We expect Autodesk Inc. (NASDAQ:ADSK) to beat expectations when it reports fiscal second-quarter 2018 results on Aug 24.

Last quarter, the company reported non GAAP loss of 16 cents, wider than the year-ago quarter’s loss of 10 cents, but much narrower than the Zacks Consensus Estimate of a loss of 22 cents and management’s guided range of a loss of 21-27 cents per share.

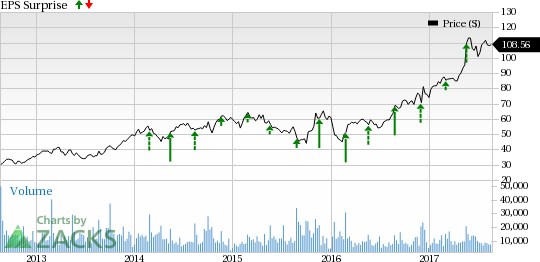

Notably, the company has a positive earnings surprise track record. It has beaten estimates in each of the trailing four quarters, delivering an average positive surprise of 51.47%.

Revenues of $485.7 million fell nearly 5.1% year over year but came ahead of the consensus mark of $473 million and the guided range of $460–$480 million. Management continues to emphasize that revenues will be impacted by the company’s business model transition from “upfront” to “ratably”.

Notably, Autodesk’s shares have gained 46.7%, substantially outperforming the 20.7% rally of the industry it belongs to. We believe the company’s broad product portfolio and accelerating subscription base to sustain the share price momentum going ahead.

Let's see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Autodesk is likely to beat earnings because it has the right combination of two key ingredients.

Zacks ESP: Autodesk currently has an Earnings ESP of +17.39%. A favorable Earnings ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Autodesk currently carries a Zacks Rank #3 (Hold). It should be noted that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings. Conversely, stocks with a Zacks Rank #4 or 5 (Sell rated) should never be considered going into an earnings announcement.

The combination of Autodesk’s Zacks Rank #3 and Earnings ESP of +17.39% makes us confident in looking for an earnings beat.

What's Driving the Better-than-Expected Earnings?

Autodesk’s business transition from licenses to cloud-based services is expected to benefit it by boosting subscriptions and deferred revenues. Additionally, marketing and promotional initiatives taken up by the company have accelerated its subscription base.

In the last reported quarter, total subscriptions increased approximately 186,000 from the prior quarter to 3.29 million while subscription plan (product, end-of-life and cloud subscriptions) increased by 233,000 to 1.32 million.

In fact, cloud subscriptions in the last reported quarter continued to show strong growth, improving more than four times from the year-ago quarter driven by robust performance from BIM 360 and Fusion tools.

Moreover, Autodesk is well positioned to capitalize on the rapid adoption of computer-aided designing and manufacturing through its comprehensive product portfolio. We expect its broad product portfolio to generate new customers in both domestic and overseas markets. Further, the company stated that demand for the core engineering product was strong as evident from 170% year-over-year growth in product subscriptions in the last reported quarter.

Notably, the company’s aggressive acquisition strategy has played a pivotal part in developing its business. Cost cutting initiatives are also a big positive.

Other Stocks to Consider

Here are a few companies that you may also want to consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming release:

The Toronto-Dominion Bank (TO:TD) with an Earnings ESP of +1.18% and Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Big Lots (NYSE:BIG) with an Earnings ESP of +0.72% and a Zacks Rank #2.

Malibu Boats (NASDAQ:MBUU) with an Earnings ESP of +3.66% and a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Toronto Dominion Bank (The) (TD): Free Stock Analysis Report

Autodesk, Inc. (ADSK): Free Stock Analysis Report

Malibu Boats, Inc. (MBUU): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Original post

Zacks Investment Research