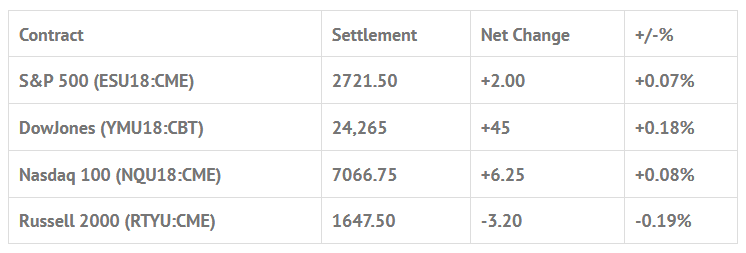

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed lower: Shanghai Comp -2.52%, Hang Seng +1.61%, Nikkei -2.21%

- In Europe 12 out of 13 markets are trading lower: CAC -0.77%, DAX -0.33%, FTSE -0.83%

- Fair Value: S&P +1.53, NASDAQ +19.15, Dow -20.03

- Total Volume: 1.60mil ESU & 613 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes PMI Manufacturing Index 9:45 AM ET, ISM Mfg Index 10:00 AM ET, and Construction Spending 10:00 AM ET.

S&P 500 Futures: End Of The Quarter Rebalance RIP And Walk Away Trade

Friday’s trade started with the major Asian markets up sharply and Europe trading higher. The overnight Globex trading range for the S&P 500 futures was 2716.75 to 2737.25. Total volume in the ES was 272,000 contracts, and the first print off the 8:30 open was 2730.00.

After the open the S&P futures traded up to 2738.75, pulled back 4 handles, popped up to 2740.50, pulled back down to 2734.25, and then shot up to 2745.50 at 10:15. It was all buy programs and buy stops. I put this out just after the high – Dboy:(10:06:50 AM) : looks like we could be getting close to an early high – and at 10:57 the ES traded down to 2736.50. The next move was back up to 2743.00. From there it was back down to 2734.75, followed by a push up to a lower low and double top at 2741.25, and then a small slide back down to 2736.00.

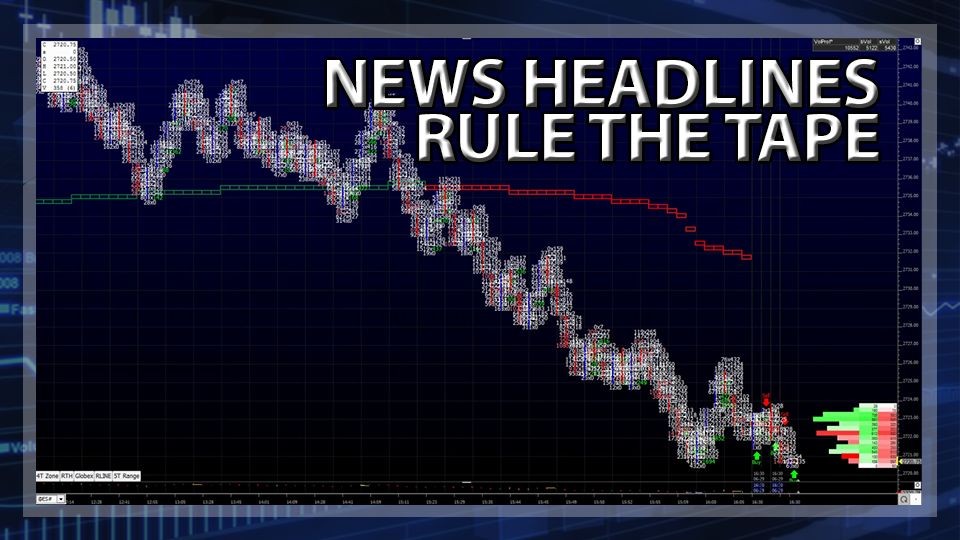

There was some decent trading action early on, but as the day wore on more traders dropped off line. At 1:30 CT total volume was 910,000 contracts, and the ES was trading 2737.00, up +16.50 handles, or +0.63%, while the VIX was trading at the high of the day. As the VIX rallied the ES sold off down to 2733.75, and then bounced back up to 2740.50 just after 2:00 pm. Then, as the MiM grew to the sell side, the late day end of the quarter sellers came in and pulled the rug out from under the equity markets.

The ESU sold off down to 2720.50, back through the open, down 20 handles in less than an hour, and down 25 handles from the morning high. On the 3:00 pm cash close the ES printed 2721.00 before settling the day at 2722.25, up +2.75 handles, or +0.10%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.