Key Points:

- BOJ reaches 75% ownership of the ETF market

- Eventual unwinding poses significant risk levels

- Watch for long term damage to ETF markets on TOPIX

There is no doubt that the past seven years have been a watershed for macroeconomic policy, as well as financial markets, as central banks have ardently cast aside the accepted playbook and moved into the realm of policy experimentation. Subsequently, what was birthed was the quantitative easing process which saw the Bank of Japan inject huge amounts of money into the broader economy in an attempt to stimulate spending and investment activity.

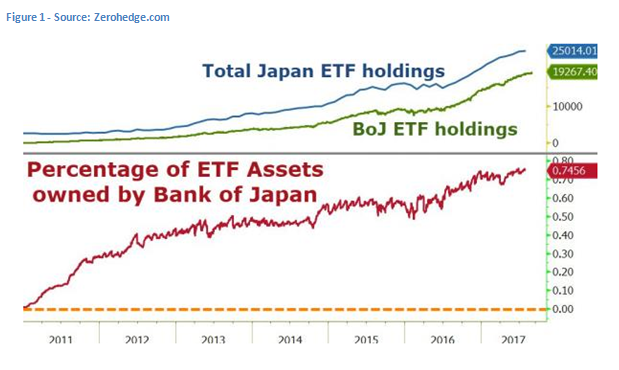

However, what started out as the noblest of endeavours has quickly turned farcical as the BOJ quickly moved from running the printing presses to targeted injections of funds directly into the ETF market. Initially, this was welcomed by the broader sector as a way to provide liquidity and cash to the Exchange Traded Funds in an attempt to stimulate some economic growth and inflation. Instead, the central bank has been slowly hoovering up the majority of ETF sales in the past five years and this has caused some significant market distortions.

In fact, the most recent figures show the Bank of Japan holding just below 75% of the total present volume of the ETF market. This is staggering to say the least and should make the free market proponents amongst us queasy with risk. Subsequently, ETF assets held by the bank have surged tenfold since the early 2010’s to the current epic proportions.

This pattern of non-monetary grade asset purchases is relatively problematic given the risk of ongoing distortions in values. Holders of ETFs would need to ask themselves what will occur when the central bank starts to unwind those positions given that they form the major buyer in the market. The reality is that ETF values would crash relatively quickly once the central bank makes moves to unwind its positions. Subsequently, there is an inherent risk in any central bank dealing directly with the market through an asset such as an ETF.

In fact, the major question that immediately pops into my mind is the potential for calamity on the broader equity market if and when the bank starts to sell off their ETF positions. At present levels, ETFs only represent around 5% of the TOPIX market but this is not an inconsequential figure and commencing a selling phase could signal the broader market that the game is up.

Ultimately, there is rising levels of risk within the Japanese markets and much of this is due to the uncertain outcomes around the Bank of Japan’s misguided quantitative easing program. Subsequently, it will remain to be seen what damage the inevitable unwind causes. But one thing is for certain….there are no free lunches in economics.