Recently, BancorpSouth Bank (NYSE:BXS) completed the acquisitions of Jackson, AL-based Merchants Trust, Inc. and wholly-owned subsidiary, Merchants Bank, along with Casey Bancorp, Inc. and its arm, Grand Bank of Texas. Notably, last month, the bank received secured consent from the Federal Deposit Insurance Corporation (FDIC) for these acquisitions. The deals were announced in November 2018.

"We're pleased to complete our mergers with these two outstanding banks," said BancorpSouth chairman and chief executive officer Dan Rollins. "By combining with Grand Bank and Merchants Bank, we're able to expand our presence in key markets and align with experienced teams of bankers who share our focus of providing superior service to customers and improving our communities," Rollins further noted.

Notably, prior to the system conversions, at the current level, the banks’ customers will continue with their current branches, checks, bank cards, online banking and other banking services.

Terms of the Mergers

For the acquisition of Merchants Trust, BancorpSouth will likely issue 950,000 shares of its own common stock for all outstanding shares of Merchants Trust’s capital stock. Along with this, BancorpSouth is expected to pay $8 million in cash, subject to certain conditions and adjustments. The total deal value, set at $37.5 million, provides for a collar that ranges from $37.5 million to $43 million.

In respect to the Casey Bancorp deal, BancorpSouth will issue 1,275,000 shares of its own common stock for all outstanding shares of Casey Bancorp’s capital stock. Along with this, BancorpSouth will likely pay $11 million in cash, subject to certain conditions and adjustments. For this one, the deal value is $51.75 million and provides for a collar that ranges between $51.75 million and $56.75 million.

For both mergers, the share count can be adjusted downward or the cash consideration can be adjusted upward, if there is a need to accommodate the respective boundaries of the collars.

Merchants Trust currently has six full-service banking offices in Clarke and Mobile counties. Casey Bancorp, which is based in Texas, operates four full-service banking offices in the cities of Dallas, Grand Prairie, Horseshoe Bay and Marble Falls.

Our Viewpoint

Driven by a solid liquidity position, BancorpSouth has been making strategic investments through mergers and acquisitions for the past few years. The company has maintained an acquisition spree, fortifying its footprint in various areas. These transactions, along with the latest, will likely keep being accretive to earnings.

Notably, continuing its efforts to strengthen footprint through strategic opportunities, this March, BancorpSouth Bank announced plans to acquire Van Alstyne Financial Corporation and Summit Financial Enterprises by the second half of 2019. Notably, both companies and their subsidiaries will be merged with BancorpSouth, upon competition.

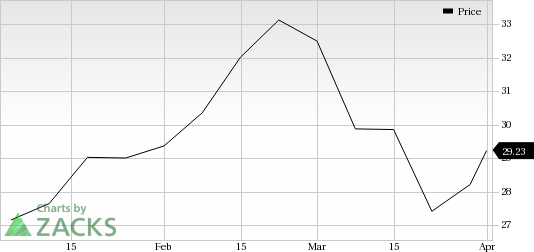

Shares of BancorpSouth have gained around 9.9% over the past three months. Currently, the stock carries a Zacks Rank #2 (Buy).

Other Key Picks

E*TRADE Financial Corporation (NASDAQ:ETFC) has been witnessing upward estimate revisions for the past 60 days, with the company’s shares rising nearly 7.9%, in three months’ time. It holds a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fifth Third Bancorp (NASDAQ:FITB) has been witnessing upward estimate revisions for the past 60 days. Over the past three months, this Zacks #2 Ranked company’s shares have been up more than 8%.

Stifel Financial Corporation (NYSE:SF) has been witnessing upward estimate revisions for the past 60 days. In the past three months, this Zacks Rank #1 company’s shares have been up more than 32%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Fifth Third Bancorp (FITB): Free Stock Analysis Report

BancorpSouth Bank (BXS): Free Stock Analysis Report

E*TRADE Financial Corporation (ETFC): Free Stock Analysis Report

Stifel Financial Corporation (SF): Free Stock Analysis Report

Original post