T2108 Status: 67.6%

VIX Status: 11.7

General (Short-term) Trading Call: Short ONLY on confirmed weakness (see below)

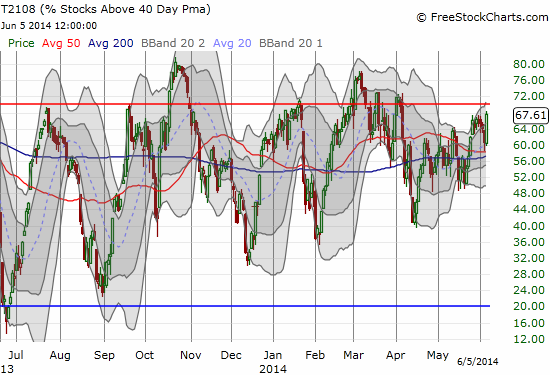

Active T2108 periods: Day #230 over 20%, Day #82 over 40%, Day #9 over 60% (over-period), Day #42 under 70% (under-period)

Commentary

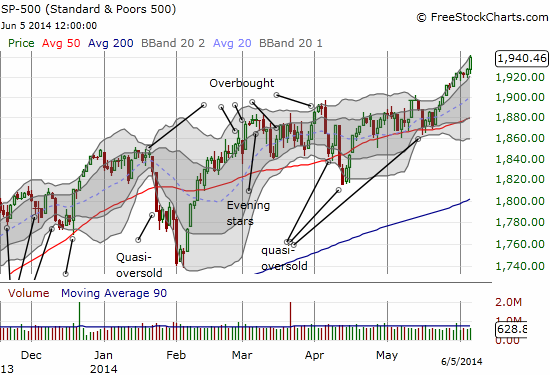

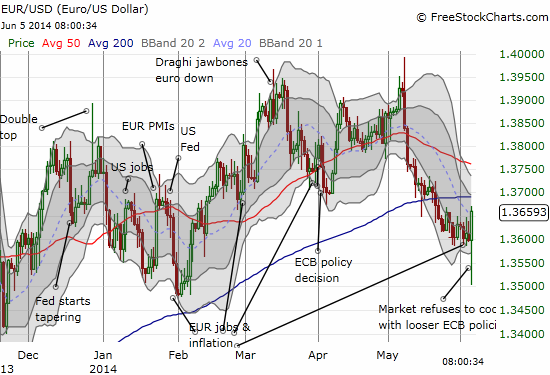

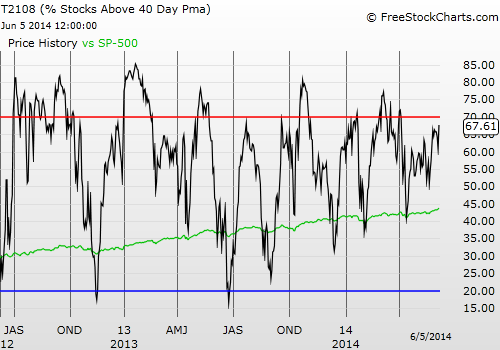

Wednesday’s bearish divergence barely lasted longer than Mario Draghi and the ECB’s attempt to weaken the euro (Rydex CurrencyShares Euro Currency (NYSE:FXE)) through looser monetary policies. The S&P 500 jumped yet again, but this time it was accompanied by a healthy surge in T2108. T2108 closed at its second highest point since last falling from overbought status in early April.

This chart is definitely and firmly bullish. A new uptrend is well-established now with baby-steps that are well short of “panic buying.” I probably share a sense of disbelief with a lot of people (or at least of the few who are still paying attention to the market as the summer gets underway!). Suspending disbelief for a while, this setup suggests an imminent extended overbought rally. I had earlier thought hitting overbought would be a bearish event, instead, the melt-up has moved so slowly and so smoothly that overbought does not quite equate to over-stretched here. The biggest caution remains the extreme levels of complacency. If I decide to chase the trend, I will hang disbelief high in a dark closet, behind the old hats and novelty t-shirts…

The good news for the bears is that this setup makes it ever more clear what weakness looks like for triggering fresh shorts. Currently, a close below 19200 on the S&P 500 is shortable. Even better if it occurs on a tumble out of overbought conditions. As the rally extends on the S&P 500, the trigger point increases.

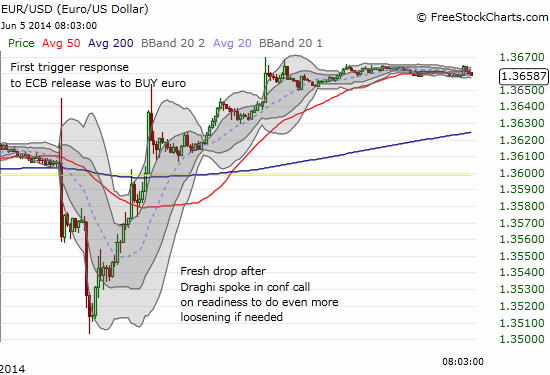

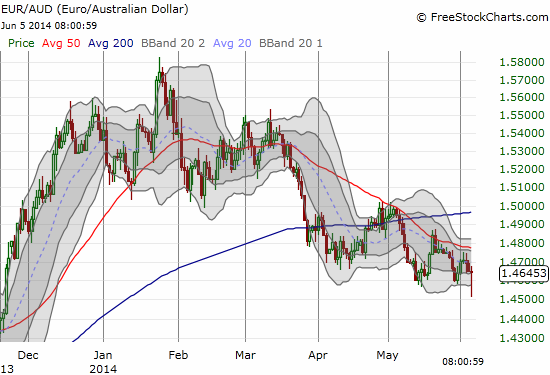

I will have to write a whole separate article on the euro. One important implication of looser monetary policy from the European Central Bank (ECB) that escaped me when I wrote about the play on the euro is the potential for a ramp in carry trades….aka, buy the Australian dollar (Rydex CurrencyShares AUD Trust (NYSE:FXA)). So, while I think I played the gyrations and fake-outs in the euro well, I was not prepared to similarly take advantage of a fresh surge in the Australian dollar. I remain net short the Australian dollar and am rebuilding a short position against the euro. I post related charts below.

Even the Australian dollar faded against the euro, but the trend seems clear for a continuation, maybe even acceleration, of a carry trade. Next move, RBA!

Up next, the U.S. non-farm payrolls numbers!

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

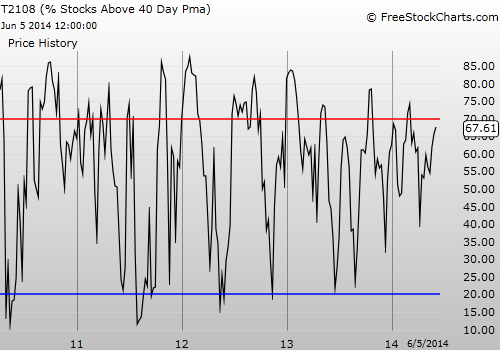

Weekly T2108

Be careful out there!

Disclosure: Net short euro, net short Australian dollar