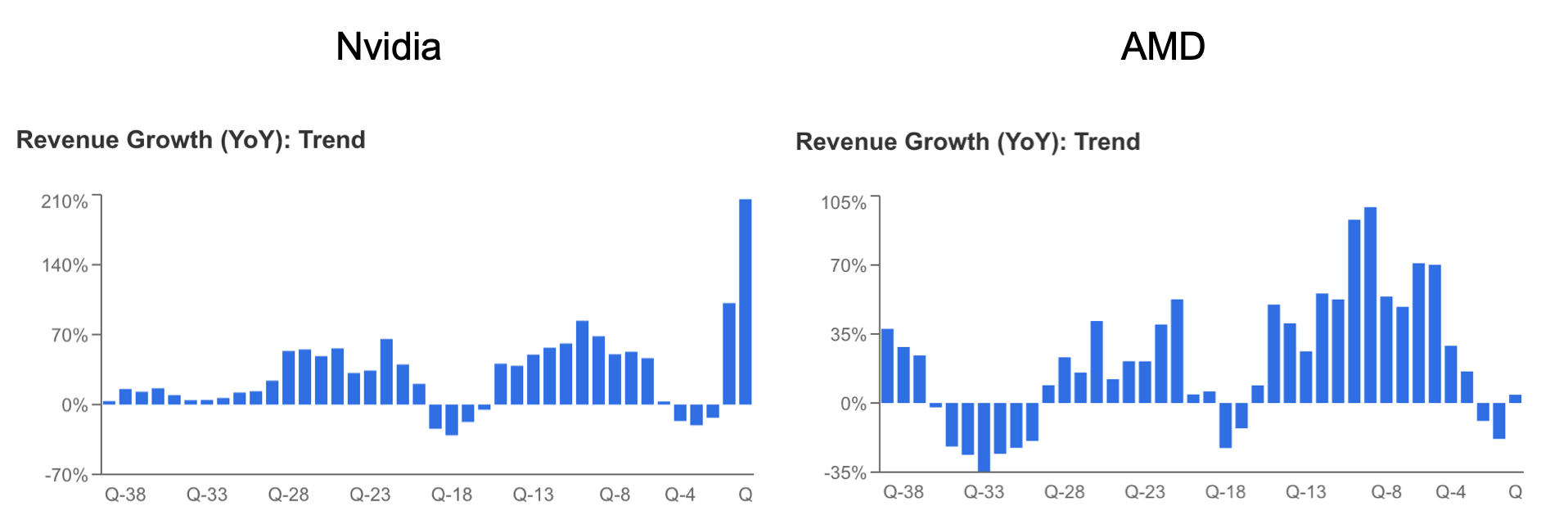

Nvidia also managed to increase its revenue by 205.5% year-on-year with $18.1 billion in its last quarter financial report. The main factor in revenue growth was, as expected, the 280% increase in artificial intelligence chip sales.

In comparison, AMD posted quarterly revenue of $5.8 billion, with a much more modest year-over-year revenue growth of 4.2%.

On the other hand, while AMD is expected to be cheaper as an emerging company in the AI stock space, Nvidia has some data that suggests it is more financially attractive given its market size.

Fair Value Analysis: Which Stock Fares Better?

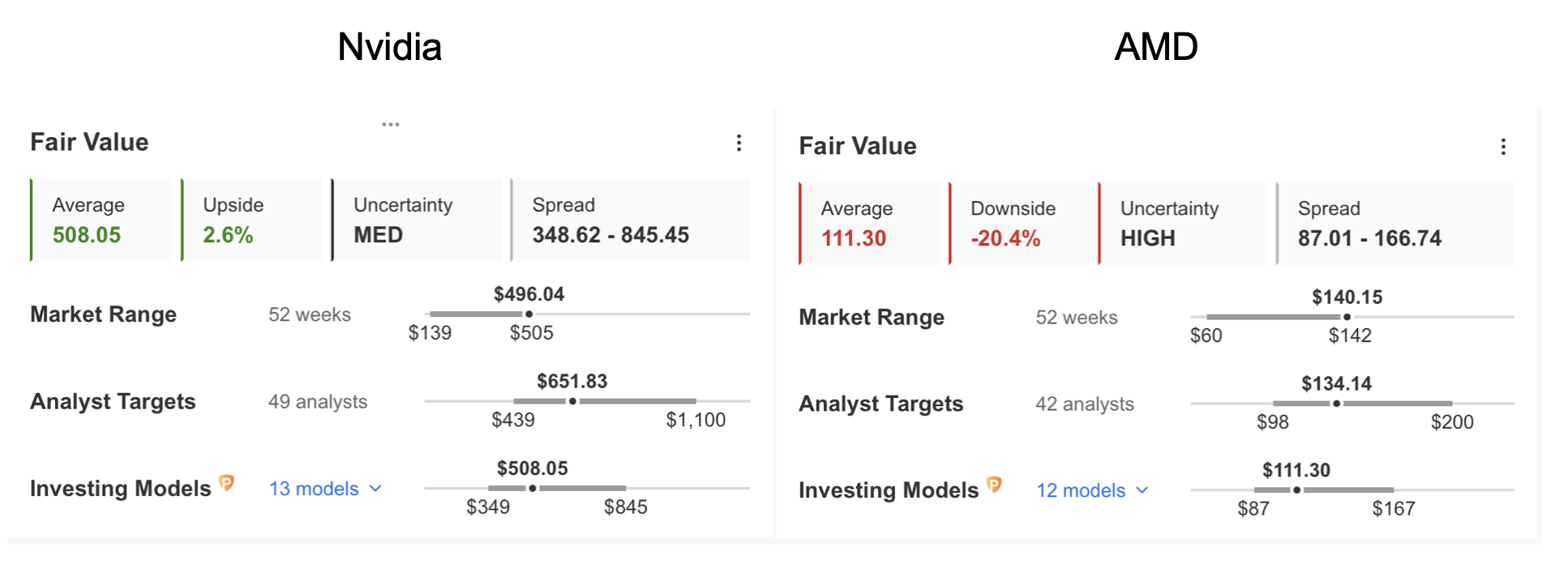

InvestingPro's fair value analysis shows that Nvidia is close to its fair value when comparing the two companies' price estimates based on financial modeling.

AMD's share is overvalued by 20%, with a forecast of a correction towards the $110 level within a year.

Source: InvestingPro

Meanwhile, with fair value analysis on the InvestingPro platform, important financial models are calculated on a price basis and a comparable price forecast is presented according to the financial structure of the companies.

In this way, you can avoid the hassle of analyzing the ratios of companies one by one.

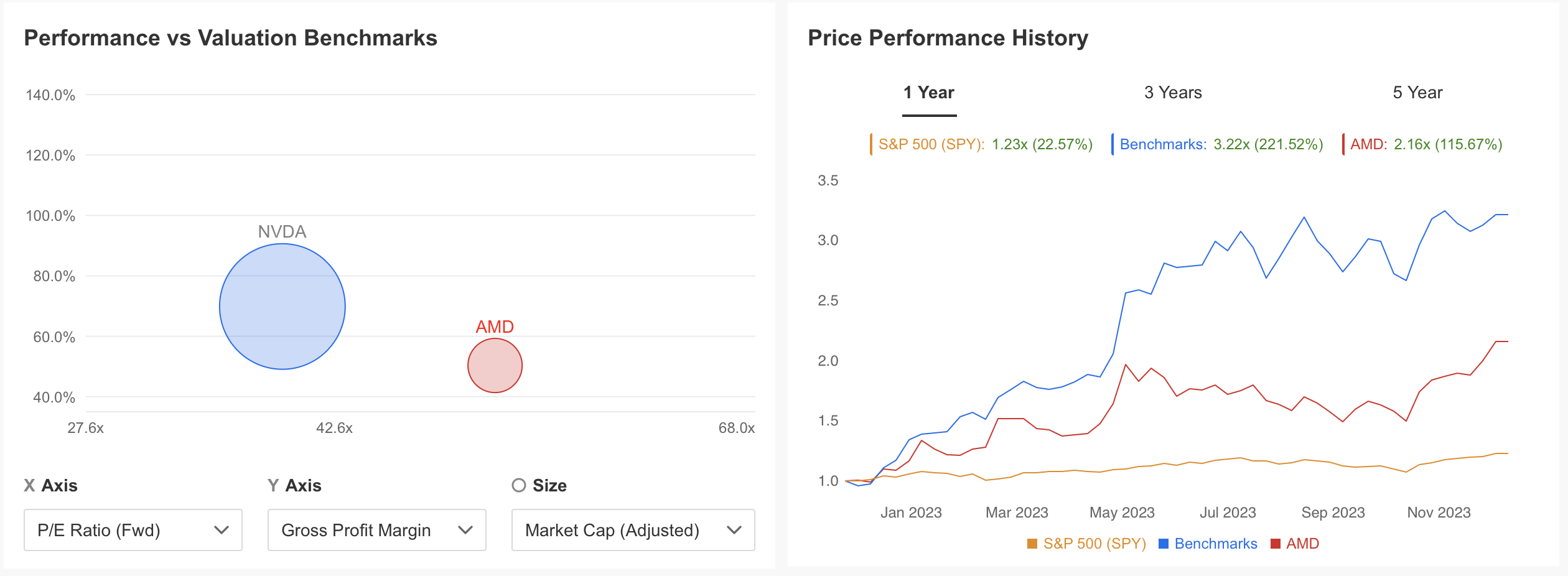

If we compare both chipmakers according to gross profit and price/earnings ratio, we see a similar picture to fair value analysis.

While Nvidia is in a better position with its gross profit margin, it looks cheaper than AMD according to the price/earnings ratio despite its market capitalization.

In addition, it can be seen in the chart that both stocks provide a return well above the S&P 500.

Conclusion: Which Stock Could Have the Upper Hand in 2024?

In a comprehensive analysis of AMD's current financial status, InvestingPro highlights several advantages:

- Free cash flow exceeding net profit.

- Anticipated net profit growth in 2023.

- Excess of liquid assets over short-term liabilities.

However, the company faces certain disadvantages, including:

- A declining trend in earnings per share.

- A high price/earnings ratio.

- Overbought status based on the rise in the last 3 months.

- High stock volatility.

Turning to Nvidia, the company boasts the following features:

- Acceleration in revenue growth.

- High potential for dividend payout with strong earnings.

- Annual growth in net profit.

- Low price/earnings ratio relative to short-term profit growth.

- Sector leadership.

In summary, both Nvidia and AMD are poised to maintain their high potential in the semiconductor industry, driven by the influence of AI.

While Nvidia emerges as the clear leader based on fundamental analysis, AMD shows potential for a performance similar to Nvidia's 2023 if it effectively manages its growth strategy in the coming year.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.