Second-quarter 2017 earnings season for the auto sector has already started. One important company which has already reported its second-quarter results is Harley-Davidson Inc. (NYSE:HOG) . The company recorded earnings of $1.48 per share, beating the Zacks Consensus Estimate of $1.37. However, it reported revenues of $1.58 billion, narrowly missing the Zacks Consensus Estimate of $1.6 billion.

Two important companies, which are expected to come up with their results on Jul 21, are Autoliv Inc. (NYSE:ALV) and Gentex Corporation (NASDAQ:GNTX) .

Per the latest Earnings Outlook, as of Jul 19, 54 S&P 500 companies have already declared their results. These companies as a whole, posted 79.6% growth in earnings and 72.2% rise in revenues, respectively.

However, second-quarter 2017 earnings and revenue growth for auto companies is expected to be below par. The year-over-year growth in earnings and revenues for the auto stocks are expected to decline 7.5% and 5.6%, respectively. Also during the quarter, the S&P 500 companies are anticipated to record year-over-year growth of 11.9% and 5.5% in earnings and revenues, respectively.

Recently, auto makers have been facing a lot of challenges, which in turn might hamper their performances in 2017. Also, the strong performance exhibited by the sector in 2016 (record year for new vehicle sales in the U.S.) is not likely to continue in 2017, as the industry is facing problems of high inventory levels and vehicle recalls.

General Motors Company (NYSE:GM) lowered the U.S. sales outlook for new vehicle sales in 2017. This indicates that the industry might be heading toward an average downfall in 2017. A decline in new vehicle volume will also lead to a dip in company’s total sales.

In addition, frequent safety recalls and related costs are burdening the financials of the auto manufacturers. A few companies, affected by these recalls are, Honda Motor Co., Ltd. (NYSE:HMC) and Toyota Motor Corporation (NYSE:TM) .

That said, let’s take a look at how these auto companies are placed ahead of their announcement.

We relied on the Zacks methodology, combining a favorable Zacks Rank and a positive Earnings ESP, to predict the chances of a beat this quarter.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Per our proprietary methodology, the Earnings ESP shows a percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. Research shows that with this combination of Zacks Rank and ESP, chances of a positive earnings surprise are as high as 70% for the stocks.

Based in Stockholm, Sweden, Autoliv is engaged in manufacturing of occupant restraint systems for automobiles and has a product portfolio consisting primarily of safety airbags, seat belts and steering wheels. Our proven model does not conclusively show that the company is likely to deliver a positive surprise as it has Earnings ESP of -3.38% despite a Zacks Rank #3.

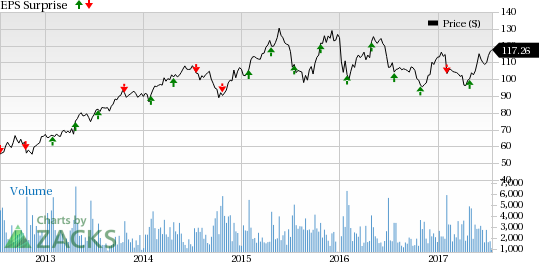

Autoliv, Inc. Price and EPS Surprise

Headquartered in Zeeland, MI, Gentex Corporation offers high-quality products to the worldwide automotive industry and the North American fire protection market. It engages in development, manufacturing and marketing of proprietary electro-optic products, including the interior and exterior electrochromics.

Currently, the aforementioned company has Earnings ESP of +6.45% but a Zacks Rank #4 (Sell), which lowers the predictive power of ESP. Hence, Sell-rated stocks (#4 or 5) should never be considered going into an earnings announcement. Based on this data, our proven model too does not conclusively show that Gentex is likely to beat estimates this quarter.

Gentex Corporation Price and EPS Surprise

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

General Motors Company (GM): Free Stock Analysis Report

Honda Motor Company, Ltd. (HMC): Free Stock Analysis Report

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Autoliv, Inc. (ALV): Free Stock Analysis Report

Gentex Corporation (GNTX): Free Stock Analysis Report

Harley-Davidson, Inc. (HOG): Free Stock Analysis Report

Original post