International Business Machines Corp. (NYSE:IBM) recently won a contract from Australia-based Acrow to refresh the latter's IT infrastructure. Per the terms of the agreement, Acrow’s existing IT infrastructure will be replaced with IBM Cloud integrated with VMware (VMW) software, which runs on the company’s bare-metal servers

IT solutions provider, IT Easy will be managing the entire project. Acrow will now use IBM's mobile device management platform – MaaS360 – to refresh its mobile infrastructure. IT Easy will also be offering a lot of “as-a-service” options like backup, disaster recovery and desktop management. Besides cost efficiency, the refresh is anticipated to deliver user experience benefits within two months of deployment.

IBM is Expanding its Presence in Cloud

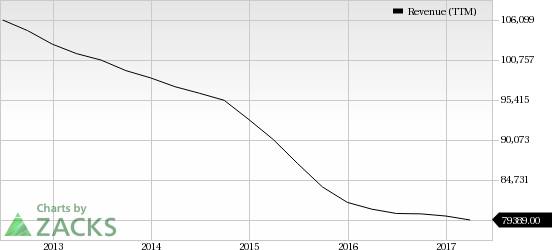

IBM reported revenues of $18.16 million in first quarter 2017, which saw a year-on-year decline of 2.8% and a sequential decline of 16.6%. However, cloud segment revenues grew 45% year over year. Hence, cloud is evidently gaining traction.

IBM has a diversified customer base in the cloud segment, ranging from Wellness Real Estate and technology firm Delos to digital marketing firm, Gamifo. Bluemix, the company’s cloud platform-as-a-service and its artificial intelligence platform, Watson are also being used for game designing.

We believe this contract along with others that leverage IBM’s strong presence in the market like its Blockchain technology and Watson platform will drive the company’s shares going forward. Notably, IBM has underperformed the S&P 500 on a year-to-date basis. While the index gained 10.1%, the stock lost 5.1%.

Per Gartner, the worldwide public cloud services market is expected to grow 18% in 2017 to reach $246.8 billion, up from $209.2 billion in 2016. Cloud system infrastructure services (Infrastructure-as-a-Service) are projected to be the highest contributor, surging 36.8% in 2017 to $34.6 billion. Cloud application services (Software-as-a Service) are expected to reach $46.3 billion, up 20.1% from the previous year.

We think contracts such as these will help IBM to gain further share of the cloud market, which is currently dominated by Amazon’s (NASDAQ:AMZN) AWS and Microsoft’s (NASDAQ:MSFT) Azure. The segment is poised for solid growth and there are ample opportunities for IBM to make inroads.

Zacks Rank

IBM currently has a Zacks Rank #4 (Sell)

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Vmware, Inc. (VMW): Free Stock Analysis Report

Original post

Zacks Investment Research