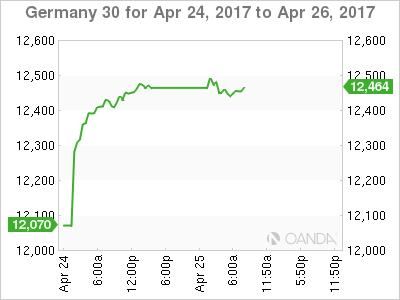

The DAX has inched upwards in the Tuesday session, as the index is currently trading at 12,445. The DAX climbed 1.2 percent on Monday, and has set a record high of 12,480 on Tuesday. It’s a quiet day on the release front, with no German or Eurozone indicators on the schedule.

European stock markets jumped on Monday, buoyed by the results from the first round of the first round of the French presidential election. The markets breathed a collective sigh of relief, as opinion polls accurately forecast the outcome. The field of 11 candidates in the first round was pared to just 2 candidates, centrist Emmanuel Macron and far-right Marine Le Pen. Macron garnered 24% of the vote and Le Pen 22%. The runoff vote takes place on May 7 and French voters couldn’t have a clearer choice as they head back to the polls on Sunday.

Macron, who served as a minister under Socialist Francois Hollande, favors deregulation and is a staunch supporter of the European Union. Le Pen, who heads the National Front, has campaigned on a ‘France first’ platform, vowing to curb immigration and take France out of the eurozone. Hollande and Francois Fillon, who ran in the first round, have thrown their support behind Macron and asked voters to reject ‘extremism’. Macron is a heavy favorite to win the second round and become president, with polls giving him a comfortable lead of above 60%.

Since opinion polls were accurate ahead of the first round of voting, the markets appear to relying on the current polls as well, meaning that a Macron victory has been priced in. Unless this sentiment drastically changes during the week, the election will be a non-event for the market. At the same time, nothing is a sure thing in politics, as underscored by the Brexit vote and the election of Donald Trump, two events which stunned the markets and triggered strong market movement.

French Election: Five Things We Have Learned

President Trump will have to reach out to the Democrats in order to avoid a shutdown of the federal government on Saturday. Congress must pass a spending bill which will fund the government until October, but the bill requires the backing of 60 senators. This means that the Republicans (who control 52 seats) will need the support of 8 Democrats.

This has led to bipartisan negotiations, and it’s reasonable to expect that these talks could go down to the wire, as both sides try to stick to their positions and try not to blink first. The last shutdown was in 2013, lasting 17 days. Another shutdown would be embarrassing for Trump, as it would start on his 100th day in office and would cast doubts on his ability to push his budget and tax plan through Congress.

Economic Calendar

Tuesday (April 25)

- There are no German or Eurozone events

DAX, Tuesday, April 25 at 6:40 EST

Open: 12,464.25 High: 12,480.75 Low: 12,437.50 Close: 12,451.00