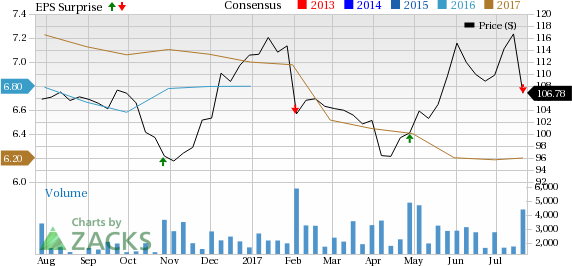

Autoliv, Inc. (NYSE:ALV) reported adjusted earnings of $1.44 per share in the second- quarter 2017, missing the Zacks Consensus Estimate of $1.48. Also, the bottom line came in 17.7% lower than the prior-year quarter figure.

During the quarter, Autoliv reported net sales of $2.54 billion, down 1.3% year over year. Also, the top line came in lower than the Zacks Consensus Estimate of $2.57 billion.

Operating income increased 1.7% to $216.4 million from $212.7 million in the year-ago quarter. Adjusted operating margin was 8.4% in the reported quarter, lower than the company’s expectation of around 8.5%.

Shares of the company declined around 7.9% to close at $106.78 on Jul 21 on the company’s lower year-over-year adjusted earnings.

Segment Results

Sales at the Passive Safety segment fell 0.6% year over year to $1.98 billion in the reported quarter. Excluding negative currency translation effects, organic sales increased 0.8%. The segment’s operating income rose year over year by 0.6% to $208.1 million.

Sales at the Electronics segment declined 3.2% year over year to $578.9 million. Operating income from the division declined 26.8% to $10.9 million.

Financial Position

Autoliv had cash and cash equivalents of $922.5 million as of Jun 30, 2017, lower than $1.11 billion reported as of Jun 30, 2016. Long-term debt was $1.32 billion as of Jun 30, 2017, down from $1.46 billion as of Jun 30, 2016.

In second-quarter 2017, the company’s cash flow from operations rose to $179 million from the year-ago figure of $103 million. Net capital expenditures rose to $138.4 million from the year-ago recorded figure of $129.9 million.

Dividend

On May 9, 2017, Autoliv announced a quarterly dividend of 60 cents per share for the third quarter of 2017, unchanged sequentially. The dividend will be paid on Sep 7, to shareholders on record as of Aug 23, 2017.

Guidance

Autoliv expects organic sales to grow by around 0–2% year over year in the third quarter of 2017. Currency translations are expected to have negligible impact on sales, leading to consolidated sales growth of 0–2%. The adjusted operating margin in the third quarter is likely to be in the range of 7.5–8%.

Autoliv expects full-year 2017 organic sales to increase around 2%, lower than the prior guidance of 4%. The recent acquisitions and currency translation are expected have a positive impact of around 1% on sales. Based on these factors, consolidated sales are expected to rise around 3%.

Tax rate for full-year 2017 is likely to be around 30%, unchanged from the prior-quarter expectation. Operating cash flows are anticipated to be about or more than $0.8 billion, excluding any discrete items and antitrust related matters, while capital expenditure for supporting the company’s growth plans are still projected to be in the range of 5–6% of sales.

Currently, Autoliv carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the auto space include Allison Transmission Holdings, Inc. (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Ferrari N.V. (NYSE:RACE) .

Each of these stocks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission, Volkswagen and Ferrari have long-term expected growth rate of 11%, 17.3% and 14.1%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Volkswagen AG (VLKAY): Free Stock Analysis Report

Autoliv, Inc. (ALV): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research