I had a really good trading day. Even though the stock market was at the highest point in human history only yesterday, the vast, vast majority of my 71 short positions are profitable, and even those with a loss have losses which are absolutely miniscule. My profits powered up about 3.5% today, thanks largely to a heavy focus on energy stocks.

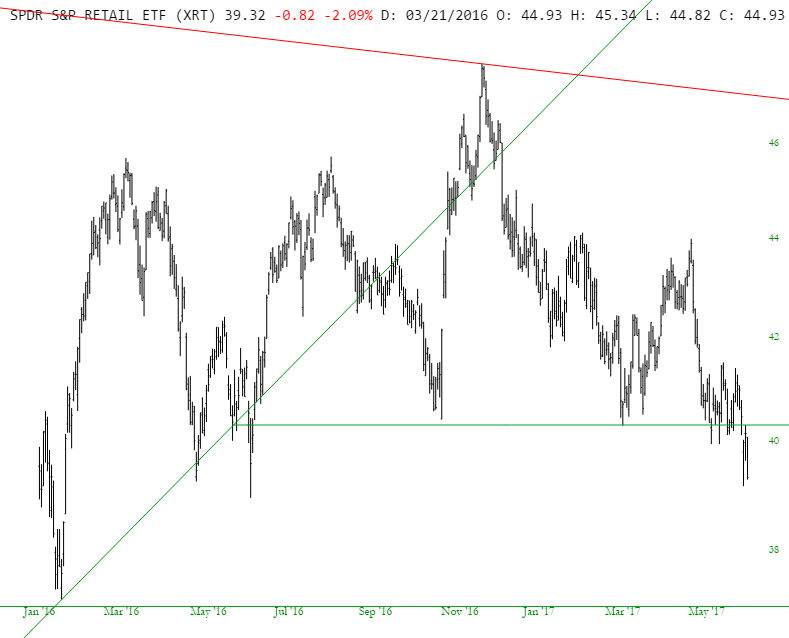

I’m also quite short retail stocks, though, which helped, including the ETF dedicated to the sector, shown below. I sense cataclysm again.

If we “zoom out” from the same chart, we can see the bigger picture. To my eyes, a 25% drop in this sector within the coming year is totally plausible, if not inevitable.

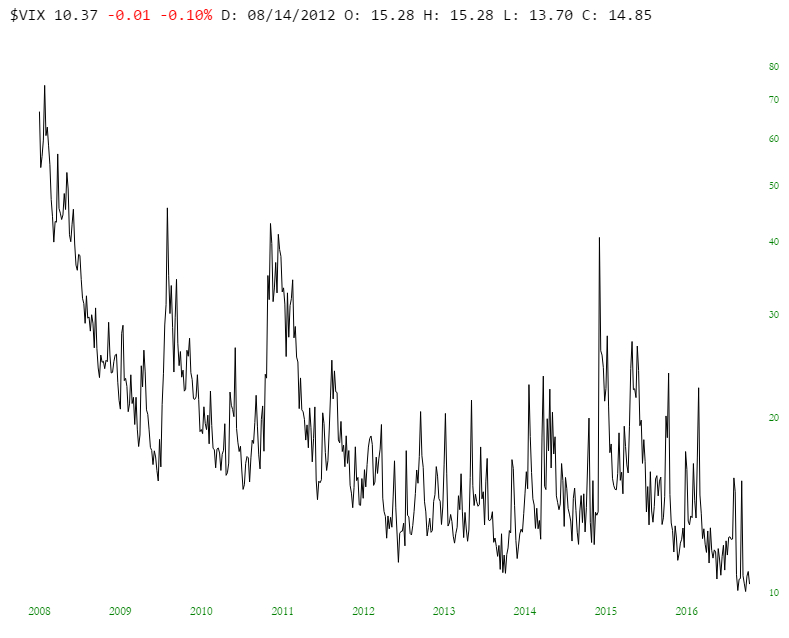

I’ve been cheerfully shorting stocks, because the massively-crushed VIX is, for me, a sign of worldwide lunacy. I seriously think you people are nuts.

Besides my “regular’ portfolio (71 short positions) and my ETF portfolio, I’ve got a small options account I’ve started trading. I have one position in there, which is the (NYSE:IWM) $142 puts. Those are in the green, and if the wind blows the right way, they could do great before they expire July 21.

The S&P Midcap 400, too, have a pattern quite like the Russell, and frankly these days I feel like a kid in a candy store with all the sensational patterns.

The next “moment of truth” (nuclear war with North Korea notwithstanding) is going to be the oil inventory report this morning. If we get another big buildup in supply, crushing oil prices, we could see another really terrific day, almost irrespective of what the powers that be are doing with the SPY (NYSE:SPY).