On Thursday, July 14th, JPMorgan Chase (JPM) will release its second quarter earnings results before the bell. The company is a Zacks Rank 4 (Hold), and have a Value, Growth, and Momentum score of F.

In our video David will take a look at the current state of JPMorgan Chase, their past earnings announcements, and he’ll give us his thoughts on their upcoming earnings call. Furthermore, David will also give us insight on how to play the options market.

JPMorgan Chase in Focus

JPMorgan Chase & Co (NYSE:JPM). is a financial services firm. The Company is engaged in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, asset management and private equity. It offers various investment banking products and services, including advising on corporate strategy and structure, capital-raising in equity and debt markets, risk management, market-making in cash securities and derivative instruments, prime brokerage. It also offers consumer and business, and mortgage banking products and services that include checking and savings accounts, mortgages, home equity and business loans, and investments. JPMorgan Chase & Co. is headquartered in New York.

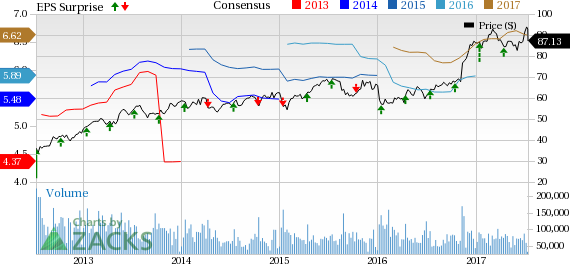

JPMorgan Chase is expected to report earnings at $1.57 per share according to the Zacks Consensus Estimate. Last quarter they reported earnings at $1.65 per share, beating expectations by $0.14. Their average EPS surprise is 12.74%.

J P Morgan Chase & Co (JPM): Free Stock Analysis Report

Original post

Zacks Investment Research