Bank of America (NYSE:BAC) has a handful of positive alternative data trends guiding its stock as the company heads into its third-quarter earnings report.

It might not always be a welcomed sign for investors when a company cuts job postings - and Bank of America did just that, globally, reducing 14.5% over the course of the third quarter - but a look at the bank's full 2019 chart bears similarities to another, JPMorgan Chase (NYSE:JPM), which mightly topped analyst estimates in what's been a big Q3 for consumer (and not investment) banks.

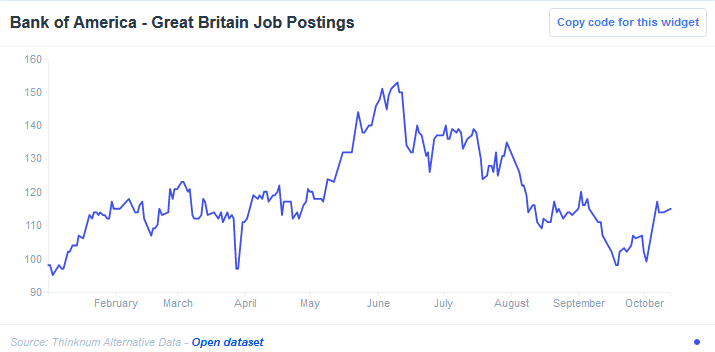

A number of Wall Street banks are back on their Brexit - as UK Prime Minister Boris Johnson steadies for a split from the European Union - but that hasn't quite applied to Bank of America, which saw job postings in Great Britain rise for a time in 2019, only to dip back down. That said, many other big banks are slashing job postings in the UK - and Bank of America's reduction in job postings appears to be tame by comparison.

Analysts are bullish on Bank of America thanks to its digital capabilities - and the chart backs them up. Our chart tracking Apple (NASDAQ:AAPL) Store Ratings Count reflects a quarterly rise of 27%, to nearly 1.75 million, for Bank of America 's mobile product, a sign that it is either catching on with more consumers - or at the least, getting more people to rate the app (which, by the way, has earned a 4.8 out of 5 score). Bank of America has earned nearly 600,000 additional ratings in the Google (NASDAQ:GOOGL) Play Store, as well.

"The company's mobile offerings are among the best in the industry, and as usage increases, we expect BAC to see an increase in its profitability and earnings growth," RBC Capital Markets analysts wrote in a note dated September 30, 2019. Still, they cautioned, the Federal Reserve could throw a wet blanket on bank investors' party: "Looking out to 2020, we expect net interest income to moderate somewhat as US banks contend with a difficult rate environment."

Analysts tracked by Zacks Investment Research are looking for EPS $0.68 when Bank of America (NYSE:BAC) announces earnings October 16 - the RBC analysts have an 'outperform' rating with expectations of $35 per share for the banks' stock.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.