The stock price of Bank of America (NYSE:BAC) is up 52% from its bottom in late-October, 2023, easily beating the S&P 500’s 28% gain. The too-big-to-fail banking giant has risen like a phoenix from the ashes of last year’s regional bank crisis. The resiliency of the US consumer and the economy as a whole have produced record profits at BAC, even in the face of sharply higher interest rates.

Could it be that the bulls have now gone too far too fast, though? Despite its huge share repurchases, Bank of America‘s earnings per share figure has been trending down for two years now. That’s because its net income has actually slipped in both 2022 and 2023. The company’s Q4 investor presentation showed that net charge-offs – the money loaned, which the bank no longer expects to ever collect – have nearly doubled from a year ago for both consumer and commercial loans.

This is not a problem specific to Bank of America. Delinquencies and charge-off rates have been climbing at most US banks, large and small. Perhaps the economy is not as strong as it seems. What interests us here, however, is if BAC stock’s bull run can continue. And of course it might, but the chart below shows that the bulls have a strong resistance to break first.

The weekly chart of Bank of America stock reveals that the $38-$40 area might be a tough nut to crack. It stopped the uptrend in its tracks in 1999, 2002, 2008 and most recently in 2022. In each of these four occasions, a notable decline soon followed. With the stock now at the $38 a share mark again, the market’s reaction to this key level is worth paying attention to.

On the other hand, support and resistance levels are meant to be broken. The bulls went right through the $38-$40 area in 1998, 2003 and 2021. So the real question is, should we expect a breakout or a pullback? To try and answer that, we need to dig deeper and take a look at the hourly charts. Let’s proceed to the 4-hour one below.

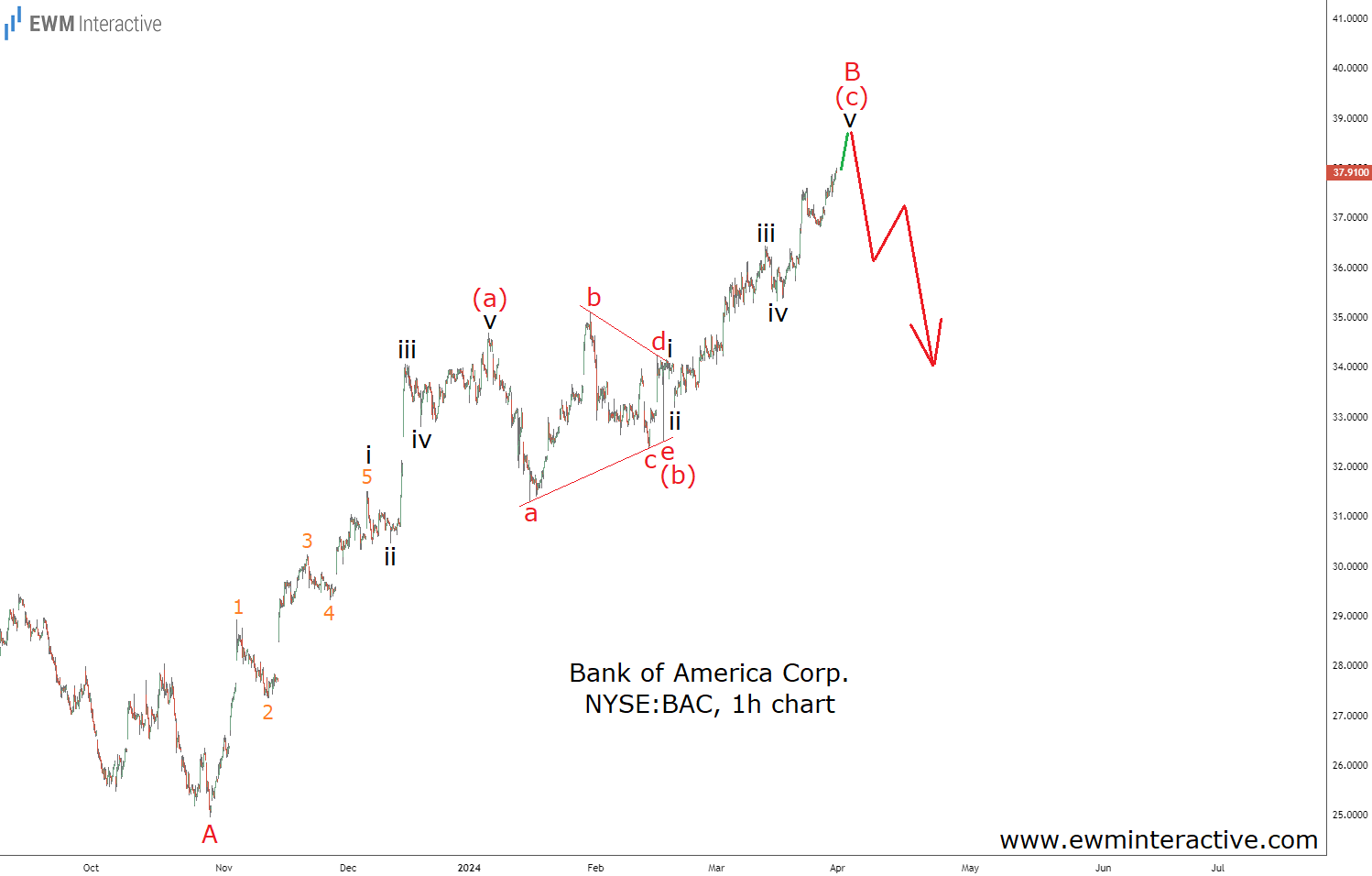

It shows that the crash from over $50 to under $25 looks strikingly similar to an Elliott Wave pattern known as a leading diagonal. It is labeled 1-2-3-4-5 in wave A, where, in contrast to a regular five-wave impulse, waves 1 and 4 do overlap. Just like an impulse, though, it is followed by a three-wave correction, before the downtrend can resume.

This is what we believe has been in progress for over five months now. Although a sharp one, the rally to $38 so far can be seen as a simple (a)-(b)-(c) zigzag retracement in wave B. If this count is correct, another major selloff in wave C is just around the corner. A closer look at the structure of wave B on the 1-hour chart below only supports the negative outlook.

Not only can both waves (a) and (c) already be marked as complete impulse patterns, but there appears to be a clear triangle correction in wave (b) in between. Triangles only occur prior to the final wave of the larger sequence, after which a reversal takes place. Here, we have an a-b-c-d-e triangle preceding wave (c), which is supposed to see the end of wave B. A sequence of patterns akin to the one the S&P 500 index drew prior to the Covid-19 crash in the spring of 2020.

The Elliott Wave structures found on the hourly charts of Bank of America stock increase the odds of a significant pullback from the $38-$40 resistance. Besides, at a P/E and price-to-tangible book value ratios of 12 and 1.55, respectively, BAC is more or less fully valued now. Further gains are always possible, but investors will have to rely on mere market optimism, rather than solid fundamentals and undervaluation. This is not a bet we’d like to make right now.