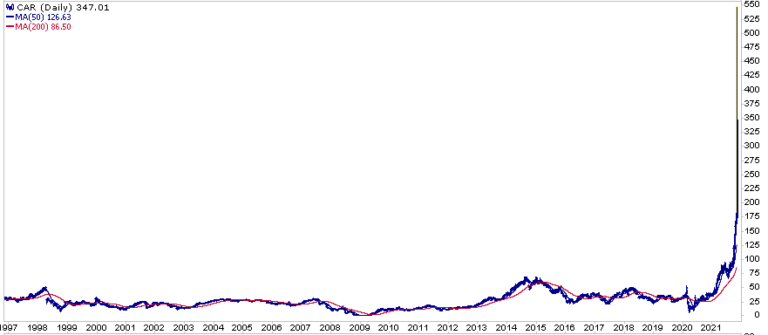

Avis Budget Group (NASDAQ:CAR) stock was up 215% yesterday morning before sellers pushed it lower. Despite decent selling pressure later in the day, it closed up over 100% higher on the day. The impetus behind the massive gain is a combination of solid earnings, a new share buyback program, short-covering, and rumors they may buy Tesla (NASDAQ:TSLA) cars. EPS of $10.74 was more than $4 above expectations and well above its 2019 pre-pandemic earnings of $3.98. CAR is up almost ten-fold since 2019.

Stocks continue to grind higher, seemingly unconcerned about today’s Fed meeting. At 2 pm ET, the Fed will release its statement on monetary policy. Expectations are for the Fed to begin tapering QE by $15 billion per month. Jerome Powell will follow up with a press conference at 2:30 pm ET.

What To Watch Today

Economy

- 7:00 a.m. ET: MBA Mortgage Applications, week ended Oct. 29 (0.3% during prior week)

- 8:15 a.m. ET: ADP Employment Change, Oct. (400,000 expected, 568,000 in September)

- 9:45 a.m. ET: Markit U.S. Services PMI, October final (58.2 expected, 58.2 in prior print)

- 9:45 a.m. ET: Markit U.S. Composite PMI, October final (57.3 in prior print)

- 10:00 a.m. ET: ISM Services Index, October (62.0 expected, 61.9 in September)

- 10:00 a.m. ET: Factory Orders, September (0.1% expected, 1.2% in August)

- 10:00 a.m. ET: Durable goods orders, September final (-0.4% in prior print)

- 10:00 a.m. ET: Durable goods orders excluding transportation, September final (0.4% in prior print)

- 10:00 a.m. ET: Non-defense capital goods orders excluding aircraft, September final (0.8% in prior print)

- 2:00 p.m. ET: Federal Open Market Committee monetary policy decision

Earnings

Pre-market

- 6:30 a.m. ET: Humana (NYSE:HUM) to report adjusted earnings of $4.69 per share on revenue of $20.85 billion

- 6:30 p.m. ET: CVS Health Corp (NYSE:CVS) to report adjusted earnings of $1.78 per share on revenue of $70.48 billion

- 7:00 a.m. ET: Discovery Inc. (NASDAQ:DISCA) to report adjusted earnings of 43 cents per share on revenue of $3.15 billion

- 7:00 a.m. ET: The New York Times Company (NYSE:NYT) to report adjusted earnings of 20 cents per share on revenue of $499.14 million

- 7:00 a.m. ET: Norwegian Cruise Line Holdings (NYSE:NCLH) to report adjusted losses of $1.96 per share on revenue of $265.89 million

- 7:00 a.m. ET: Marriott International (NASDAQ:MAR) to report adjusted earnings of 99 cents per share on revenue of $3.77 billion

- 7:30 a.m. ET: Sinclair Broadcast Group (NASDAQ:SBGI) to report adjusted losses of $1.10 per share on revenue of $1.58 billion

Post-market

- 4:00 p.m. ET: Booking Holdings (NASDAQ:BKNG) to report adjusted earnings of $32.23 per share on revenue of $4.30 billion

- 4:00 p.m. ET: Qorvo (NASDAQ:QRVO) to report adjusted earnings of $3.26 per share on revenue of $1.25 billion

- 4:00 p.m. ET: Electronic Arts (NASDAQ:EA) to report adjusted earnings of $1.17 per share on revenue of $1.76 billion

- 4:00 p.m. ET: Qualcomm (NASDAQ:QCOM) to report adjusted earnings of $2.26 per share on revenue of $8.86 billion

- 4:05 p.m. ET: Vimeo (NASDAQ:VMEO) to report adjusted losses of 10 cents per share on revenue of $99.85 million

- 4:05 p.m. ET: Roku (NASDAQ:ROKU) to report adjusted earnings of 9 cents per share on revenue of $681.13 million

- 4:05 p.m. ET: Etsy (NASDAQ:ETSY) to report adjusted earnings of 67 cents per share on revenue of $519.00 million

- 4:05 p.m. ET: GoDaddy (NYSE:GDDY) to report adjusted earnings of 39 cents per share on revenue of $945.18 million

- 4:05 p.m. ET: Take-Two Interactive Software (NASDAQ:TTWO) to report adjusted earnings of $1.36 per share on revenue of $865.95 million

- 4:15 p.m. ET: The Allstate Corp (NYSE:ALL) to report adjusted earnings of $1.60 per share on revenue of $11.78 billion

- 4:15 p.m. ET: MGM Resorts International (NYSE:MGM)to report adjusted losses of 3 cents per share on revenue of $2.41 billion

- 4:15 p.m. ET: Marathon Oil Corp (NYSE:MRO) to report adjusted earnings of 32 cents per share on revenue of $1.32 billion

Taking Some Profits

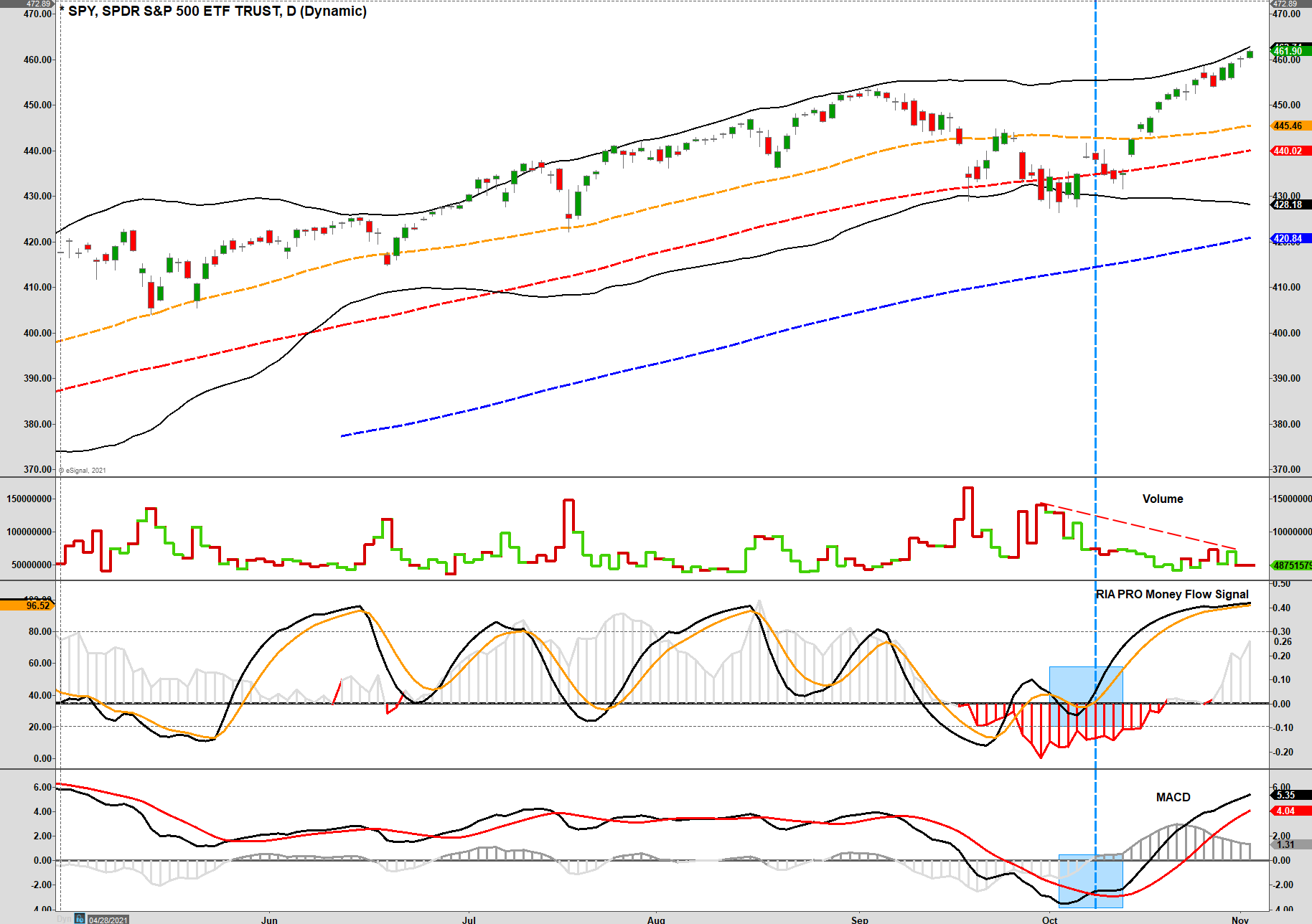

As noted in yesterday’s “3-minute” video, the market is now back to extreme overbought and extended levels. With volume weak, and our money-flow signal close to triggering, a pull-back over the next four weeks would not be surprising. Such a pullback would also set the market up for the traditional year-end “Santa Rally.”

As such, we are now beginning to raise some cash by taking profits out of our most egregiously extended positions.

In our equity model, we reduced our holdings slightly in Ford Motor Company (NYSE:F), NVIDIA (NASDAQ:NVDA), Albemarle (NYSE:ALB), and Netflix (NASDAQ:NFLX). Those positions were reduced to their respective model weights. We also sold all of SBUX after it violated our stop-loss levels.

In the sector ETF model, we reduced Global X Lithium & Battery Tech ETF (NYSE:LIT) by 0.5% as it is as overbought as ALB in the equity model. However, despite the reduction, we remain overweight in the basic materials sector.

Equity Model

- Reduced to model weight F, NVDA, ALB, and NFLX

- Sold 100% of SBUX

ETF Model

- Reduced LIT by 0.5% of the portfolio weight.

You can follow all of our trades and receive real-time alerts at RIAPRO.NET

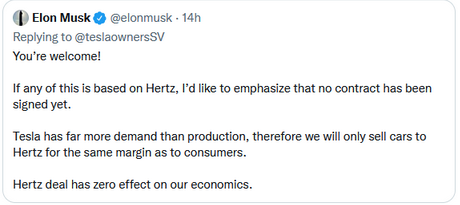

Hertz

Hertz Global Holdings (OTC:HTZZ), which is supposedly buying Tesla’s cars, has doubled since late September. We say “supposedly” because of the tweet below from Elon Musk. It is worth noting two things in his tweet. First, there is no signed contract to buy cars between Hertz and Tesla. Second, if they do agree, Hertz will be paying retail prices for the cars, not discounted prices as is customary for a large fleet purchase.

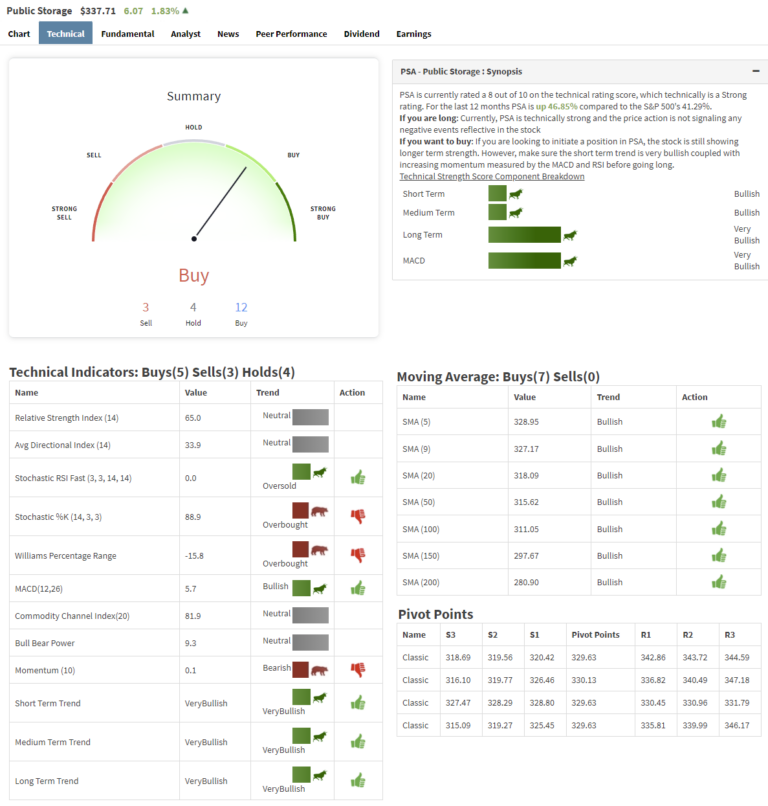

Public Storage Earnings

Public Storage (NYSE:PSA) reported third-quarter earnings Monday after the close. Funds From Operations (FFO) of $3.42 beat expectations of $3.22 thanks to a 20.8% YoY increase in net operating income. Revenue of $894.9M (+21.8% YoY) also beat the consensus of $858.8M. A 14% increase in same-store sales combined with a 6.2% decrease in same-store direct operating costs drove the positive results.

PSA entered an agreement during the quarter to purchase an All Storage portfolio for $1.5B. Of 56 properties acquired, 52 are in the high-growth Dallas-Fort Worth market. Management expects the acquisition to be immediately accretive to FFO/share with acceleration through 2025. The stock is trading 2% higher today following the upbeat earnings announcement. We hold a 2% position in the Equity Model.

Market Winners And Losers

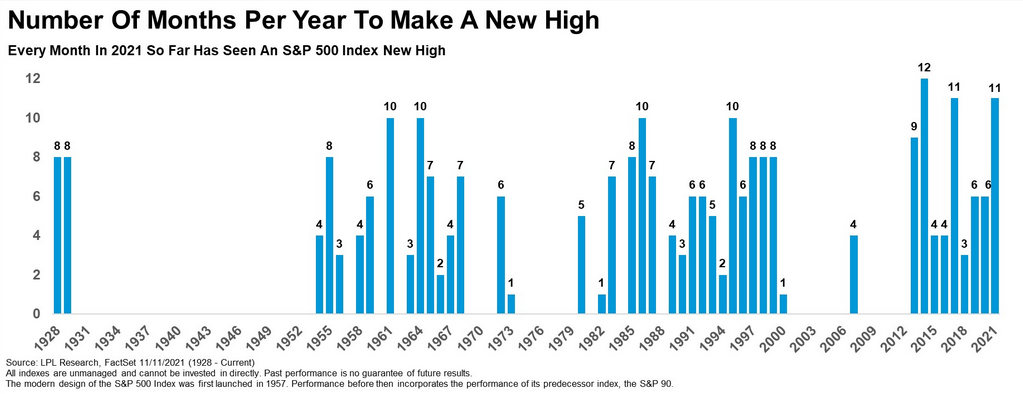

Another Feat For The Bull Market

The LPL graph below shows, thus far, in 2021, the S&P 500 hit a new record high each month. If it can register another high in December, it will join 2014, as the only year since at least 1928 to have all 12 months set a record high.

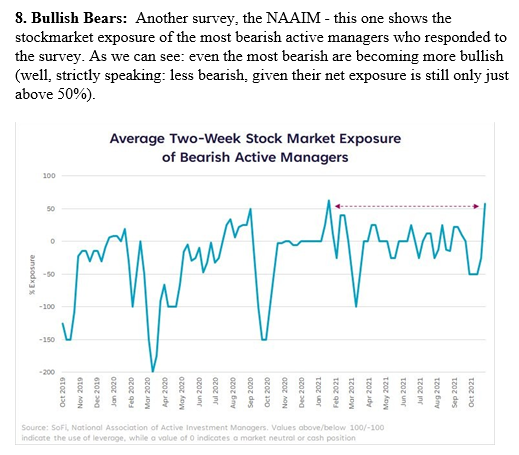

Bullish Bears

The market is so bullish that even the bears are bullish. The graph and commentary below show that, per the NAAIM survey of active investment professionals, bearish managers have about 50% exposure to stocks on average. That figure is tied for the most significant allocation since the pandemic started.

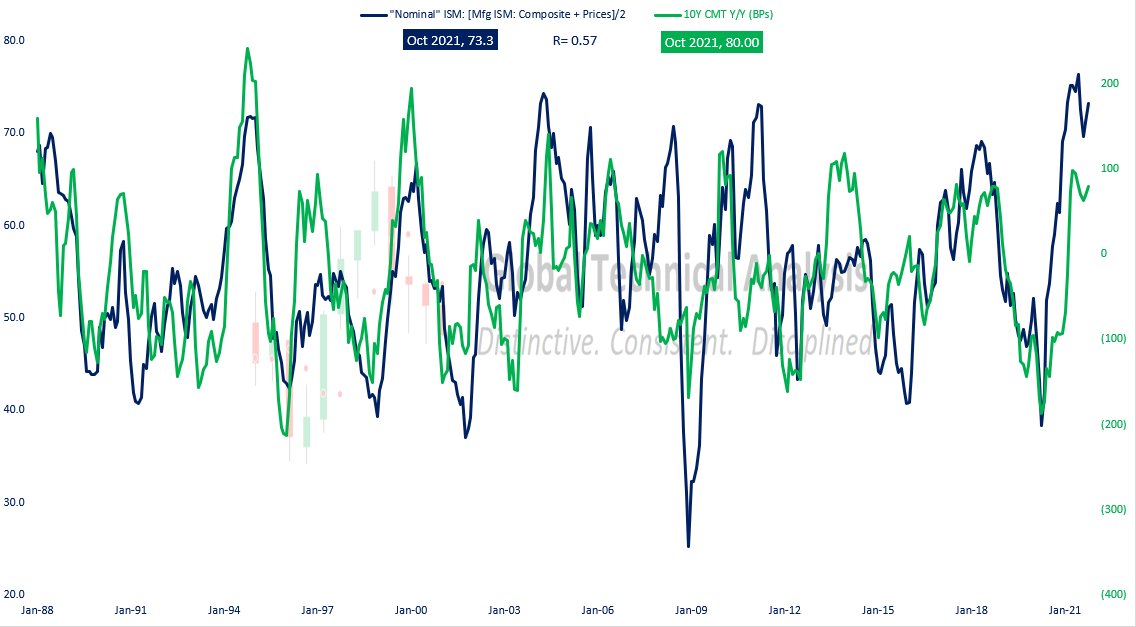

Manufacturing And Yields

The graph below, courtesy of Brett Freeze, shows the nominal adjusted ISM manufacturing index is highly correlated with the change in 10-year Treasury yields. The ISM index tends to oscillate, portending yields are likely to fall from current levels when the ISM index trends lower. That said, if inflationary pressures remain persistent, the nominal index may stay elevated even if the ISM index declines. If so, yields are likely to remain at current levels.