Design software maker Autodesk (NASDAQ:ADSK) late Tuesday offered a tepid fourth quarter outlook as it makes a major business transition into a subscription model.

The San Rafael, California-based company reported a Q3 net loss of $0.18 per share, which was still $0.06 better than the average Wall Street estimate for a loss of $0.24 per share. Revenues plunged 18.4% from last year to $489.6 million, beating out analysts’ $476.78 million view.

Much like Adobe, Autodesk is in the process of a seismic shift in its business away from up-front software sales and into a subscription-based model. In that vein, new model subscriptions increased by 168,000 from Q2 to 861,000. Meanwhile, total subscriptions rose by 134,000 from Q2 to total 2.95 million. New model annualized recurring revenue (ARR) surged 88% from last year to $414 million.

Looking ahead, ADSK forecast a Q4 net loss of $0.39 to $0.32 per share, which is worse than the $0.31 loss that analysts were expecting. It also sees Q4 revenues ranging from $460 to $480 million, below Wall Street’s $488.50 million estimate.

The company commented via press release:

“We are pleased with our results for the quarter, which were driven by strong growth in product subscription,” said Carl Bass, Autodesk president and CEO. “This was the first quarter of selling only subscriptions, a significant milestone in our business model transition. We also had a record-breaking quarter for cloud subscription additions, driven by continued momentum of BIM 360 and Fusion 360. Coupled with diligent cost control, we continue to progress steadily to our fiscal year 2020 goals.”

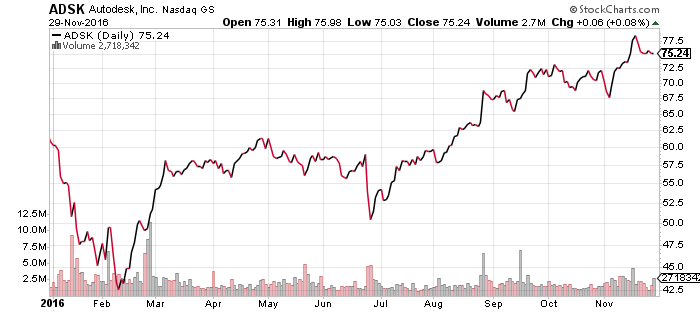

Autodesk shares fell $2.14 (-2.84%) to $73.12 in after-hours trading Tuesday. Prior to today’s report, ADSK had surged 23.52% year-to-date, nearly tripling the return of the benchmark S&P 500 during the same period.