With a low correlation to the S&P 500, Balyasny Asset Management had a positive August, up 1.92% and 2.61% in the Atlas Global and Atlas Enhanced funds respectively according to a letter to investors reviewed by ValueWalk. This comes against a backdrop where the S&P 500 was up just 0.05% on the month, a statistical outlier of low positive return for the index amid near-record dormant market volatility. It was the shorts that stepped up performance during the month along with new strategies that are beginning to show signs of life for Dmitry Balyasny’s $12.6 billion global hedge fund as the fund ramp-ed up hiring with two new portfolio managers.

New strategies paying dividends for Balyasny in August

After more than doubling assets under management, Balyasny added people and expanded portfolio sleeves. That appeared to pay off in August.

“We are starting to see traction in Systematic and we are looking to grow exposures as new Portfolio Managers and additional strategies ramp up into Q4,” Balyasny told investors, discussing a month in which the BarclayHedge CTA index was reported up 0.58%. “Overall, we were pleased with the positive skew of our portfolio for the month of August.”

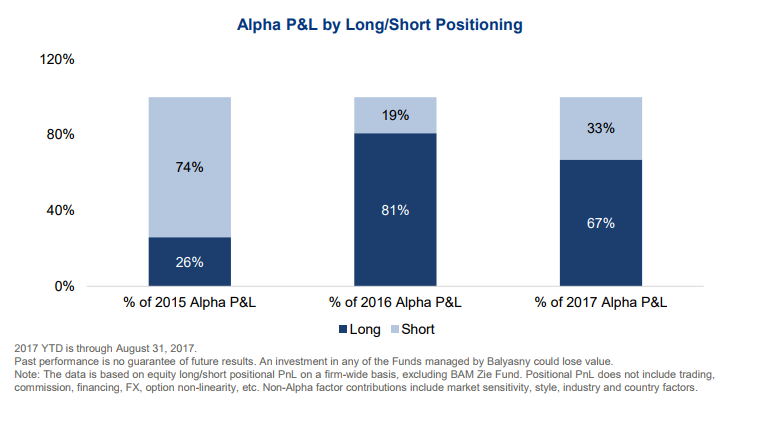

In addition to systematic CTA strategies delivering positive returns, Equity Long / Short strategies were performers during a month of muted stock market returns. The strategy was particularly positive in Consumer, Tech, Industrials and Healthcare, all aided by short exposure and “strong performance on a number of core positions, particularly on the short side.” Long short strategies had a generally positive month, up 1.10% basis the BarclayHedge database.

“it was good to see short-side alpha as short monetization has been challenging over the last 18 months,” Balyasny wrote. Short exposure could prove helpful to the fund as signs of earnings exhaustion are becoming apparent. “With the length of the bull market, generous valuations, and potential interest rate headwinds going forward, investors are being less forgiving to earnings misses.” Balyasny said third-quarter earnings season for their holdings “has been one of our best performing seasons since 2014.”

In Macro, the fund placed an unidentified “negative beta bet” during the middle of the month that was credited with pulling the strategy sleeve positive for the year. Commodities and credit portfolio exposures were down slightly on the month. The Balyasny letter did not specifically provide strategy performance attribution or specific trade details.

Fed withdrawal of stimulus not a major issue this time around as market is "normalizing", fund hires new portfolio managers

As the US Federal Reserve is ever so gradually withdrawing quantitative stimulus – Janet Yellen and crew are expected to announce balance sheet reduction by not re-investing accumulated interest in September – Balyasny sees a market normalcy approaching.

“Markets feel like they are normalizing and we are seeing good follow-through on names,” he wrote. This is a sharp contrast to 2015 when Balyasny had predicted that the Fed withdrawing stimulus would result in a market disruption and reduced their equity exposure as a result.

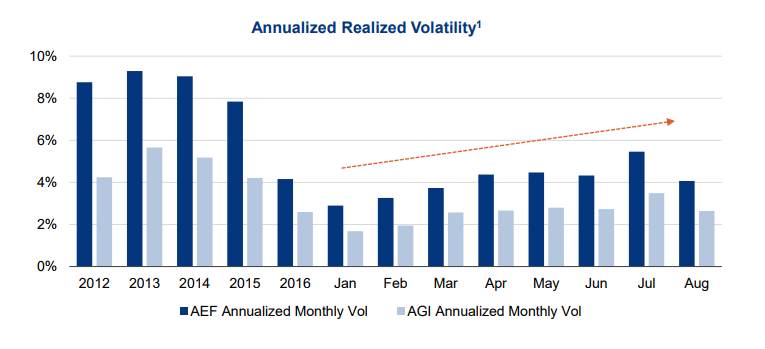

In this “normalizing” environment of historic low volatility, Balyasny’s own fund volatility has been steadily rising.

“Portfolio construction is in a good spot with tight beta and high stock-specific risk,” Balyasny wrote. “Fund volatility continues to gradually increase as we scale up performing strategies. As we continue to grow our teams and add some additional strong PMs, we expect to be close to our historical volatility range over the next six months.”

The fund also added two new portfolio managers: Bryandon Kline comes from bp and Barclays (LON:BARC) to work as commodities portfolio manager and Steve Brown comes from Pine River Capital and Barclays to work as relative value fixed income macro portfolio manager.